The Opioid Crisis Is Dire. Why We Need a National Conversation About It Separate From Obamacare.

Let’s be honest—the opioid crisis in America is huge, it is severe, and it is devastating. But this partisan-fought legislation just isn’t the place to put that funding. And it would likely do little to help stem and reverse the opioid crisis.

First, it’s not as though funding for opioid treatment and recovery has been absent from the federal budget. As recently as last month, Sen. Susan Collins, R-Maine, was touting signed legislation that spent more than $1 billion to fund recovery programs.

This money was authorized separately from the debate over Obamacare in two pieces of legislation known as the Comprehensive Addiction and Recovery Act and the 21st Century Cures Act.

We know that prevention programs have worked in the past, whether they pertain to forest fires or drunk driving or, for that matter, the massive reduction in drug use we witnessed in the late 1980s and early 1990s.

Such a prevention program for the opioid crisis must start with leadership from the White House in leading these conversations and highlighting the devastation of substance abuse initiation.

It requires detailing what is driving the opioid epidemic—namely, illegal fentanyl, heroin, and other illegal drug use and diversion. It requires more law enforcement—from border and customs policies and cracking down on cartels to international initiatives. And it requires messaging to our youth. More here.

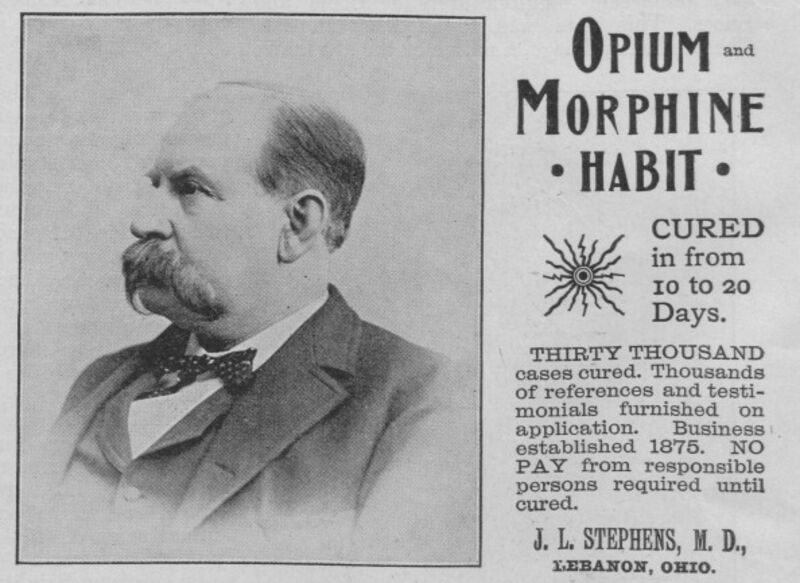

This Isn’t the First U.S. Opiate-Addiction Crisis

Problem and solution. Source: Museum of Science and Industry, Chicago/Getty Images

Bloomberg: The U.S. is in the throes of an “unprecedented opioid epidemic,” reports the Centers for Disease Control. The crisis has spurred calls for action to halt the rising death toll, which has devastated many rural communities.

It’s true that there’s an opioid epidemic, a public health disaster. It’s not true that it’s unprecedented. A remarkably similar epidemic beset the U.S. some 150 years ago. The story of that earlier catastrophe offers some sobering lessons as to how to address the problem.

Opioids are a broad class of drugs that relieve pain by acting directly on the central nervous system. They include substances such as morphine and its close cousin, heroin, both derived from the opium poppy. There are also synthetic versions, such as fentanyl, and medications that are derived from a mix of natural and synthetic sources, such as oxycodone.

Opioid addiction can take many forms, but the current crisis began with the use and abuse of legal painkillers in the 1990s, and has since metastasized into a larger epidemic, with heroin playing an especially outsized role.

All of this is depressingly familiar. The first great U.S. opiate-addiction epidemic began much the same way, with medications handed out by well-meaning doctors who embraced a wondrous new class of drugs as the answer to a wide range of aches and pains.

The pharmacologist Nathaniel Chapman, writing in 1817, held up opium as the most useful drug in the physician’s arsenal, arguing that there was “scarcely one morbid affection or disordered condition” that would fail to respond to its wonder-working powers. That same year, chemists devised a process for isolating a key alkaloid compound from raw opium: morphine.

Though there’s some evidence that opiate dependency had become a problem as early as the 1840s, it wasn’t until the 1860s and 1870s that addiction became a widespread phenomenon. The key, according to historian David Courtwright, was the widespread adoption of the hypodermic needle in the 1870s.

Prior to this innovation, physicians administered opiates orally. During the Civil War, for example, doctors on the Union side administered 10 million opium pills and nearly three million ounces of opium powders and tinctures. Though some soldiers undoubtedly became junkies in the process, oral administration had all manner of unpleasant gastric side effects, limiting the appeal to potential addicts.

Hypodermic needles by contrast, delivered morphine directly into a patient’s veins with no side effects, yielding immediate results. As Courtwright notes: “For the first time in the entire history of medicine near-instantaneous, symptomatic relief for a wide range of diseases was possible. A syringe of morphine was, in a very real sense, a magic wand.”

An enthusiastic medical profession began injecting morphine on a vast scale for all manner of aches and pains, much the way that a more recent generation of doctors began prescribing Oxycontin and other legal drugs in a reaction against widespread undertreatment of pain. Wounded veterans became addicts, but so, too, did people suffering from arthritis. Women also became addicts en masse, thanks to the practice of treating menstrual cramps – or for that matter, any female complaint of pain – with injections of morphine.

Skeptics in the medical profession warned about the dangers of administering too much morphine. Yet these warnings generally fell on deaf ears. Some of the problem lay with the doctors themselves. One well-regarded doctor put it this way: “Opium is often the lazy physician’s remedy.”

But distance played a role, too. Doctors traveling dirt roads on horseback couldn’t always follow up with patients in pain, and so they left their charges with vials of morphine. Well-meaning doctors who might otherwise resist administering morphine also faced pressure from patients and families to do so. If they refused, it was easy to find a doctor who would comply.

In the end, though, the medical profession largely solved the problem on its own. As awareness of physicians’ role in fostering addiction spread, medical schools taught aspiring doctors to avoid prescribing morphine except under carefully controlled circumstances. The growing availability of milder analgesics – salicylates like aspirin – made the job easier, offering a less powerful, but far safer, alternative to morphine.

While the younger generation of doctors stigmatized morphine, the problem was increasingly linked to older, poorly trained doctors who had come of age in an era when the hypodermic needle was touted as a cure-all. A study in 1919, for example, found that 90 percent of opiate prescriptions in Pennsylvania came from only a third of the state’s doctors, most of whom were over 50 years old.

As the medical profession started to police its ranks, shaming those who enabled addiction, the epidemic began to burn itself out. “Old addicts died off faster than new ones were created,” writes Courtwright. The smaller group of addicts who became the face of opiate addition tended to be poorer “pleasure users” who picked up the habit in the criminal underworld.

Today’s opioid epidemic is similar to the one that came and went over a century ago. While there is plenty of room for government assistance in funding treatment for addicts, never mind regulation of drugs, history suggests that the medical profession will ultimately play the most important role.

There are some promising signs. The number of opioid prescriptions written by doctors has dropped by small amounts over the past few years, though some of the evidence suggests that the decline has more to do with patients anxious about the potential for addiction.

Still, it took decades during the 19th century for doctors to shy away from injecting patients with morphine for the slightest complaint. It may take just as long before doctors kick the habit of prescribing powerful pain pills.

SuissNews

SuissNews