You cant even trust a bank employee, much less the bank? And a big banking network. So who pays the fine, who goes to jail, who does the formal walk of shame?

CNN: Wells Fargo is being slapped with the largest penalty since the CFPB was founded in 2011. The bank agreed to pay $185 million in fines, along with $5 million to refund customers.

“We regret and take responsibility for any instances where customers may have received a product that they did not request,” Wells Fargo said in a statement.

Wells Fargo confirmed to CNNMoney that the firings represents about 1% of its workforce.

“At Wells Fargo, when we make mistakes, we are open about it, we take responsibility, and we take action,” the bank said in a memo to employees on Thursday.

Wells Fargo to pay $185 million to settle allegations its workers opened fake accounts

LATimes: City and federal officials have reached a $185-million settlement with Wells Fargo over allegations that the bank’s employees, driven by strict sales quotas, regularly opened new accounts for customers without their knowledge.

The settlement, announced Thursday morning, calls for the San Francisco banking giant to pay $100 million in penalties to the Consumer Financial Protection Bureau — the largest fine the federal agency has ever imposed — and $35 million to the Office of the Comptroller of the Currency, another federal regulator.

It also will pay $50 million in penalties to local officials and to compensate account holders for fees related to bogus accounts.

The bank did not admit any wrongdoing in the consent order but apologized to customers and announced steps to tighten its sales practices.

The questionable practices were uncovered by a 2013 Times investigation that found Wells Fargo pressured its employees to open more accounts and that some employees resorted to opening fake ones to meet sales goals.

Last year, Los Angeles City Atty. Mike Feuer filed a lawsuit that alleged Wells Fargo “victimized their customers by using pernicious and often illegal sales tactics” including unrealistic quotas and policies that have “driven bankers to engage in fraudulent behavior.”

Feuer’s suit caught the attention of the CFPB and OCC, which conducted their own investigations into the bank’s sales tactics. The CFPB, citing an analysis by Wells Fargo, said bank employees may have opened as many as 2 million accounts — including more than 500,000 credit cards — without customers’ authorization.

The investigations found that employees would illegally transfer funds into unauthorized accounts, create PINs for debit cards customers never asked for and even created bogus email addresses to secretly sign customers up for online banking.

“Wells Fargo employees secretly opened unauthorized accounts to hit sales targets and receive bonuses,” said Richard Cordray, director of the CFPB, in a statement Thursday. “Because of the severity of these violations, Wells Fargo is paying the largest penalty the CFPB has ever imposed.”

On a conference call with reporters on Thursday, Feuer called the bank’s practices “a major breach of trust.”

“It’s outrageous for a bank to use a customer’s private information without permission to open an unwanted account,” he said. “Customers must be able to trust their banks.”

The bank has consistently said such practices are not widespread and that workers who cheat to meet sales goals are disciplined or fired. In a statement Thursday, Wells Fargo confirmed the settlements and said it has set aside $5 million to cover refunds to customers.

The bank said it has already provided refunds to about 100,000 customers, paying a total of $2.6 million so far with payments averaging $25. The bank said the number of accounts refunded represent “a fraction of one percent of the accounts reviewed.”

“Wells Fargo is committed to putting our customers’ interests first 100 percent of the time, and we regret and take responsibility for any instances where customers may have received a product that they did not request,” the bank said in its statement.

The Times’ 2013 story, based on court records and interviews with dozens of former and current Wells Fargo employees, reported that workers opened duplicate accounts, ordered credit cards for customers who did not ask for them and even forged customers’ signatures.

In many cases, customers say they’ve had to pay fees related to accounts they never opened.

In a more extreme case, Mexican pop star Ana Bárbara this summer sued Wells Fargo, saying an employee opened up accounts without her knowledge then spent more than $400,000 in her name.

Wells Fargo employees have sued the bank alleging they were forced to work unpaid overtime as they tried to meet goals, while bank customers have sued alleging that fake accounts were opened in their names.

But the customers have so far been unsuccessful in their lawsuits. At Wells Fargo, as at many other banks, when customers sign up for accounts, they agree that any dispute with the bank will be handled in private arbitration rather than in court.

Judges have ruled that those arbitration agreements hold up even in cases in which customers are suing over accounts they never authorized.

Along with reimbursing customers and paying $25 million to the city of Los Angeles and another $25 million to the county, the bank will send notices to customers asking them to stop by a branch so that employees can “help you close any accounts or discontinue services you do not recognize or want,” according to the settlement agreement with Feuer’s office.

Already, Wells Fargo officials said the bank has hired an outside firm that has reviewed customer accounts looking for bogus accounts. The bank said the outside review was finalized before the settlements.

