NY In Biggest Ever Drug Raid On Rival Gangs

Eighty eight suspected members of the 2Fly Ygz and Big Money Bosses gangs are arrested following raids in the Bronx.

Nearly 700 New York Police officers and federal agents have carried out the biggest drug gang operation in the city’s history, a federal prosecutor has said.

Some 88 people were arrested in a series of pre-dawn raids in the Bronx targeting two rival drug gangs from top to bottom on Wednesday.

US Attorney Preet Bharara told a news conference that more suspects were being sought in what he described as the biggest ever gang takedown in New York City.

He said: “We bring these charges so that all New Yorkers, including those in public housing, can live their lives as they deserve: free of drugs, free of guns and free of gang violence.”

The raids took place in the Eastchester Gardens housing projects. Pic: NYPD

The arrests stemmed from charges brought against 120 gang members and came after a 16-month investigation which began when police moved to address a surge in violence in the Bronx – particularly around the Eastchester Gardens housing projects.

Related: 2012 TEN MEMBERS OF BRONX GANG INDICTED IN VIOLENT TURF BATTLE: MURDER CONSPIRACY CHARGED

Related: Black Mob Crips (BMB)

- According to user sources, the Black Mob Crips have bases of operations in Los Angeles, New York, Virginia, Washington DC, Maryland, and Detroit

- Lithia Springs High School gang in Lithia Springs, Georgia, associated with the Crips. A BMB gang has also been reported in Jacksonville, North Carolina.

Related: 120 Charged in Bronx Gang Bust

Dozens of shootings, stabbings, beatings and robberies and the killings of a 15-year-old who was stabbed to death and a 92-year-old hit by a stray bullet have been tied to the two gangs – 2Fly Ygz and the Big Money Bosses – Mr Bharara said. More here.

He said 2Fly gang members stores guns and sold drugs at a playground in the centre of the housing project, with the rival gang operating a few blocks away.

Both gangs used social media to promote, protect and grow their organisations, including boasting about their exploits on YouTube, Mr Bharara said.

Officials are now investigating whether the city’s 400,000 public housing residents were being protected in safe conditions as required by federal law.

The Housing Authority said: “Many conditions influence the presence of a gang and other illegal activity, and we continue to work closely with the NYPD to address these challenges.”

The raids follow charges being filed against 36 members of two rival drug trafficking gangs operating out of three Housing Authority complexes in East Harlem.

During the raid on Wednesday, a man who was not part of the investigation but was wanted for a string of knife-point robberies jumped from a window and later died, police said.

Category Archives: FBI

A Judge Issued a Gag Order, Preventing Speech

Oregon Bakers Continue Legal Fight, Challenging ‘Gag Order’

The Oregon bakers who were ordered to pay $135,000 for refusing to bake a cake for a same-sex wedding filed a brief with the Oregon Court of Appeals on Monday, arguing the ruling against them was biased and violates both the Oregon and U.S. constitutions.

“In America, you’re innocent until proven guilty,” said Kelly Shackelford, president and CEO of First Liberty Institute, the group representing Aaron and Melissa Klein in their legal fight. “Commissioner Brad Avakian decided the Kleins were guilty before he even heard their case. This is an egregious violation of the Kleins’ rights to due process. We hope the Oregon Court of Appeals will remedy this by dismissing the government’s case against the Kleins.”

Brad Avakian, commissioner of the Oregon Bureau of Labor and Industries, was responsible for issuing the final ruling on the case. On July 2, 2015, he ruled that in declining to bake a cake for a same-sex wedding due to their religious beliefs, the Kleins violated an Oregon law that prohibits discrimination in places of public accommodation against people based on their sexual orientation.

Avakian ordered the Kleins to pay $135,000 in mental, physical, and emotional damages to the couple whom they denied service.

Rachel and Laurel Bowman-Cryer (who have since married) filed a complaint against Sweet Cakes by Melissa in Gresham, Ore., in February 2013, a month after the Kleins refused to make a cake for the same-sex couple’s wedding.

The Bureau of Labor and Industries opened its investigation into Sweet Cakes by Melissa in August 2013, six months after the agency received the initial complaint from Rachel and Laurel Bowman-Cryer alleging the bakery owners discriminated against them.

Yet, in the appeal brief filed Monday, lawyers for the Kleins argued that Avakian had publicly declared the Kleins guilty before even waiting for an investigation to take place, citing a Feb. 5, 2013, Facebook post.

