Mr. Kerry told the press at the time that the settlement included $400 million that Iran under the Shah had paid into a U.S. trust fund for an arms deal that collapsed after Iran’s 1979 Islamic revolution. Plus, said Kerry, the U.S. had agreed to pay “a roughly $1.3 billion compromise on the interest.”

The Wall Street Journal’s Jay Solomon and Carole E. Lee broke earlier this month the news that on the same day that Mr. Obama announced the settlement, his administration secretly sent Iran the $400 million payment in cash. Last week, the State Department finally confirmed that the January 17 cash shipment was used as “leverage” to ensure Iran’s release that same day of four American prisoners — fueling questions about whether the Obama administration, despite its denials, had paid ransom.

Yet more questions surround the administration’s handling of the remaining $1.3 billion. Could this have been drawn from a fund bankrolled by American taxpayers and housed at Treasury, called the Judgment Fund? And why were the 13 payments in amounts of one cent less than $100,000,000?

The Judgment Fund has long been a controversial vehicle for federal agencies to detour past one of the most pointed prohibitions in the Constitution: “No Money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law.”

The Judgment Fund, according to a Treasury Department Web site, is “a permanent, indefinite appropriation” used to pay monetary awards against U.S. government agencies in cases “where funds are not legally available to pay the award from the agency’s own appropriations.”

In March, in letters responding to questions about the Iran settlement sent weeks earlier by Representatives Edward Royce and Mike Pompeo, the State Department confirmed that the $1.3 billion “interest” portion of the Iran settlement had been paid out of the Judgment Fund. But State gave no information on the logistics.

