Operation ReWired:

Federal authorities announced today a significant coordinated effort to disrupt Business Email Compromise (BEC) schemes that are designed to intercept and hijack wire transfers from businesses and individuals, including many senior citizens. Operation reWired, a coordinated law enforcement effort by the U.S. Department of Justice, U.S. Department of Homeland Security, U.S. Department of the Treasury, U.S. Postal Inspection Service, and the U.S. Department of State, was conducted over a four-month period, resulting in 281 arrests in the United States and overseas, including 167 in Nigeria, 18 in Turkey and 15 in Ghana. Arrests were also made in France, Italy, Japan, Kenya, Malaysia, and the United Kingdom (UK). The operation also resulted in the seizure of nearly $3.7 million.

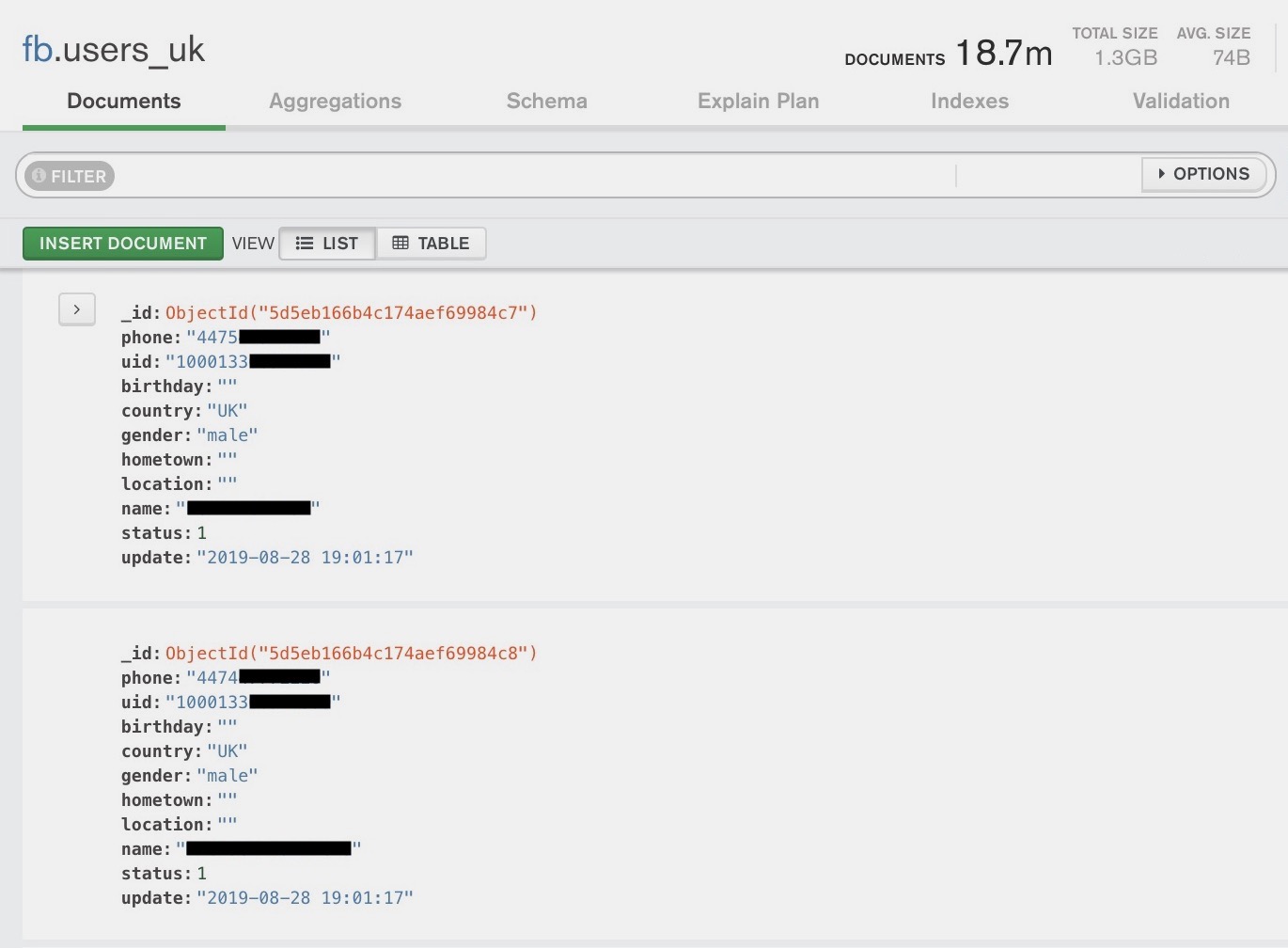

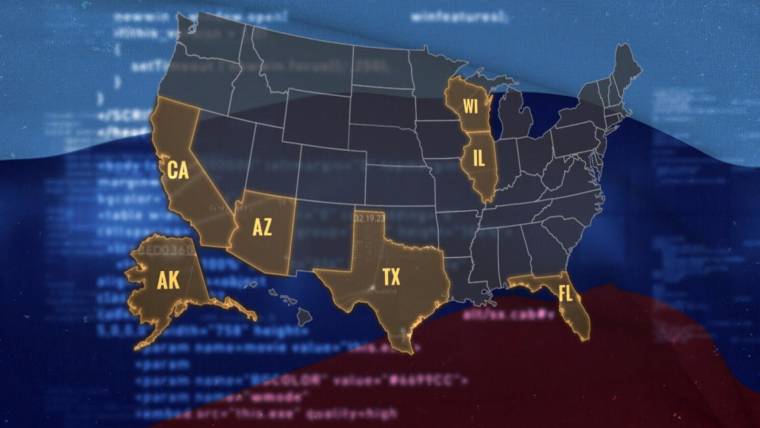

photo

photo

BEC, also known as “cyber-enabled financial fraud,” is a sophisticated scam often targeting employees with access to company finances and businesses working with foreign suppliers and/or businesses that regularly perform wire transfer payments. The same criminal organizations that perpetrate BEC also exploit individual victims, often real estate purchasers, the elderly, and others, by convincing them to make wire transfers to bank accounts controlled by the criminals. This is often accomplished by impersonating a key employee or business partner after obtaining access to that person’s email account or sometimes done through romance and lottery scams. BEC scams may involve fraudulent requests for checks rather than wire transfers; they