In that post, Avakian writes, “Everyone has a right to their religious beliefs, but that doesn’t mean they can disobey laws that are already in place. Having one set of rules for everybody ensures that people are treated fairly as they go about their daily lives.”

In August 2013, after the Oregon Bureau of Labor and Industries announced it was opening an investigation to determine whether the Kleins had discriminated against the same-sex couple, Avakian also commented about the case, suggesting he had already decided that the Kleins were guilty. “Everybody is entitled to their own beliefs,” he said in an interview with The Oregonian, “but that doesn’t mean that folks have the right to discriminate.”

“The goal is never to shut down a business. The goal is to rehabilitate,” Avakian added.

Ken Klukowski, an attorney at First Liberty, told The Daily Signal that “it’s clear” Avakian demonstrated bias “that rises to the level of violating due process.”

In addition to ruling the Kleins must pay $135,000, Avakian also ordered the former bakery owners to “cease and desist” from speaking publicly about not wanting to bake cakes for same-sex weddings based on their Christian beliefs.

“The Commissioner of the Bureau of Labor and Industries hereby orders [Aaron and Melissa Klein] to cease and desist from publishing, circulating, issuing or displaying, or causing to be published … any communication … to the effect that any of the accommodations … will be refused, withheld from or denied to, or that any discrimination be made against, any person on account of their sexual orientation,” Avakian wrote in the final order.

The justification for this part of his final order originates from an interview Aaron and Melissa Klein participated in with Family Research Council’s Tony Perkins in 2014. During the interview, Aaron said that they, “don’t do same-sex weddings,” and “This fight is not over. We will continue to stand strong.”

Avakian wrote those statements demonstrate a “prospective intent to discriminate.”

“This gag order that they’re under right now, where they have been ordered by the government that they can’t even discuss these things with the media,” Klukowski said, “is shockingly overbroad.”

“There are aspects of their beliefs and of this case, including aspects of their religious beliefs about marriage, that if they were to share these things publicly, that the government could punish them, saying that it amounts to the equivalent of advertising their intention to continue engaging in illegal discrimination,” Klukowski said.

“That censors so much protected speech.”

The punishment for violating the order is “notoriously unspecific,” Klukowski added. Because of that, lawyers for the Kleins are treading carefully on what they allow their clients to do and say in public.

“This is a couple with young children and where the law does not specify what the most severe penalty could be where as far as we know, the sky could be the limit, that’s where we owe it to our clients to err on the side of caution and try to shield them from additional exposure that could have consequences of unspecified severity,” he said.

In reviewing the appeal, the Oregon Appeal Court will determine whether or not the Oregon Bureau of Labor and Industries violated the Kleins’ constitutional rights to religious freedom, free speech, and due process.

The Kleins maintain that they did not decline the same-sex couple due to their sexual orientation—stating in the brief that they have served one of the women who filed the complaint against them in the past. Instead, they maintain they were only declining to participate in an event that they disagree with because of their Christian beliefs about marriage.

Avakian ruled there is “no distinction” between the two situations.

Klukowski said he expects oral arguments to take place later this year. If the Oregon Court of Appeals rules against the Kleins, the next step would be appealing to the Oregon Supreme Court.

A New Scheme for Syrian Refugees?

Related: Obama pledge to welcome 10,000 Syrian refugees far behind schedule

Read more from the White House directly:

Infographic: The screening process for refugee entry into the U.S.

Infographic: The screening process for refugee entry into the U.S.

Download graphic

Download graphic

“Alternative Safe Pathways” for Syrian Refugees – Resettlement in Disguise?

CIS.org: With the Syrian crisis entering its sixth year, the United Nations High Commissioner for Refugees (UNHCR) is thinking of “innovative approaches” to organize Syrian admissions, alongside the refugee resettlement program, to countries willing to welcome them. UNHCR’s target for resettlement is 480,000 places over the next three years; it is not sure how many additional admissions into the U.S. and elsewhere these new “alternative safe pathways” will ensure. Refugees who are not resettled could be “legally admitted” using various routes described below.

The legitimacy and transparency of these new “alternative pathways,” aimed at admitting increasing numbers of Syrian refugees into the United States without calling them “refugees,” remain to be seen. They might even amount to convenient admissions detours at a time when the U.S. refugee resettlement program is under tight scrutiny.