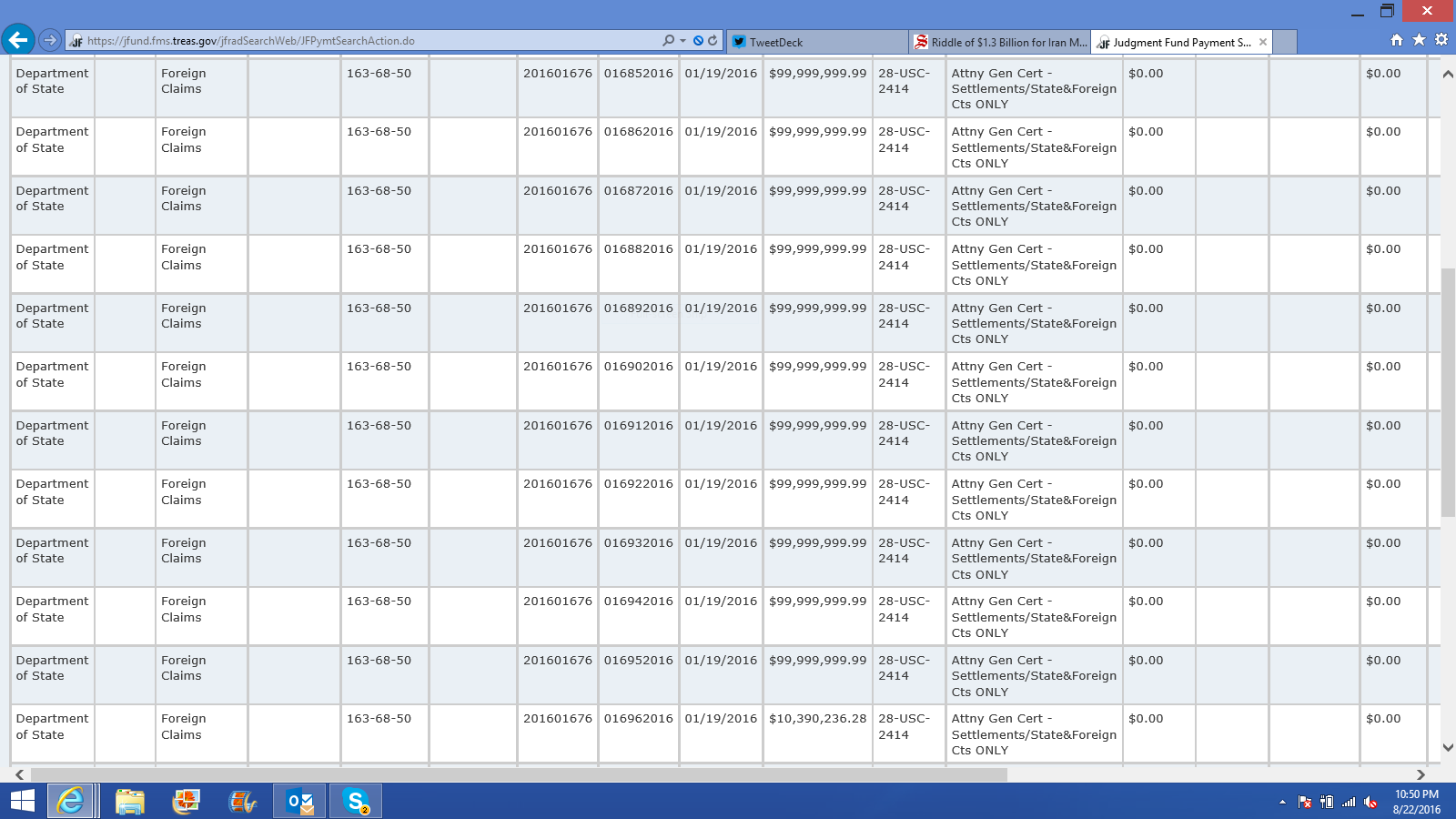

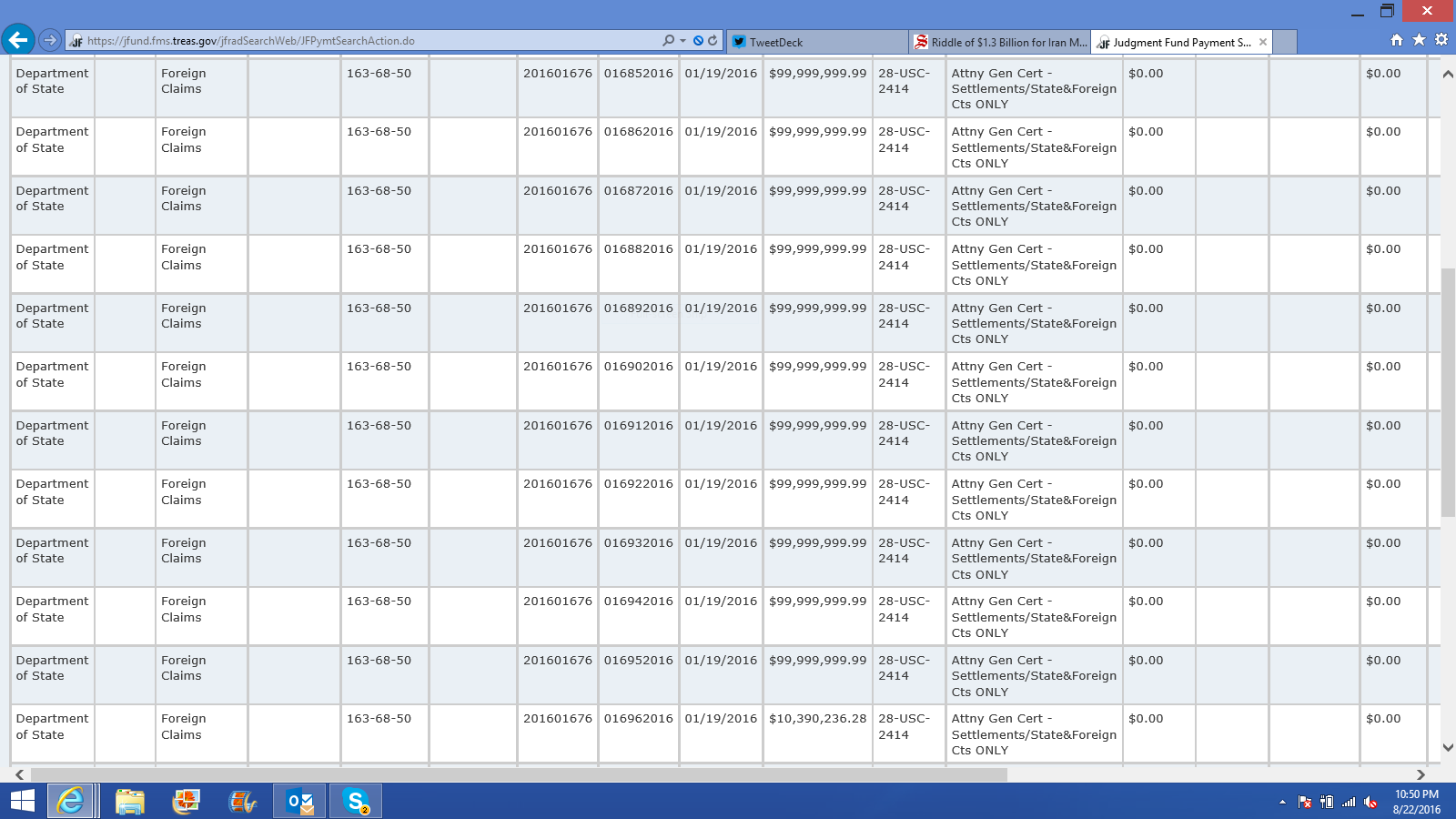

The 13 payments that may explain what happened are found in an online database maintained by the Judgment Fund. A search for “Iran” since the beginning of this year turns up nothing. But a search for claims in which the defendant is the State Department turns up 13 payments for $99,999,999.99.

![Description: https://ssl.gstatic.com/ui/v1/icons/mail/images/cleardot.gif]()

They were all made on the same day, all sharing the same file and control reference numbers, all certified by the U.S. Attorney General, but each assigned a different identification number. They add up to $1,299,999,999.87, or 13 cents less than the $1.3 billion Messrs. Clinton and Kerry announced in January.

Together with a 14th payment of just over $10 million, the grand total paid out by Treasury from the Judgment Fund on that single day, January 19, for claims pertaining to the State Department, comes to roughly $1.31 billion.

Treasury has provided no answers to my queries about whether these specific payments were for the Iran settlement. Nor why these transfers comprised 13 payments, each of which was a cent under $100,000,000. Nor whether the $10 million related to the same matter.

The Judgment Fund database contains over the past year no other payouts pertaining to State that come anywhere near the scale of $1.3 billion of the announced with Iran. And it contains no details on what the State Department might have done with the $1.3 billion.

It does say, as a general matter, that “Defendant Agency Name is the same as the Responsible Agency Name.” It leaves open the question of whether it was State rather than Treasury that determined by what route and in what form the funds would reach their final destination.

State has refused to disclose even such basic information as the date on which Iran took receipt of the $1.3 billion. As recently as August 4, a State spokesman told the press: “I don’t have a date of when that took place.”

