Guccifer 2.0 has been busy toward the end of the week with a new release found below:

As you see the U.S. presidential elections are becoming a farce, a big political performance where the voters are far from playing the leading role. Everything is being settled behind the scenes as it was with Bernie Sanders.

I wonder what happened to the true democracy, to the equal opportunities, the things we love the United States for. The big money bags are fighting for power today. They are lying constantly and don’t keep their word. The MSM are producing tons of propaganda hiding the real stuff behind it. But I do believe that people have right to know what’s going on inside the election process in fact.

To make a long story short, here are some DCCC docs from their server. Make use of them.

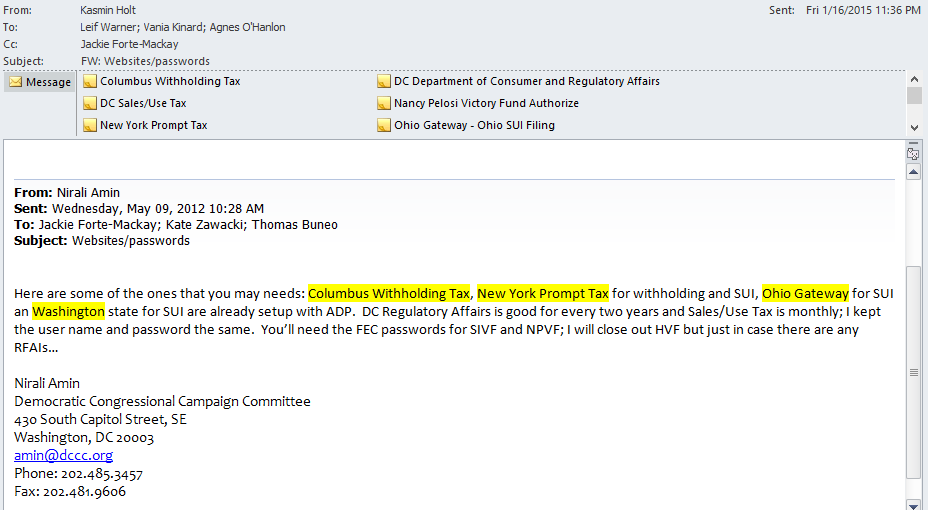

Special thanks to Nirali Amin for the list of passwords.

By the way, the complexity of the passwords leaves much to be desired.

Here are more docs from the DCCC server.