In a panel discussion on The Global Refugee Crisis: Moral Dimensions and Practical Solutions organized by the Brookings Institution earlier this year, Beth Ferris, Research Professor at Georgetown University and adviser to the United Nations Secretary General on humanitarian refugee policy, talked about the need to find different solutions to the ongoing humanitarian Syrian crisis. The refugee resettlement program was no longer sufficient to admit Syrian refugees she said; “alternative safe pathways” are needed:

Refugees and government officials are expecting this crisis to last 10 or 15 years. It’s time that we no longer work as business as usual … UNHCR next month [March 2016] is convening a meeting to look at what are being called “alternative safe pathways” for Syrian refugees. Maybe it’s hard for the U.S. to go from 2,000 to 200,000 refugees resettled in a year, but maybe there are ways we can ask our universities to offer scholarships to Syrian students. Maybe we can tweak some of our immigration policies to enable Syrian-Americans who have lived here to bring not only their kids and spouses but their uncles and their grandmothers. There may be ways that we could encourage Syrians to come to the U.S. without going through this laborious, time-consuming process of refugee resettlement.” (Emphasis added.)

The UNHCR conference Ferris was referring to took place in Geneva this March 30. It is one of a series of initiatives aimed at comprehensively addressing the Syrian crisis in 2016. The Geneva “High-level meeting on global responsibility sharing through pathways for admission of Syrian refugees” focused on the need for a substantial increase in resettlement numbers and for “innovative approaches” to admit Syrian refugees. It followed February’s London Conference on Syria, which stressed the financial aspect of this humanitarian crisis ($12 billion pledged in humanitarian aid) and precedes a September 2016 high-level plenary meeting of the United Nations General Assembly in New York. Worthy of note here, President Obama will host a global refugee summit this September 20 on the margins of this upcoming General Assembly meeting.

The focus of the Geneva meeting was to introduce “other forms of humanitarian admissions” since “[r]esettlement is not the only aim”, explained UNHCR’s spokesperson. UN High Commissioner for Refugees Filippo Grandi appealed to the international community in his opening statement, calling for “alternative avenues” for the admission of Syrian refugees:

These pathways can take many forms: not only resettlement, but also more flexible mechanisms for family reunification, including extended family members, labour mobility schemes, student visa and scholarships, as well as visa for medical reasons. Resettlement needs vastly outstrip the places that have been made available so far… But humanitarian and student visa, job permits and family reunification would represent safe avenues of admission for many other refugees as well.

At the end of the meeting, Grandi highlighted several commitments made by a number of participants in his closing remarks. Promises were made to:

- Increase the number of resettlement and humanitarian admission places.

- Ease family reunification and increase possibilities for family reunion.

- Give scholarships and student visas for Syrian refugees.

- Remove administrative barriers and simplify processes to facilitate and expedite the admission of Syrian refugees.

- Use resources provided by the private sector in order to create labor mobility schemes for Syrian refugees.

The Geneva meeting was attended by representatives of 92 countries, including the United States. Heather Higginbottom, Deputy Secretary of State for Management and Resources, reiterated in her remarks the U.S. commitment to refugees: “President Obama has made assisting displaced people a top priority for the U.S. government.” Last year alone the U.S. contributed more than $6 billion to humanitarian causes. So far this year, the United States has provided nearly $2.3 billion in humanitarian assistance worldwide. She also announced additional measures: “We are further increasing our support of Syrian refugees, and we will make additional contributions to the global displacement effort through September, and beyond”, while reminding the participants of President Obama’s role in hosting a high-level refugee summit this September.

The U.S. State Department released a Media Note following the Geneva meeting. It confirmed the goal of resettling at least 10,000 Syrians in FY 2016 and of 100,000 refugees from around the world by the end of FY 2017 – an increase of more that 40 percent since FY 2015. It also announced the following:

- “The United States pledged an additional $10 million to UNHCR to strengthen its efforts to identify and refer vulnerable refugees, including Syrians, for resettlement.”

- “The United States joins UNHCR in calling for new ways nations, civil society, the private sector, and individuals can together address the global refugee challenge.”

- “Additionally, the United States has created a program to allow U.S. citizens and permanent residents to file refugee applications for their Syrian family member.” [Emphasis added.]

On this last note, why create a family reunification program for Syrian refugees when refugees in the U.S. are already entitled to ask for their spouse and unmarried children under 21 to join them? Unless of course, the aim is to widen family circles to include aunts and uncles, brothers and sisters, grandmothers and grandfathers.