may target sensitive information such as personally identifiable information (PII) or employee tax records instead of, or in addition to, money; and they may not involve an actual “compromise” of an email account or computer network. Foreign citizens perpetrate many BEC scams. Those individuals are often members of transnational criminal organizations, which originated in Nigeria but have spread throughout the world.

“The Department of Justice has increased efforts in taking aggressive enforcement action against fraudsters who are targeting American citizens and their businesses in business email compromise schemes and other cyber-enabled financial crimes,” said Deputy Attorney General Jeffrey Rosen. “In this latest four-month operation, we have arrested 74 people in the United States and 207 others have been arrested overseas for alleged financial fraud. The coordinated efforts with our domestic and international law enforcement partners around the world has made these most recent actions more successful. I want to thank the FBI, more than two dozen U.S. Attorney’s Offices, U.S. Secret Service, U.S. Postal Inspection Service, Homeland Security Investigations, IRS Criminal Investigation, U.S. Department of State’s Diplomatic Security Service, our partners in Nigeria, Ghana, Turkey, France, Italy, Japan, Kenya, Malaysia, and the UK, and our state and local law enforcement partners for all of their hard work to combat these fraud schemes and protect the hard-earned assets of our citizens. Anyone who engages in deceptive practices like this should know they will not go undetected and will be held accountable.”

