The vote is very….very close so far.

CNNMoney: U.K. citizens worldwide will vote in the historic referendum on June 23. Prime Minister David Cameron will campaign for the U.K. to stay in the EU. The British economy is the second largest in the EU. Its decision on whether to stay or go will have big implications not only for the people of the U.K. but also global financial markets and the future of Europe. More here.

‘Monstrous interference’: UK pols furious at Obama’s plan to intervene in EU debate

FNC: President Obama looks set to wade into the contentious debate in the United Kingdom over whether or not the nation should remain a member of the European Union – and some Brits are angry at the president’s intrusion into a delicate UK issue ahead of a major vote.

Obama will arrive in London late Thursday for a three-day trip. On Friday he will meet Prime Minister David Cameron — who is reportedly keen to get Obama’s backing ahead of the June 23 referendum, in which Britons will choose to remain or leave the European Union.

Cameron is in a difficult position, backing the “Remain” campaign, while many within his own Conservative Party are campaigning for the “Leave” or “Brexit” (British-Exit) campaign. Polls have shows the race is tight, with the Remain campaign holding an edge as small as one percent.

The White House has said Obama is willing to offer his opinion and may announce that he favors Cameron’s position – that Britain should remain in the European Union.

“If he’s asked his view as a friend, he will offer it,” U.S. Deputy National Security Adviser Ben Rhodes said. “As the president has said, we support a strong United Kingdom in the European Union.”

Those calling for Britain to leave the European Union are not happy at that news, with U.K. Independence Party leader Nigel Farage saying Obama should stay home.

‘A monstrous interference,” Farage told Fox News Thursday. “I’d rather he stayed in Washington, frankly, if that’s what he’s going to do.”

“You wouldn’t expect the British Prime Minister to intervene in your presidential election, you wouldn’t expect the Prime Minister to endorse one candidate or another. Perhaps he’s another one of those people who doesn’t understand what [the EU] is,” Farage said.

In March, a letter sent from Conservative MP and former cabinet minister Liam Fox, and co-signed by over 100 MPs from four different political parties, asked the U.S. Ambassador to the U.K. to persuade Obama not to intervene, calling any such intervention “extremely controversial and potentially damaging.”

“It has long been the established practice not to interfere in the domestic political affairs of our allies and we hope that this will continue to be the case,” the letter to Ambassador Matthew Barzun read.

“While the current U.S. administration may have a view on the desirability or otherwise of Britain’s continued membership of the E.U., any explicit intervention in the debate is likely to be extremely controversial and potentially damaging,” the letter said.

London Mayor Boris Johnson — who was born in New York and has expressed strong support for the UK-U.S. relationship — accused Obama of hypocrisy.

“I just think it’s paradoxical that the United States, which wouldn’t dream of allowing the slightest infringement of its own sovereignty, should be lecturing other countries about the need to enmesh themselves ever deeper in a federal superstate,” Johnson said Tuesday.

Cameron however, has said that the advice of allies was welcome, saying “listening to what our friends say in the world is not a bad idea.”

“I struggle to find the leader of any friendly country that thinks we should leave,” he said Wednesday.

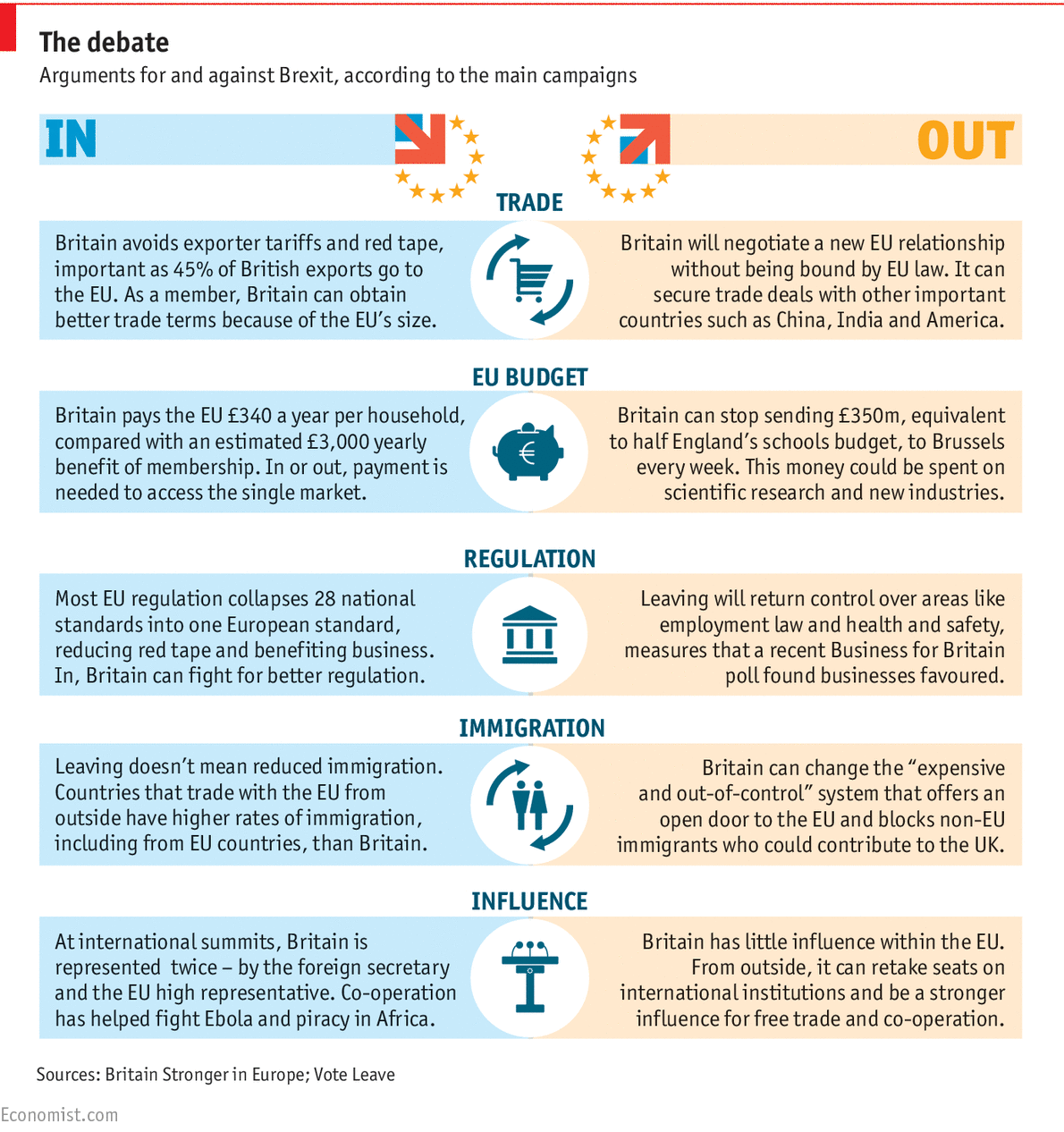

***** For the explanation of the referendum and graphics by The Economist, go here.