Let’s see if we got this right: More Syrian refugees are to be resettled in the United States; administrative barriers (including security checks?) are to be removed to expedite admissions. Come to think of it, this is exactly what we witnessed with the “Surge Operation” in Jordan, where refugee resettlement processes were reduced from 18-24 months to three months in order to meet the target of 10,000 Syrian refugees this year.

Moreover, the United States government, by its own admission, “joins UNHCR in calling for new ways” to move more Syrians to other countries. With the U.S. Refugee Resettlement program under close scrutiny, other routes for “legal admissions” (not “resettlement”) of Syrian refugees into the United States seem more appropriate. Those routes may vary from private sponsorships, labor schemes, expanded family reunification programs, humanitarian visas, medical evacuation, to academic scholarships and apprenticeships, etc.

What remains to be determined is how transparent these “alternative pathways” will be. Will we be given details about numbers, profiles, locations, screening, or costs? Also, what additional measures are we to expect from this administration as it prepares to host a Global Refugee Summit this September 20?

Meanwhile, we are left to wonder: aren’t these “pathways” for refugees nothing more than disguised resettlement routes? Akin to “pathways to citizenship” in lieu of amnesty…

Why Trump Refuses to Release Tax Returns?

The Panama Papers scandal led to many wealthy elites across the world being exposed for in many cases illicit financial transactions. Further, continued investigations by journalists have exposed the likes of John Kerry and the Hillary campaign leaders, a little known obscure address in Delaware. While tax havens are not illegal due to loopholes in the tax code, those that exploit them call into question how and why the tax havens are used in the first place. Humm….Trump will not release his tax returns until after the convention.

Related: Trump Foundation has not released all veteran fundraising money.

Related: Judge decides on Trump University Trial

Related: Trump’s new hire Manafort Trouble in the Ranks

Related: Trump’s Team Stuffed with Lobbyists

Enter the Clintons and oh…Donald Trump.

Trump and Clinton share Delaware tax ‘loophole’ address with 285,000 firms

1209 North Orange Street in Wilmington is a nondescript two-storey building yet is home to Apple, American Airlines, Walmart and presidential candidates

TheGuardian: There aren’t many things upon which Hillary Clinton and Donald Trump agree, especially as they court very different Delaware voters ahead of a primary on Tuesday. But the candidates for president share an affinity for the same nondescript two-storey office building in Wilmington. A building that has become famous for helping tens of thousands of companies avoid hundreds of millions of dollars in tax through the so-called “Delaware loophole”.

The receptionist at 1209 North Orange Street isn’t surprised that a journalist has turned up unannounced on a sunny weekday afternoon.

“You know I can’t speak to you,” she says. A yellow post-it note on her computer screen reads “MEDIA: Chuck Miller” with the phone number of the company’s director of corporate communications. Miller can’t answer many questions either, except to say that the company does not advise clients on their tax affairs.

The Guardian is not the first media organisation to turn up at the offices of Corporation Trust Centre, and it’s unlikely to be the last.

This squat, yellow brick office building just north of Wilmington’s rundown downtown is the registered address of more than 285,000 companies. That’s more than any other known address in the world, and 15 times more than the 18,000 registered in Ugland House, a five-storey building in the Cayman Islands that Barack Obama called “either the biggest building in the world, or the biggest tax scam on record”.

Officially, 1209 North Orange is home to Apple, American Airlines, Coca-Cola, Walmart and dozens of other companies in the Fortune 500 list of America’s biggest companies. Being registered in Delaware lets companies take advantage of strict corporate secrecy rules, business-friendly courts and the “Delaware loophole”, which can allow companies to legally shift earnings from other states to Delaware, where they are not taxed on non-physical incomes generated outside of the state.

The loophole is said to have cost other states more than $9bn in lost taxes over the past decade and led to Delaware to be described as “one of the world’s biggest havens for tax avoidance and evasion”.

But it’s not just big corporations that have chosen to make 1209 North Orange their official home.

Both the leading candidates for president – Hillary Clinton and Donald Trump – have companies registered at 1209 North Orange, and have refused to explain why.

Clinton, who has repeatedly promised that as president she will crack down on “outrageous tax havens and loopholes that super-rich people across the world are exploiting in Panama and elsewhere”, collected more than $16m in public speaking fees and book royalties in 2014 through the doors of 1209, according to the Clintons’ tax return.