Nor has the administration answered whether the $1.3 billion was transferred to Iran via the banking system, or, like the $400 million, in cash. According to the Judgment Fund web site, the “preferred method” for payments is “by electronic fund transfer,” approved by the relevant government agency, to the party receiving the award.

But, the Weekly Standard noted last week, President Obama recently defended his $400 million cash shipment to Iran on the grounds that “We don’t have a banking relationship with Iran… We could not wire the money.”

The Judgment Fund’s public database provides no information about where precisely the $1.31 billion in January payments went, or how. The Fund’s web site does provide blank “Voucher for Payment” forms, requiring administration officials to provide such details, and sign off on them.

These payouts from the Judgment Fund were made within days of the announcement of the Iran settlement. The Judgment Fund’s web site states that while its bureaucracy has recently become more efficient, “processing times” for payments still take “6 to 8 weeks.”

If the multiple 10-digit payments of January 19 do turn out to be connected to the Iran settlement announced January 17, that would suggest that the Judgment Fund completed its processing for Iran in a mere two days one of which — Monday, January 18 — was a federal holiday.

Ms. Rosett, a Foreign Policy Fellow with the Independent Women’s Forum, a columnist of Forbes and a blogger for PJMedia, is a contributing editor of The New York Sun.

CNN reported Wednesday that Cabrera’s attorney, Stephen Bronis, said $20,000(given to the Clinton-Gore campaign) was not intended to buy protection for drug smuggling.

CNN reported Wednesday that Cabrera’s attorney, Stephen Bronis, said $20,000(given to the Clinton-Gore campaign) was not intended to buy protection for drug smuggling.