The bank said it has also disciplined and fired managers and employees who “acted counter to our values,” and has worked to improve training and monitoring programs.

Regulators said Thursday that their actions against Wells Fargo should send a message that banks must ensure their sales tactics do not lead to consumer harm.

The CFPB’s Cordray said banks can have sales goals and financial incentives for employees to open accounts for customers, but those goals and incentives must be carefully structured and monitored.

“What happened here is Wells Fargo built an incentive-compensation program that made it possible for Wells Fargo employees to pursue underhanded sales tactics,” he said. “Companies need to pay very close attention … to ensure that customers are protected.”

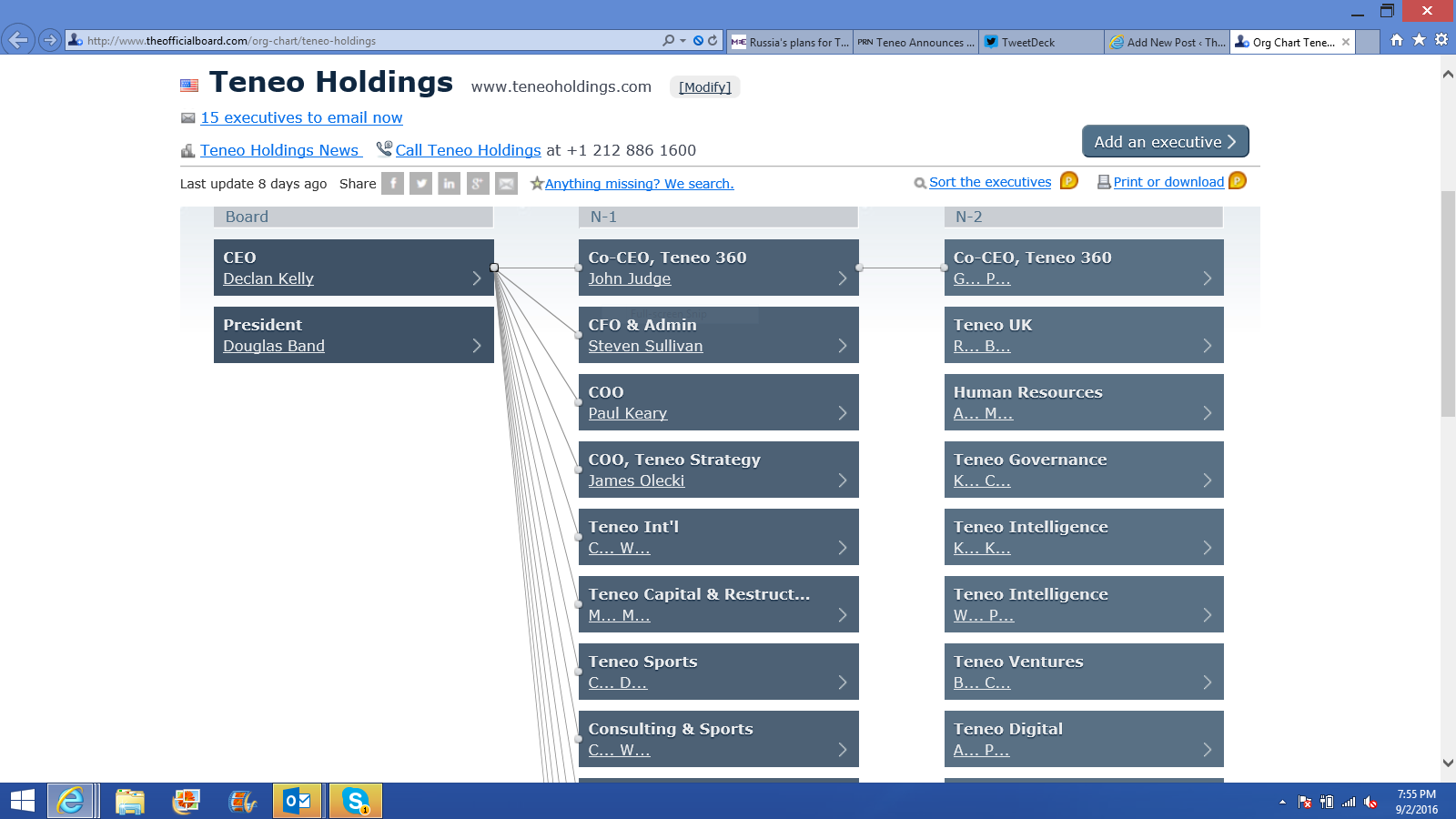

According to Wikipedia, Teneo is an US-based global advisory firm that partners exclusively with the

According to Wikipedia, Teneo is an US-based global advisory firm that partners exclusively with the