Just eight days after stepping down as secretary of state in February 2013, Clinton registered ZFS Holdings LLC at CTC’s offices. Bill Clinton set up WJC LLC, a vehicle to collect his consultation fees, at the same address in 2008.

A spokesman for Clinton said: “ZFS was set up when Secretary Clinton left the State Department as an entity to manage her book and speaking income. No federal, state, or local taxes were saved by the Clintons as a result of this structure.”

The Clintons’ companies share the office with several of Trump’s companies. They include Trump International Management Corp and several companies that form part of Hudson Waterfront Associates, a Trump partnership to develop more than $1bn worth of luxury condos on the west side of Manhattan.

Of the 515 companies on Trump’s official Federal Election Commission (FEC) filing, 378 are registered in Delaware, he revealed, after being questioned by the Guardian about why so many of his New York-based companies are incorporated in Delaware.

He said he asked his staff to find out how many entities he has in Delaware. “I figured they’d maybe say two or three, right?” Trump said at a rally in Harrington, Delaware, on Friday. “We have 378 entities registered in the state of Delaware, meaning I pay you a lot of money, folks. I don’t feel at all guilty, OK?”

Among them are 40 Wall Street Corporation, Trump’s 72-storey downtown tower that was the tallest building in the world for two months in 1930, and the Trump Carousel in Central Park.

The Trump campaign did not respond to questions about whether Trump was using Delaware in order to avoid taxes in New York.

It is not unusual for rich individuals and companies to register their business in Delaware due to the ease of company formation in the state, but the Clintons’ and Trump’s companies in the state are likely to come under greater scrutiny as the US presidential primary roadshow rolls into the state on Tuesday. A poll by research firm Gravis Marketing last week showed Trump had a 37-point lead over John Kasich; Clinton polled 45%, ahead of Sanders on 38% in the same poll.

A report by the Institute on Taxation and Economic Policy, titled Delaware: An Onshore Tax Haven, said the state’s tax code made it “a magnet for people looking to create anonymous shell companies, which individuals and corporations can use to evade an inestimable amount in federal and foreign taxes”.

Several accounting experts said there are many legitimate reasons why US and foreign companies incorporate in Delaware, particularly because of its highly respected Court of Chancery and business-friendly state government. The process of setting up a company in the state can be completed in just a few hours and requires less paperwork than registering for a library card in the state. There are more than 1m companies registered in the state – more than Delaware’s population of 935,000.

In the US presidential election, Clinton’s rival Bernie Sanders has led the charge to counter corporate greed, and highlighted the tax havens revealed by the Panama Papers as evidence that “the wealthiest people and largest corporations must start paying their fair share of taxes”.

Clinton has called offshore tax havens “a perversion” of the legal code, and Obama called for reform of the international system earlier this month. Even Trump has said he supports raising taxes on the wealthiest Americans, “including myself”, though his tax plan offers cuts.

The Guardian Media Group, owner of theguardian.com, is registered in Dover, Delaware. “Guardian Media Group has business operations in the UK, US and Australia,” a Guardian spokesperson said. “The group’s assets are held entirely by companies in these countries and are fully subject to prevailing tax laws and regulations. The group also has a UK endowment fund which holds a mixture of UK and non-UK assets and is fully subject to UK tax laws and regulations.”

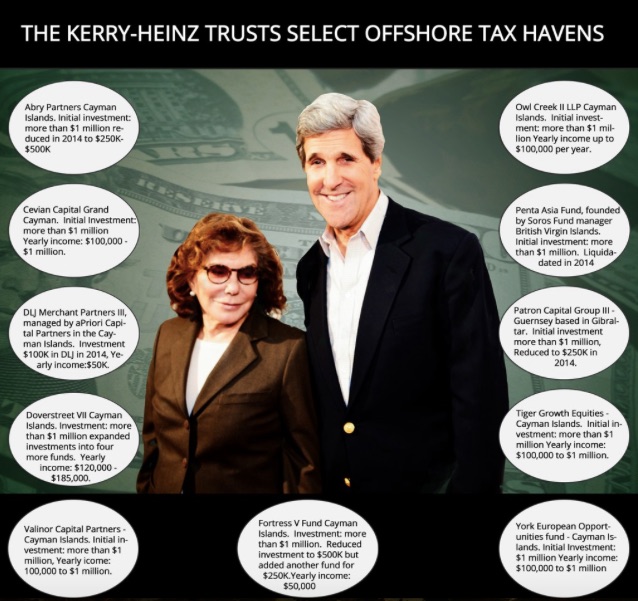

Heinz and John Kerry Deep Tax Havens in Panama Papers

EXCLUSIVE: Kerry, Heinz Family Have Millions Invested In Offshore Tax Havens

Pollock/DailyCaller: Secretary of State John Kerry and his wife Teresa Heinz have invested millions of U.S. dollars through family trusts in at least 11 offshore tax havens, according to The Daily Caller News Foundation’s Investigative Group.

