In the United States, with a starting number such as $500,000, you can buy a passport and with just a little more you can advance to citizenship under the EB-5 visa program. Swell huh? It has been going on for years and even Senator Dianne Feinstein has an issue with it. So, where is President Trump on the matter? Crickets…..

In February of this year, Senator Grassley and Feinstein introduced legislation to stop the EB-5 abuse.

The EB-5 program is inherently flawed,” Feinstein said in a joint statement with Grassley on Friday. “It says that U.S. citizenship is for sale. It is wrong to have a special pathway to citizenship for the wealthy while millions wait in line for visas.”

Roughly 10,000 EB-5 visas are awarded each year, with more than 85 percent going to Chinese investors in 2014, according to a study by Savills Studley, a real estate services firm. The program, begun in 1990 to stimulate the economy, has turned into a convenient way for wealthy Chinese citizens to become permanent U.S. residents and later bring over their family members. More here.

The Chinese, the Ukrainians and the Russians, all oligarchs are the largest exploiters of the program and most of these oligarchs are corrupt, paying for speedy processes with dirty money.

We know there are multiple investigations going on inside the DC Beltway regarding Russian interference and rightly so. Both Democrats and Republicans have some complicity in foreign collaboration.

In March of this year, this site published an extensive summary of Russian relations with people in the Trump camp as well as with Nancy Pelosi and Steny Hoyer. Few take a look at Secretary Wilbur Ross and his Cyprus connections. Cyprus is a location where abuse and corruption is as normal as breathing. One interesting person is Dmitry Rybolovlev, who happens to know Donald Trump as well as Wilbur Ross.

Beyond paying for a speedy process to obtain a passport or citizenship, there is also yet another method and that is money laundering illicit funds through U.S. real estate purchases where the buyer’s name is not listed if cash is paid. You dont say…..yup. This site published a summary of such activities in July of 2014.

So, while we have examined the issue in the United States and in Cyprus, it is the same for the European Union.

Russian and Ukrainian oligarchs suspected of corruption are among hundreds who have acquired EU passports under the “golden visa” program – a bourgeois shortcut to European citizenship in exchange for cash investments, the Guardian reported Sunday.

A list of recipients seen by The Guardian includes “prominent businesspeople and individuals with considerable political influence.”

The paper claims that Cyprus alone has made over $US 4 billion selling passports to international oligarchs, “granting them the right to live and work throughout Europe,” completely legally.

However, Cyprus is not alone. “The Golden Visa program for Spain, Portugal, Malta, Greece and Cyprus are the most prominent. Bulgaria and Hungary offer residency and citizenship by investment in Europe through government bonds,” the Golden Visa website states.

The BBC reported about this kind of purchasable citizenship three years ago.

“Just like you diversify an investment portfolio, you want to diversity your passport portfolio,” investment expert Christian Kalin, told the BBC.

The list of individuals who have received Cypriot citizenship includes Bashar al-Asad’s cousin, who was previously placed under American sanctions because of allegations he benefited from corruption. It also includes a former member of the Russian parliament and the founder of Ukraine’s largest bank.

According to Global Witness, an international NGO dedicated to exposing global corruption, global visas have the potential to give applicants fleeing persecution a “get out of jail for free card.”

Portuguese MEP, Ana Gomes, said golden visas are an immoral way to grant citizenship.

“I’m not against individual member states granting citizenship or residence to someone who would make a very special contribution to the country, be it in arts or science, or even in investment. But granting, not selling,” said Gomes.

Gomes also questioned the secrecy of obtaining golden visas. If they’re legal, why is it so hard to see who has them, asked Gomes.

The European Parliament will be debating the legality of golden visas in light of the leak, The Guardian reported.

So, for the leaders of respective countries, the definition of citizenship and the spirit of that loyalty means nothing when it comes to money, dirty money.

Perhaps we should be pushing harder for the Grassley/Feinstein legislation at a minimum….what say you?

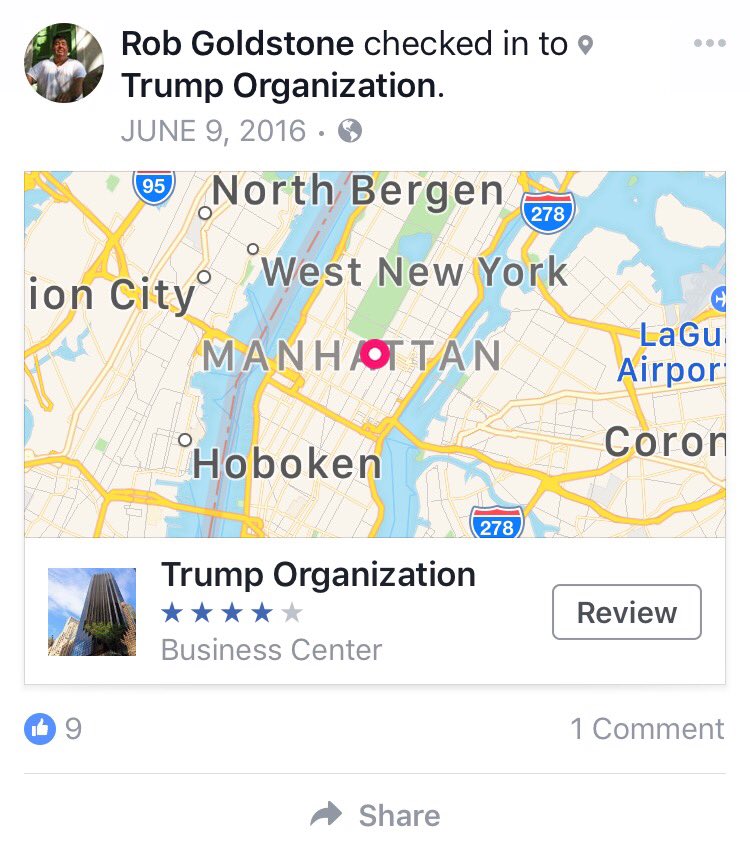

Facebook check-ins can be damming.

Facebook check-ins can be damming. Rob Goldstone, the man

Rob Goldstone, the man