Alright, let us review.

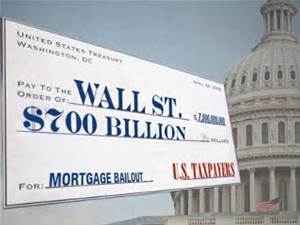

1. Geithner took control of $350 Billion to keep America from the financial abyss.

2. Geithner’s father was the chief manager of the Ford Foundation’s Microfinance in Indonesia system that was developed by Stanley Ann Dunham, Barack Obama’s mother.

3. Larry Summers was Tim Geithner’s mentor.

4. Geithner was a member of the Council of Foreign Relations and Policy Director for the International Monetary Fund.

5. Geithner came to the financial rescue of Bear Sterns, Goldman Sachs and AIG but left Lehman Brothers to die on the vine.

6. Geithner also did not pay $35,000 personally owed to Social Security and Medicare through payroll taxes while working for the IMF. Only through an audit did he get caught and paid up.

7. If Geithner was so experienced in the matter of global and domestic banking and financial systems, then he failed at never predicting the 2008 global financial crisis.

8. Geithner worked at the Bank of International Settlements and is a member of the Bilderberg Group.

So now, Geithner has authored a book titled Stress Test and the text reveals he did not enjoy his time at the Federal Reserve or much less the constant edits to lie about many issues at the behest of the White House, especially Dan Phieffer. This is telling as the lies from the White House began from day one and pressure was applied to all cabinet secretaries to do the same.

Hat tip to Deborah Soloman at the Wall Street Journal.

Former Treasury Secretary Timothy Geithner, whose time in Washington was often colored by accusations he was too close to Wall Street and did little to help Main Street, uses his 538-page book “Stress Test” to largely defend and explain the decisions he made during the financial crisis.

“The inconvenient truth of financial-crisis response is that the actions that feel right are often wrong,” he writes. Mr. Geithner, who was tapped by President Barack Obama to lead the Treasury and before that was president of the Federal Reserve Bank of New York, says he was right to avoid the populist push for blood, including refusing to upend bonus payments to employees of American International Group Inc.

He also acknowledges a tepid response to the housing crisis, saying “I wish we had expanded our housing programs earlier, to relieve more pain for homeowners.”

Here are five takeaways from Mr. Geithner’s book:

Obama’s Financial Rescue: Mr. Geithner reveals dissension between himself and another top member of the Obama administration, Lawrence Summers, saying the two initially disagreed about the best approach to fixing struggling banks.

Mr. Summers wanted to take a more forceful approach and essentially nationalize “zombie” banks that were proved to be insolvent, Mr. Geithner writes, while he wanted to take a more wait-and-see approach by forcing all the banks to undergo “stress tests” that would reveal how much of a capital shortfall they had. Those with a gap that hindered their ability to withstand losses would be required to raise more capital or submit to tough government restrictions to get taxpayer money.

Mr. Geithner writes that while he was away at the G-20 meeting in Europe, Mr. Summers convinced two Treasury officials to make the Summers strategy “sound like a cool hawkish approach that would make the President a populist hero, while ours sounded like an equivocating dovish approach that would make the President seem cowed by banks.”

Mr. Geithner says Mr. Summers “often implied that while the President stood for bold problem solving, I stood for tentative half-measures.” He recounts a meeting in the Oval Office where Mr. Summers described their respective approaches and told Mr. Obama ‘I’m much closer to you, Mr. President’.”

In the end, Mr. Summers’s approach was nixed by former White House Chief of Staff Rahm Emanuel who, upon learning it could cost the government hundreds of billions of dollars, exclaimed “There’s no more f— money!”

Lehman Brothers: Mr. Geithner was widely known as favoring a more forceful approach to Lehman Brothers, the investment bank that ultimately filed for bankruptcy after it was unable to find a buyer or get a government bailout. In his book, he points that out as a source of friction between himself, former Federal Reserve Chairman Ben Bernanke and former Treasury Secretary Henry Paulson.

As Mr. Paulson continued to draw a line in the sand and declare there would be no government bailout of Lehman, Mr. Geithner writes: “I began to worry that he actually meant it.”

Mr. Geithner says the three policymakers “didn’t want to bolster the impression that government handouts were available upon request” but says while that made sense as a bargaining position “I didn’t think it made sense as actual public policy.”

“This was one of the few times during the crisis when there was any distance between Hank and me. There was even some distance between Ben and me.”

AIG: Mr. Geithner’s arguably biggest drubbing came in March 2009, when it was revealed that AIG, the giant insurer that owed its survival to a $182 billion U.S. government lifeline, was going to pay its workers $165 million in bonuses. Mr. Geithner, who helped engineer the rescue of AIG, was caught off guard by the bonuses and says he called Edward Liddy, whom the government had hand-picked to run AIG, and told him “This is going to kill us and you.”

Mr. Geithner says he knew it was going to be a deeply unpopular decision but defended his refusal to undo the bonuses, saying it would have violated a contract and called into question what other types of guarantees the government was willing to abridge.

“I was instinctively skittish about the U.S. government breaking contracts, especially at a time when all sorts of commitments had been called into question. We weren’t Venezuela.”

Mr. Geithner also reveals he was uncomfortable when Mr. Obama suggested Mr. Geithner would try to reclaim some of the money.

Mr. Obama, in public remarks, said Mr. Geithner would “use [our] leverage and pursue every single legal avenue to block these bonuses and make the American taxpayers whole,” he said. “I want everybody to be clear that Secretary Geithner has been on the case.”

Mr. Geithner writes that “we didn’t think we could claw back the bonuses that had already been obligated and even if we could modestly reduce future payouts, raising public expectations seemed unwise.”

He adds: “I didn’t see the need to remind everyone that I was ‘on the case,’ either.”

Dodd-Frank: Mr. Geithner has perhaps his harshest words for members of Congress, suggesting some used the financial overhaul law as a Christmas tree to win points and favors without considering what was best for the financial system.

He recounts a meeting with Sen. Scott Brown, then a Massachusetts Republican, saying that he made it clear in a meeting he “liked the idea of financial reform and expected to be with us. But without any irony or self-consciousness he said he needed to protect two financial institutions in Massachusetts from the Volcker Rule’s restrictions.”

Mr. Geithner writes that Mr. Brown then furrowed his brow, turned to his aide and asked “Which ones are they, again?”

Housing: Mr. Geithner acknowledges the slow pace of help for homeowners, who were supposed to be among the first on “Main Street” to receive attention in the new administration. “One of every eight mortgages was in foreclosure or default” and yet the administration’s programs “were off to an embarrassingly slow start.”

Mr. Geithner says the lack of help frustrated Democrats who were already uneasy about the amount of assistance the government was giving to large banks. “I held a bunch of meetings with angry Democrats who derisively questioned the depth of our commitment to help homeowners.”

Mr. Geithner recounts how, after a dinner with “disgruntled progressive leaders,” his chief of staff, Mark Patterson, told Mr. Geithner he “needed to stop trying to explain all the barriers that made it harder to do more on housing.” John Podesta one of the dinner guests and a former White House chief of staff, had told Mr. Patterson that Mr. Geithner was “only making it worse.”

Mr. Obama, too, was frustrated and Mr. Geithner says he “kept urging us to think big, to think bold, to consider anything that would help homeowners in distress.”

But Mr. Geithner says the biggest problem was a severely weak economy, which had rendered so many mortgages underwater—worth less than their mortgages—that there was little the government could do to help people build up equity.

The administration fiddled with the homeowner programs several times, but ultimately didn’t come up with a bigger foreclosure-mitigation effort.