The revelation comes on the heels of the release of the Panama Papers, a treasure trove of 11.5 million legal and financial records documenting how some of the world’s richest and most powerful people have used offshore bank accounts to conceal their wealth and avoid taxes.

Since the release of the papers, no American politician has been identified as using the secretive offshore accounts.

But a DCNF investigation has confirmed that the former Massachusetts Democratic senator and his billionaire wife, using an elaborate set of Heinz family trusts, have invested “more than $1 million” each into 11 separate offshore accounts — mainly hedge funds in the Cayman Islands.

The investments were made during both Kerry’s tenure in the Senate and in his present position as the nation’s chief diplomat.

The trusts funneled millions of dollars over the years into various offshore investment vehicles through a Heinz trust called the “Heinz Family Commingled Alternative Investment Fund.”

Two other trusts appear to have been set up by the Heinz family since Kerry was appointed by President Barack Obama in 2013 to succeed Hillary Clinton as secretary of state. One is called “HFI Intermediate Fund II” and other the “HFI Dividend Investments.” HFI stands for the Heinz Family Investments.

Another Heinz trust, called “HP Imperial,” invests in companies throughout Asia, including state-run companies within the People’s Republic of China. It is an interesting decision by the Heinz family, given Kerry’s present duties.

When Kerry joined the Obama administration in February 2013, he was considered the second wealthiest member of the Senate, with personal assets totaling nearly $200 million.

Teresa Heinz inherited hundreds of millions of dollars when her former husband, Republican Sen. John Heinz of Pennsylvania, died in 1991 in an airplane crash. Forbes estimates Heinz’s net worth today is $1 billion.

Even after his ascension as secretary of state, the Heinz family continues to make sizable investments in tax havens, a fact that doesn’t sit well with some who would normally be supportive of Kerry.

“Well I say it doesn’t look good by any means,” said Susan Harley, deputy director of Congress Watch, a progressive lobby organization founded by Ralph Nader.

“There’s always a question of whether it’s tax avoidance or tax evasion,” she told TheDCNF. “We would expect our government servants to uphold the law. Those folks need to be held to the same standards as everyone else.”

Obama recently lashed out at U.S. citizens who use tax havens.

On April 5, a few days after the Panama Papers were released, the president said the rich “have enough lawyers and enough accountants to wiggle out of responsibilities that ordinary citizens are having to abide by.” He said they were “gaming the system.”

Harley said the president might not be pleased with some of his cabinet members investing in tax havens: “Given what the president has said, it doesn’t sound like he would be in favor of that kind of behavior as far as people in his cabinet.”

For its part, State Department Spokesman Adm. John Kirby told TheDCNF Kerry is not a beneficiary of the investments and does not own them.

“Secretary Kerry has no offshore investments. He is not, nor has he ever been a beneficiary of Heinz Family and Marital Trusts and he has no decision-making power over them since they are entirely controlled by independent trustees,” said Kirby.

Heinz is a beneficiary, Kirby said, but he emphasized that the investments “are entirely controlled by independent trustees.” He declined to say who controls the trust and makes investment decisions.

The Kerry/Heinz family investments are so vast that Kerry’s federal financial disclosure form runs 169 pages in length, with about 10 investments per page.

Although Democrats are united in condemning offshore accounts, many Democrats, including Obama, have actually benefited from them.

The Fortress Fund, founded by James Dinan, is a tax shelter that is close to Democrats. The Heinz family invested “more than $1 million” in Fortress V when Kerry was a senator, according to his 2015 financial disclosure form.

Fortress is incorporated in the Cayman Islands, according to the company’s filing with the Securities and Exchange Commission.

In 2006, Fortress first came to public attention when it was disclosed that the hedge fund paid Democratic presidential candidate John Edwards $480,000 for a “part time job.” Edwards had invested $16 million into Fortress.

The New York Times described the Fortress Fund in 2007, saying it was comprised of “thinly regulated pools of often risky investments,” and linked it to the subprime mortgage meltdown of 2008.