Copy of 114th Congressional Contacts

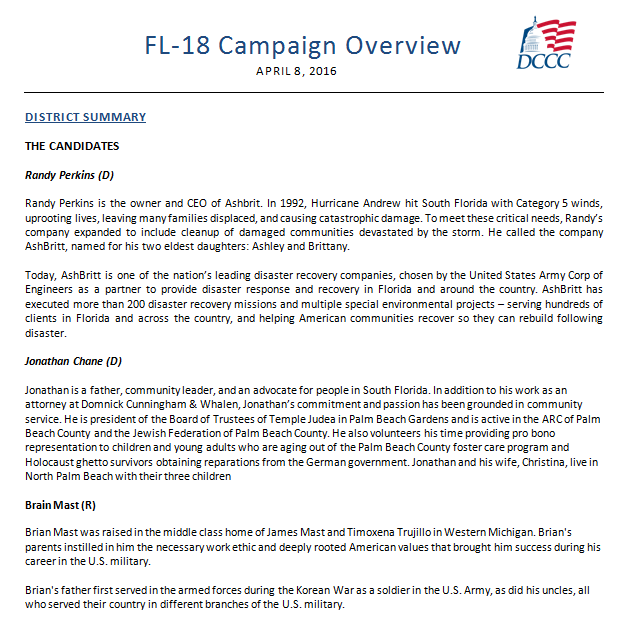

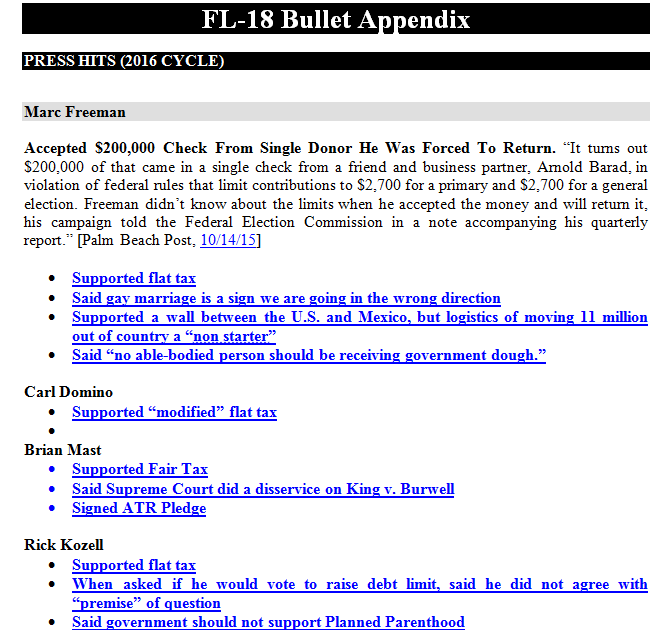

FL-18 Campaign Overview Appendix

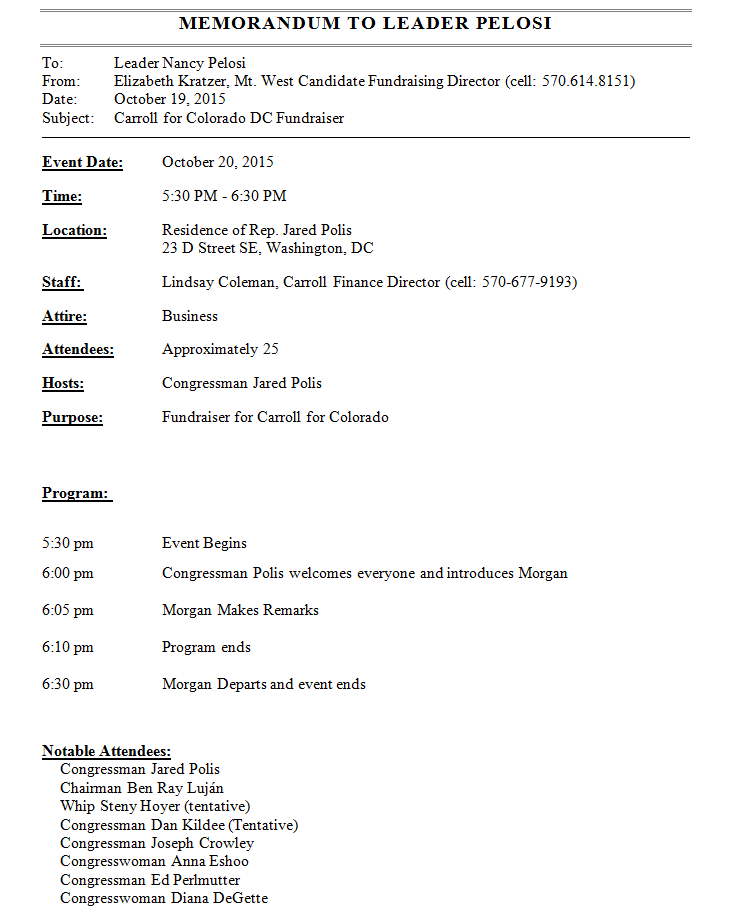

These docs are from Nancy Pelosi’s PC

*****

Clinton Releases 2015 Tax Returns — Here’s Where 96 Percent of Their Charitable Donations Went

TheBlaze and Mediaite: Of the $10.6 million Hillary and Bill Clinton earned last year, they gave more than $1 million to charity, according to a tax filing released by the Democratic presidential nominee’s campaign Friday.

As it turns out, 96 percent of the Clintons’ 2015 charitable donations went to the Clinton Family Foundation, a tax-exempt charity owned by the Clintons but separate from the well-known Clinton Foundation. According to the tax release, the Clintons donated $42,000 to Desert Classic Charities and $1 million to the Clinton Family Foundation.

Interestingly, as the Daily Caller pointed out, the money donated to Desert Classic soon funneled back to the Clintons as the charity donated $700,000 to the Hillary, Bill and Chelsea Clinton Foundation. The money was donated for work on obesity programs.

In 2012, Republican presidential nominee Mitt Romney became the subject of much scrutiny for his charitable donations. The former Massachusetts governor earned $14 million and gave $4 million to charity. Many progressive pundits hit Romney because a majority of his charitable giving went to the Mormon church and part of it was gifted to a foundation controlled by his family.

The Clintons’ charity work has been criticized ever since the release of Peter Schweitzer’s 2015 book “Clinton Cash.” The author asserts that many of the embattled Clinton Foundation’s donations from foreign and domestic people occurred alongside favorable treatment from Clinton’s State Department.

This comes amid a new release of Clinton emails seemingly showing a tangled relationship between the State Department and the Clinton Foundation during Clinton’s tenure as secretary of state.

The FBI pushed the Department of Justice to launch an integrity probe into the Clinton Foundation, but the agency denied, claiming there was not enough evidence of wrongdoing to justify such an investigation.

**** Oh Bill, what have you been doing lately?

Bill Clinton netted $1.6 million from for-profit colleges

WashingtonExaminer: Bill Clinton netted $1.6 million last year from a pair of for-profit education companies that caused controversy for the future president during Hillary Clinton’s time as secretary of state.

Laureate Education paid Bill Clinton nearly $1.1 million in 2015, according to tax returns released by his wife’s campaign Friday. GEMS Education, a Dubai-based firm, paid him more than $560,000.

Both companies are major donors to the Clinton Foundation.

Bill Clinton’s lucrative consulting contracts with the corporations have raised questions about how closely his personal fortune is linked to his philanthropic activities.

What’s more, the State Department handed Laureate’s chairman taxpayer-funded grants under Hillary Clinton’s watch.

** Be sure to click the link below for the income graphic.Douglas Becker, CEO of Laureate, also heads a nonprofit group called the International Youth Foundation, which netted millions from the U.S. Agency for International Development in 2010. USAID is an arm of the State Department.

The Clintons have weathered criticism in the past for promoting affordable or free higher education while accepting a paycheck from one of the largest for-profit college education firms in the world.

Bill Clinton said he ended his time as the honorary chancellor of Laureate in April of last year, the same month Hillary Clinton launched her presidential bid.

Contracts with GEMS and Laureate have earned Bill Clinton more than $15 million. That sum padded the additional millions he pocketed from speaking fees thanks to engagements he booked around the world while Hillary Clinton served as the nation’s chief diplomat.