ISIS is trying to make a comeback by creating chaos with assassinations — the same tactic it employed before it rose to power 5 years ago

- The terrorist group ISIS has lost most of its territory and has few fighters left in Iraq and Syria, but it remains a threat in the region.

- A new report warns that ISIS is attempting to make a comeback by resorting to a tactic it employed back in 2013 when it was still known as Al Qaeda in Iraq (AQI) — the targeted assassinations of Iraqi security personnel.

- ISIS also continues to wage an effective propaganda campaign online, which helps it maintain a global footprint even as its presence in Iraq and Syria has become more faint.

Roughly four years ago, ISIS shocked the world when it took over a large swath of territory across Iraq and Syria, declaring the establishment of a new Islamic caliphate in the process.

Fast forward to 2018 and the terrorist group is a shadow of what it was even a year ago. It has lost the vast majority of the territory it previously held and the number of fighters it counted among its ranks has dwindled exponentially to below 3,000.

Nevertheless, ISIS remains a threat in the Middle East, and a new report from the Soufan Center warns it’s attempting to make a comeback by resorting to a tactic it employed back in 2013 when it was still known as Al Qaeda in Iraq (AQI) — the targeted assassinations of Iraqi security personnel.

“To get back to its heyday of 2014, the Islamic State first needs to get back to 2013, a year in which the terrorist group concluded one very successful campaign to free thousands of its detained members from Iraqi jails and started another campaign to assassinate and intimidate Iraqi security personnel, particularly local police officers,” the report stated.

In late June, Iraq executed 12 ISIS members, which the Soufan Center says was in response to the “high-profile assassination” of eight Iraqi security personnel.

‘A weakened Islamic State is now trying to recreate that past’

With fewer numbers, ISIS will be less inclined to focus on regaining territory and more likely to ramp up attacks on Iraqi police to sow the same brand of chaos it did back in 2013, according to the Soufan Center.

“A weakened Islamic State is now trying to recreate that past,” the report noted.”Targeted attacks on police and government officials have risen in several provinces as the group has stopped its military collapse and refocused on what is possible for the group now.”

The report added, “Assassinations require few people and are perfectly suited as a force multiplier for a group that has seen its forces decimated.”

‘The social fabric of Iraq remains severely frayed’

Peter Mandaville, a professor of international affairs at George Mason University who previously served as a top adviser to the State Department on ISIS, backed up the Soufan Center report.

“I think it would be difficult for ISIS to retake significant territory given the ongoing presence and vigilance of [US-led] coalition forces,” Mandaville told Business Insider, adding, “They certainly have the capacity to engage in an extended insurgency campaign using the kinds of tactics highlighted in the Soufan Center report.”

Mandaville said the situation on the ground in Iraq — that led to the rise of ISIS in the first place — has not changed significantly even though ISIS has more or less been defeated militarily.

“The social fabric of Iraq remains severely frayed, with high levels of political polarization,” Mandaville said. “Until the central government succeeds in advancing key political and security reforms, many areas of Iraq will continue to provide a permissive environment for low intensity ISIS operations.”

David Sterman of the New America Foundation, an expert on terrorism and violent extremism, expressed similar sentiments.

Sterman told Business Insider that the threat of ISIS returning to the strategy of breeding chaos on the local level by targeting Iraq security personal is “very serious.”

“ISIS continues to show capability to conduct attacks in liberated areas, an issue seen also during the surge,” Sterman added. “Bombings in Baghdad in January illustrate this as well as the assassinations and smaller attacks discussed” in the Soufan Center report.

In short, ISIS is still in a position to create havoc, albeit in a more limited capacity, in an already troubled country that really hasn’t even begun to recover from years of conflict.

ISIS continues to operate underground across the world

From a broader standpoint, this does not necessarily mean ISIS poses a significant threat to the US.

“Even at its height, ISIS did not demonstrate a capability to direct a strike on the US homeland (as opposed to Europe),” Sterman said. “So the threat [in the US] predominantly remains homegrown and inspired. Of course that doesn’t mean the US should take its eye off of what is happening in Iraq and Syria. ISIS’s bursting onto the global scene is proof of that.”

ISIS continues to wage an effective propaganda campaign online, which helps it maintain a global footprint even as its presence in Iraq and Syria has become more faint.

Moreover, ISIS is also turning to Bitcoin and encrypted communications as a means of rallying its followers worldwide.

“If you look across the globe, the cohesive nature of the enterprise for ISIS has been maintained,” Russell Travers, the acting head of the National Counterterrorism Center, recently told The New York Times. “The message continues to resonate with way too many people.”

The Trump administration says there’s ‘still hard fighting ahead’ against ISIS

Speaking with reporters in late June, Defense Secretary James Mattis lauded the success the US-led coalition has had against ISIS in Iraq and Syria but added that “there’s still hard fighting ahead.”