“The FBI is working every day to disrupt and dismantle the criminal enterprises that target our businesses and our citizens,” said FBI Director Christopher A. Wray. “Cooperation is the backbone to effective law enforcement; without it, we aren’t as strong or as agile as we need to be. Through Operation reWired, we’re sending a clear message to the criminals who orchestrate these BEC schemes: We’ll keep coming after you, no matter where you are. And to the public, we’ll keep doing whatever we can to protect you. Reporting incidents of BEC and other internet-enabled crimes to the IC3 brings us one step closer to the perpetrators.”

“The Secret Service has taken a multi-layered approach to combating Business Email Compromise schemes through our Global Investigative Operations Center (GIOC),” said U.S. Secret Service Director James M. Murray. “Domestically, the GIOC assists Secret Service Field Offices and other law enforcement partners with analysis and investigative tactics to enhance the impact of local BEC investigations. Internationally, the GIOC targets and identifies transnational organized crime networks that perpetrate these cyber-enabled financial fraud schemes. Through this approach, the Secret Service continues to strive to protect the citizens of the United States and our financial infrastructure from these complex crimes.”

“Homeland Security Investigations (HSI), together with its law enforcement partners, has proven once again, that cyber-enabled financial fraud will not be tolerated in the United States,” said Acting Director Matthew T. Albence of U.S. Immigration and Customs Enforcement (ICE). “Operation reWired sends a clear message to criminals, that no matter how or where crimes are committed, we will do everything within our means to dismantle criminal enterprises that seek to manipulate U.S. institutions and taxpayers.”

“The consequences of this type of fraud scheme are far reaching, affecting not only people in the United States, but also across the world,” said Chief Postal Inspector Gary Barksdale. “This investigation is just another example of how effective law enforcement agencies can be when they join forces. By working together, we can keep our communities and our vulnerable populations safe from financial exploitation. The U.S. Postal Inspection Service is proud to be at the forefront of the fight against fraud and Postal Inspectors will continue to adapt to the ever changing landscape to stop the scammers and protect our customers.”

“In unraveling this complex, nationwide identity theft and tax fraud scheme, we discovered that the conspirators stole more than 250,000 identities and filed more than 10,000 fraudulent tax returns, attempting to receive more than $91 million in refunds,” said Chief Don Fort of IRS Criminal Investigation. “We will continue to work with our international, federal and state partners to pursue all those responsible for perpetrating this fraud, preying on innocent victims and attempting to cheat the U.S. out of millions of dollars.”

“The investigation of these crimes crossed international borders,” said Director Todd J. Brown of the U.S. Department of State’s Diplomatic Security Service (DSS). “Today’s charges are another successful example of our commitment to working together with both foreign colleagues abroad as well as local, state and federal law enforcement partners here at home in the pursuit of those who commit cyber-related financial crimes.”

A number of cases involved international criminal organizations that defrauded small to large sized businesses, while others involved individual victims who transferred high dollar funds or sensitive records in the course of business. The devastating effects these cases have on victims and victim companies affect not only the individual business but also the global economy. According to the Internet Crime Complaint Center (IC3), nearly $1.3 billion in loss was reported in 2018 from BEC and its variant, Email Account Compromise (EAC), nearly twice as much as was reported the prior year. BEC and EAC are prevalent scams and the Justice Department along with our partners will continue to aggressively pursue and prosecute the perpetrators, including money mules, regardless of where they are located.

Money mules may be witting or unwitting accomplices who receive ill-gotten funds from the victims and then transfer the funds as directed by the fraudsters. The money is wired or sent by check to the money mule who then deposits it in his or her own bank account. Usually the mules keep a fraction for “their trouble” and then wire the money as directed by the fraudster. The fraudsters enlist and manipulate the money mules through romance scams or “work-at-home” scams, though some money mules are knowing co-conspirators who launder the ill-gotten gains for profit.

