Good for Donald Trump, America should be first when it comes to policy and diplomacy. Applause to the Donald for that standard. Well said.

Tell us again how to pronounce Tanzania or San Bernardino.

What was not said however is disturbing for those who have a keen interest in foreign policy. Of particular note, the Ambassador of Russia was sitting on the front row. Perhaps this is but one reason, Trump never mentioned Russia or Vladimir Putin.

Remember it was only recently that Russia has been more than provocative in reckless actions against a U.S. destroyer and U.S. military aircraft. This is a violation of the IncSea Treaty. This is not the first time either, noting Russian bombers off the West Coast and the same with our European allies. What about the Baltic States, Crimea or Ukraine? Anything?

What about the constant war in the cyber realm? Trump did mention artificial intelligence, does he know what that is? What about electronic or economic warfare?

al Qaeda, Boko Harem, Haqqani, Jabhat al-Nusra, Houthis? Nah….the plight of Jews and Christians, Yazidis, Peshmerga? Standing with France on their recent attacks? Nothing about China’s aggression with the new islands and fighter jets there?

Well said Donald on the destruction of Islamic State, high marks for that. Additional high marks for the IRGC and kidnapping our sailors.

Trump made a mere simple reference to Iran and their nuclear program, stating they will never have a nuclear weapon and the Joint Plan of Action was a bad deal. How come no reference to Iran being a violator of conventions, a rogue state sponsor of terror? Nothing about the Iranian Revolutionary Guard Corp or Hezbollah or IED’s made by Iran that killed and maimed our soldiers? What about Iran’s collusion with North Korea? Anything on that? No…

Does Trump approve of John Kerry’s work as the current Secretary of State? Humm, perhaps as Trump never mentioned Kerry.

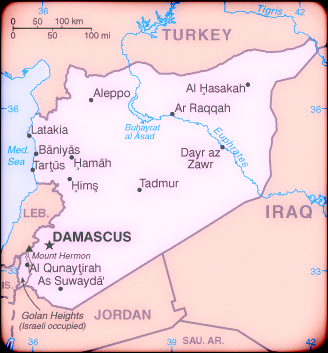

Syria unleashed Islamic State? Really? Trump blames China for North Korea. Does Donald think that China is fully, exclusively responsible and accountable for Kim Jung Un?

Why no mention of foreign aid? There is likely a bailout coming for Puerto Rico. Does Trump have a clue on that? When it comes to NATO, Trump backed off and merely mentioned that only four member countries pay the 2% of GDP. Never a mention that countries do pay the United States for bases and protection like Philippines and Japan. Did Trump slight Israel by not stating nurturing and restoring the relationship or is he still in a neutral position when it comes to the Palestinians? Hamas? Anything on human rights violations? What about the corruption of the United Nations?

When referencing Cuba, Trump correctly stated that Obama was slighted at the airport with no Cuban official being on the formal reception. Is Trump cool with normalizing relations with Cuba considering the treatment of dissidents or U.S. criminals that have receive safe haven on the island or the debt Cuba owes to U.S. domestic corporations for nationalizing them? What about Guantanamo as a whole?

Forgotten is a war we are currently fighting against the Taliban in Afghanistan…not a word at all by Trump.

Trump did layout his policy on foreign matters stating diplomacy, caution and restraint. That is always the standard. Did Trump mention he was going to revisit or retool those approaches? No….

Most disturbing, included in Trump’s foreign policy speech was the feeble condition of our own nuclear program and the military as a whole. Why explain any weakness at all where adversaries are listening with a keen ear? The U.S. military is still today the most advanced power on the globe while new technologies and weapons systems are in the future pipelines. Hey Donald, how about making a positive declaration about the military condition and the work of the Pentagon and the military collaboration with allies that does demonstrate strength?

Well, here is the text of his speech for your reference.

For additional reference, those included on Trump’s foreign policy team are:

Zalmay Khalilzad, the former Ambassador to Iraq and Afghanistan. He is under investigation. Trump only met Khalilzad earlier in the day. Further, the Ambassador stated that if Hillary had asked him to be part of her team, he would gladly do so.

Walid Phares, a Lebanese Christian and commentator on Middle East Affairs.

George Papadopoulos, energy consultant

Carter Page, energy consultant and lobbyist for Gazprom, a Russian energy company

Joe Schmitz, fired as former Inspector General, Department of Defense, formerly of Blackwater and his sister is Mary Kay Letourneau gained infamy after having a sexual relationship with her 12-year-old student, to whom she is now married.

LTG Keith Kellogg (ret), Chief Operating Officer of the Coalition Provisional Authority in Baghdad, Iraq