What We Found Full 126 page Inspector General Report is here.

Of note, Speaker Boehner hired a law, Jonathan Turley to represent the House in a lawsuit, where Treasury under Barack Obama was ordered to take monies from other agencies to fund Obamacare and pay insurers. That lawsuit case is found here. Where is the case now? In May 2016, Collyer ruled that the payments were illegal. The case is already on appeal to the D.C. Circuit and will probably be argued in early 2017.

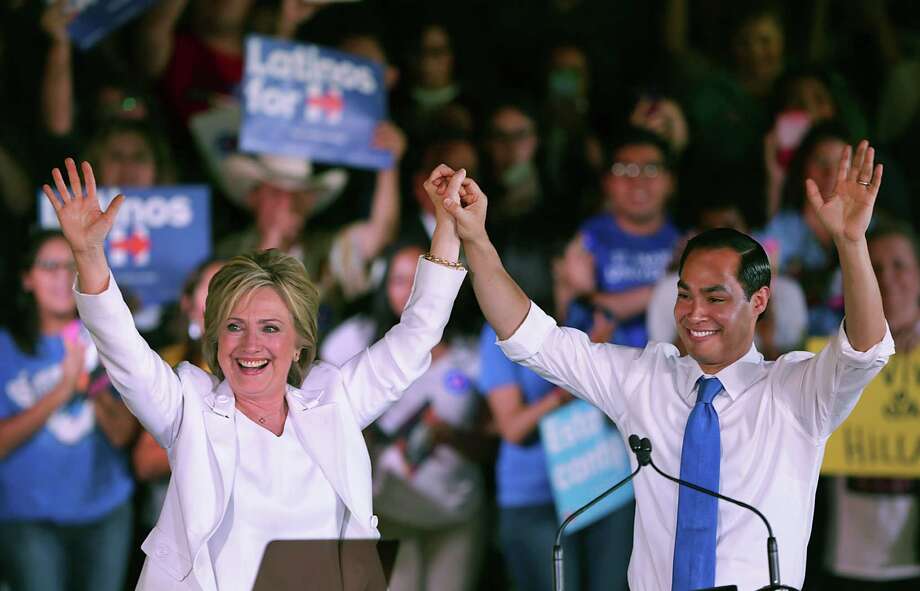

Meanwhile, how about fraud at HUD, where Julian Castro was Secretary? Julian is a radical and a LaRaza advocate. Further, Politico reported that Julian Castro’s name was floated early as a Hillary running mate.

Back to the half a trillion dollars….

Back to the half a trillion dollars….

The total amounts of errors corrected in HUD’s notes and consolidated financial statements were

$516.4 billion and $3.4 billion, respectively. There were several other unresolved audit matters,

which restricted our ability to obtain sufficient, appropriate evidence to express an opinion.

These unresolved audit matters relate to (1) the Office of General Counsel’s refusal to sign the

management representation letter, (2) HUD’s improper use of cumulative and first-in, first-out

budgetary accounting methods of disbursing community planning and development program

funds, (3) the $4.2 billion in nonpooled loan assets from Ginnie Mae’s stand-alone financial

statements that we could not audit due to inadequate support, (4) the improper accounting for

certain HUD assets and liabilities, and (5) material differences between HUD’s subledger and

general ledger accounts. This audit report contains 11 material weaknesses, 7 significant

deficiencies, and 5 instances of noncompliance with applicable laws and regulations.

What We Recommend

In addition to recommendations made in audit reports 2017-FO-0001, 2017-FO-0002, and 2017-

FO-0003, we recommend that HUD (1) reassess its current consolidated financial statement and

notes review process to ensure that sufficient internal controls are in place to prevent and detect

errors, (2) evaluate the current content of HUD’s consolidated note disclosures to ensure

compliance with regulations and GAAP, and (3) develop a plan to ensure that restatements are

properly reflected in all notes impacted.

On November 15, 2016, we issued an independent auditor’s report1 stating that the U.S.

Department of Housing and Urban Development (HUD) was unable to provide final fiscal years

2016 and 2015 consolidated financial statements and accompanying notes in a timeframe that

would allow us to obtain sufficient, appropriate evidence to determine whether they were free

from material misstatement. We also reported on the delays encountered in the material

weakness, Weak Internal Controls Over Financial Reporting Led to Errors and Delays in the

Preparation of Financial Statements and Notes.2

The delays were due to insufficiently designed and implemented financial reporting processes

and internal controls that were put into place because of HUD’s transition of its core financial

system to a Federal shared service provider (FSSP). HUD inadequately planned and tested the

changes to HUD’s financial reporting process before the transition. Additionally, late

restatements performed by HUD’s component entities, the Government National Mortgage

Association (Ginnie Mae) and Federal Housing Administration (FHA), contributed to the delay

in providing final consolidated financial statements.3 As a result, we were unable to provide an

opinion on HUD’s fiscal years 2016 and 2015 financial statements. While there were other

material matters that supported our basis for disclaimer, this was the primary reason for our

disclaimer of opinion.