BEC scams are related to, and often conducted together with, other forms of fraud such as:

“Romance scams,” where victims are lulled into believing they are in a legitimate relationship, and are tricked into sending or laundering money under the guise of assisting the paramour with an international business transaction, a U.S. visit, or some other cover story;

“Employment opportunities scams,” where victims are convinced to provide their PII to apply for work-from-home jobs, and, once “hired” and “overpaid” by a bad check, to wire the overpayment to the “employer’s” bank before the check bounces;

“Fraudulent online vehicle sales scams,” where victims are convinced they are purchasing a nonexistent vehicle and must pay for it by sending the codes of prepaid gift cards in the amount of the agreed upon sale price to the “seller;”

“Rental scams,” where a scammer agrees to rent a property, sends a bad check in excess of the agreed upon deposit, and requests the overpayment be returned via wire before the check bounces; and

“Lottery scams,” where victims are convinced they won an international lottery but must pay fees or taxes before receiving the payout.

Starting in May 2019, this coordinated enforcement action targeted hundreds of BEC scammers. Law enforcement agents executed over 214 domestic actions including arrests, money mule warning letters, and asset seizures and repatriations totaling nearly $3.7 million. Local and state law enforcement partners on FBI task forces across the country, with the assistance of multiple District Attorney’s Offices, also arrested alleged money mules for their role in defrauding victims.

Among those arrested on federal charges in BEC schemes include:

Following an investigation led by the FBI’s Chicago Division, Brittney Stokes, 27, of Country Club Hills, Illinois, and Kenneth Ninalowo, 40, of Chicago, Illinois, were charged in the Northern District of Illinois with laundering over $1.5 million from proceeds of BEC scams. According to the indictment, a community college and an energy company were defrauded into sending approximately $5 million to fraudulent bank accounts controlled by the scammers. Banks were able to freeze approximately $3.6 million of the $5 million defrauded in the two schemes. Law enforcement officials seized a 2019 Range Rover Velar S from Stokes and approximately $175,909 from Stokes and Ninalowo.

As a result of a joint investigation by the FBI, HSI, and DSS, Opeyemi Adeoso, 44, of Dallas, Texas, and Benjamin Ifebajo, 45, of Richardson, Texas, were arrested and charged in the Northern District of Texas with bank fraud, wire fraud, money laundering, and conspiracy. Adeoso and Ifebajo are alleged to have received and laundered at least $3.4 million. In furtherance of their scheme, they are alleged to have assumed 12 fictitious identities and defrauded 37 victims from across the United States.

As part of a larger investigation by the FBI and the USSS in Miami, Yamel Guevara Tamayo, 36, of Miami, Florida, and Yumeydi Govantes, 39, of Miami, Florida, were charged in the Southern District of Florida with laundering more than $950,000 of proceeds of BEC scams. The two individuals were also responsible for recruiting approximately 18 other individuals to serve as money mules, who laundered proceeds of BEC scams for an international money laundering network. The victims of the BEC scams included title companies, corporations, and individuals. The individuals were indicted June 18, 2019 and arrested June 20, 2019. The change of plea for both individuals is scheduled for Sept. 16.

In an investigation by FBI Atlanta, two individuals were charged in the Northern District of Georgia for their involvement in a Nigeria-based BEC scheme that began with a $3.5 million transfer of funds fraudulently misdirected from a Georgia-based health care provider to accounts across the United States. Two Nigerian nationals, Emmanuel Igomu, 35, of Atlanta, Georgia, and Jude Balogun, 29, of San Francisco, California, have been arrested on charges of aiding and abetting wire fraud for their part in receiving and transmitting monies derived from the BEC.

Following an investigation by the FBI, Cyril Ashu, 34, of Austell, Georgia; Ifeanyi Eke, 32, of Sandy Springs, Georgia; Joshua Ikejimba, 24, of Houston, Texas; and Chinedu Ironuah, 32, of Houston, Texas, were charged in the Southern District of New York with one count of conspiracy to commit wire fraud and one count of wire fraud for their involvement in a Nigeria-based BEC scheme that impacted hundreds of victims in the United States, with losses in excess of $10 million.