Dinan also was a top Obama bundler who raised between $50,000 to $100,000 in 2008, according to OpenSecrets, a nonprofit campaign finance research group.

And Penta Asia Fund, based in the British Virgin Islands, was founded by former George Soros fund manager John Zwaanstra.

According to records from Kerry’s Senate filing and his federal disclosure filing, he and his family appear to have cut back on their offshore investments after he joined the Department of State, but did not eliminate them. In some instances, they actually invested more in various offshore funds.

The Kerry family trust offshore investments are in:

Abry Partners – The company finalized $42 billion in “leveraged transactions” according to its website. Incorporation: Cayman Islands. Kerry family investment was worth “more than $1 million” while he was in the Senate, but was reduced in 2014 to between $250K to $500K.

Cevian Capital – Is an active ownership investment firm that seeks ownership in undervalued public companies. Incorporated: George Town, Grand Cayman. This is the only offshore investment organized by the new Kerry family “HFI Diversified Investment Fund.” While secretary of state, Kerry and family invested “more than $1 million” in the fund. It pays annual dividends, interest and capital gains of $100,000 to $1 million.

DLJ Merchant Partners III — is a Delaware registered company, but as of 2013, it was managed by APriori Capital Partners, a Cayman Island registered firm. Kerry only had $100K in DLJ in 2014, but the family still receives dividends, rentals and royalties, interest and capital gains. Annual income is $50,000.

Dover Street VII – Seeks to buy investments in venture capital or buyouts in the U.S. and U.K. Incorporated: Cayman Islands. The family trust invested more than $1 million while Kerry was in the Senate. As secretary of state, the family expanded investments into four more funds. They get annual dividends, interest, rents royalties, and capital gains totaling $120,000 to $185,000.

Fortress V Fund – Specializes in buyouts and recapitalizations, according to Bloomberg. Incorporation: Cayman Islands. The trust investment: more than $1 million. After Kerry became secretary of state, the family reduced investment to $500,000 for Fortress V but added a new investment in “Fortress V Co-investment Fund” for $250,000. The family receive dividends, rents and royalties, interest and capital gains.

Owl Creek II – A hedge fund. Incorporation: Cayman Islands. Kerry family investment: More than $1 million in Senate filing; reduced to $100,000 from $1 million in 2014. The family receives dividends, rent and royalties, and capital gains up to $100,000 per year.

Penta Asia Fund – An Asia-focused hedge fund founded by Soros Fund manager John Zwaanstra. Registration: British Virgin Islands. The trusts investment began while Kerry was in the Senate with an investment of more than $1 million. It was liquidated in 2014.

Patron Capital Group III – The fund makes “opportunistic and value-oriented investments,” including “liquidity constrained property assets” predominantly in Western Europe. Registered in Guernsey and based in Gibraltar. While Kerry was in the Senate, the family invested more than $1 million, but that was reduced to $250,000 in 2014. They receive dividends, interest, and capital gains, now only $5,000 per year

Tiger Growth Equities – This fund primarily focuses investment in China, Southeast Asia, Latin America and Eastern Europe. Incorporation: Cayman Islands. More than $1 million in Kerry’s Senate filing. Kerry and family have continued their investment during his secretary of state years. They receive annual dividends, interest and capital gains estimated from $100,000 to $1 million.

Valinor Capital Partners – Is a “pooled investment hedge fund.” Incorporated: Cayman Islands. Kerry and family invested more than $1 million, receiving annual income from dividends, interest and capital gains of $100,000 to $1 million.

York European Opportunities fund – a hedge fund, that invests in “restructures, spinoffs, split-ups and proxy contests.” Incorporation: Cayman Islands. Kerry Family Investment: $1 million during the Senate term. Dividends: $100,000 to $1 million annually. Subsidiary York Capital Management’s number one investment is in the HJ Heinz Company.

“HP Imperial,” another Heinz trust invests in Malaysia, Hong Kong, Thailand and South Korea. Its biggest investments are in communist China, including the Alibaba Group; Boer Holdings, a Chinese electrical distribution company in Wuxi, Yixing and Shanghai; Hubao International Holdings, a tobacco company; Labixiaoxin Snacks Group, a Chinese snack food provider; Sands China, with six casinos in Macau; and Tibet 5100 Water Holdings, a Chinese-owned company trying to sell Tibetan premium water like Evian.