An indictment is merely an allegation and the defendants are presumed innocent until proven guilty beyond a reasonable doubt in a court of law.

The cases were investigated by the FBI, U.S. Secret Service, U.S. Postal Inspection Service, ICE’s Homeland Security Investigations (HSI), IRS Criminal Investigation and U.S. Department of State’s Diplomatic Security Service. U.S. Attorney’s Offices in the Districts of Arizona; Central, Eastern and Southern California; Colorado; Delaware; Southern Florida; Northern Georgia; Northern Illinois; Kansas; Eastern Louisiana; Massachusetts; Nebraska; Nevada; Southern New York; Middle North Carolina; Northern Ohio; Oregon; Northern, Western and Southern Texas; Western Tennessee; Eastern Virginia; Eastern Washington, and elsewhere have ongoing investigations some of which have resulted in arrests in Nigeria. The Justice Department’s Computer Crime and Intellectual Property Section, Money Laundering and Asset Recovery Section, and Office of International Affairs of the Criminal Division provided assistance. District Attorney’s Offices of Harris County, Texas; Fort Bend County, Texas; and Washington County, Arkansas are handling state prosecutions. Additionally, private sector partners and the Nigerian Economic and Financial Crimes Commission, Ghana Police Service (GPS) and Economic and Organized Crime Office (EOCO), Turkish National Police (TNP) Cyber Department, Direction Centrale de la Police aux Frontieres (PAF) of France, Squadra Mobile Di Caserta and Italian National Police, National Police Agency of Japan, Tokyo Metropolitan Police Department (TPMD), Royal Malaysian Police, Directorate of Criminal Investigations (DCI) of Kenya and the National Crime Agency (NCA), North Wales Police, Metropolitan Police Service and Hertfordshire Constabulary of the UK provided significant assistance.

This operation serves as a model for international cooperation against specific threats that endanger the financial well-being of each member country’s residents. Deputy Attorney General Rosen expressed gratitude for the outstanding efforts of the participating countries, including law enforcement actions that were coordinated and executed by the Economic and Financial Crimes Commission (EFCC) in Nigeria to curb business email compromise schemes that defraud businesses and individuals alike.

The Justice Department’s efforts to confront the growing threat of cyber-enabled financial fraud led to the formation of the BEC Counteraction Group (BCG), which assists U.S. Attorney’s Offices and the Department with the coordination of BEC cases and the centralization of related expertise. The BCG facilitates communication and coordination between federal prosecutors, serves as a bridge between federal prosecutors and federal agents, centralizes and manages institutional knowledge and training, and participates in efforts to educate the public about protecting themselves and their organizations from BEC scams.

The BCG draws upon the expertise of the following sections within the Department’s Criminal Division: the Computer Crime and Intellectual Property Section, which regularly investigates and prosecutes cases involving computer crimes, including network intrusions; the Fraud Section, which manages complex litigation involving sophisticated fraud schemes; the Money Laundering and Asset Recovery Section, which brings experience in seizing assets obtained through criminal activity; the Office of International Affairs, which plays a central role in securing international evidence and extradition; and the Organized Crime and Gang Section, which contributes strategic guidance in prosecuting complex transnational criminal cases.

Operation reWired was funded and coordinated by the FBI and the Justice Department’s International Organized Crime Intelligence and Operations Center (IOC-2) and follows “Operation Wire Wire,” the first coordinated enforcement action targeting hundreds of BEC scammers. That effort, announced in June 2018, resulted in the arrest of 74 individuals, the seizure of nearly $2.4 million, and the disruption and recovery of approximately $14 million in fraudulent wire transfers.

Victims are encouraged to file a complaint online with the IC3 at bec.ic3.gov. The IC3 staff reviews complaints, looking for patterns or other indicators of significant criminal activity, and refers investigative packages of complaints to the appropriate law enforcement authorities in a particular city or region. The FBI provides a variety of resources relating to BEC through the IC3, which can be reached at www.ic3.gov.