“Bear with us; there’s still hard fighting ahead,” Mattis said. “It’s been hard fighting, and again, we win every time our forces go up against them. We’ve lost no terrain to them once it’s been taken.”

Meanwhile, US troops stationed near the Iraq-Syria border have been hammering ISIS in Syria with artillery in recent weeks.

***

SOUTHWEST ASIA, July 9, 2018 — Combined Joint Task Force Operation Inherent Resolve and its partners have accelerated offensive activity against Islamic State of Iraq and Syria targets in designated parts of Syria and Iraq, Combined Joint Task Force Operation Inherent Resolve officials reported today.

Operation Roundup

Since the May 1 start of Operation Roundup, Syrian Democratic Forces resumed major offensive operations in the Middle Euphrates River Valley. Since then, the SDF has continued to gain ground through offensive operations coupled with precision coalition strike support.

CJTFOIR and its partner forces continue to exert pressure on ISIS’ senior leaders and associates in order to degrade, disrupt and dismantle ISIS structures and remove terrorists throughout Iraq and Syria. ISIS morale is sinking on the frontlines as privileged leaders increasingly abandon their own fighters on the battlefield, taking resources with them as they flee.

Over the coming weeks, Operation Roundup will continue to build momentum against ISIS remnants remaining in the Iraq-Syria border region and the Middle Euphrates River Valley. the Coalition remains committed to the lasting defeat of ISIS here, increasing peace and stability in the region and protecting all our homelands from the ISIS threat.

Between July 2-8, coalition military forces conducted 31 strikes, consisting of 42 engagements, in Iraq and Syria

Strikes in Syria

Yesterday in Syria, coalition military forces conducted a strike consisting of one engagement against ISIS targets near Abu Kamal. The strike engaged an ISIS tactical unit and destroyed an ISIS vehicle.

On July 7, coalition military forces conducted two strikes consisting of two engagements against ISIS targets near Abu Kamal. The strikes engaged an ISIS tactical unit and destroyed an ISIS vehicle.

On July 6, coalition military forces conducted two strikes consisting of two engagements against ISIS targets near Abu Kamal. The strikes destroyed two ISIS vehicles.

On July 5, coalition military forces conducted six strikes consisting of 11 engagements against ISIS targets:

— Near Abu Kamal, two strikes engaged an ISIS tactical unit and destroyed an ISIS vehicle.

— Near Shadaddi, four strikes engaged an ISIS tactical unit and destroyed an ISIS improvised explosive device, an ISIS vehicle, an ISIS logistics hub and an ISIS headquarters.

On July 4, coalition military forces conducted four strikes consisting of eight engagements against ISIS targets.

— Near Abu Kamal, two strikes engaged an ISIS tactical unit and destroyed an ISIS vehicle and an ISIS-held building.

— Near Shadaddi, two strikes engaged an ISIS tactical unit and destroyed three ISIS vehicles and an ISIS headquarters.

On July 3, coalition military forces conducted four strikes consisting of four engagements against ISIS targets near Abu Kamal. The strikes engaged an ISIS tactical unit and destroyed two ISIS vehicles and an ISIS fighting position.

On July 2, coalition military forces conducted three strikes consisting of three engagements against ISIS targets.

— Near Abu Kamal, two strikes destroyed two ISIS supply routes.

— Near Shadaddi, a strike engaged an ISIS tactical unit and destroyed an ISIS vehicle.

Strikes in Iraq

Yesterday in Iraq, coalition military forces conducted two strikes consisting of two engagements against ISIS targets:

— Near Makhmur, a strike destroyed an ISIS-held building.

— Near Kisik, a strike destroyed an ISIS tunnel.

On July 7, coalition military forces conducted two strikes consisting of two engagements against ISIS targets:

— Near Tal Afar, a strike destroyed an ISIS-held building.

— Near Qaim, a strike destroyed an ISIS supply route.

On July 6, coalition military forces conducted two strikes consisting of two engagements against ISIS targets:

— Near Hawijah, a strike destroyed two ISIS fighting positions.

— Near Qaim, a strike destroyed an ISIS supply route.

On July 5, coalition military forces conducted one strike consisting of one engagement against ISIS targets near Basheer. The strike destroyed five ISIS caves.

There were no reported strikes conducted in Iraq on July 4.

On July 3, coalition military forces conducted a strike consisting of three engagements against ISIS targets near Habbaniyah. The strike engaged an ISIS tactical unit and destroyed an ISIS vehicle.

On July 2, coalition military forces conducted a strike consisting of one engagement against ISIS targets near Tal Afar. The strike destroyed an ISIS vehicle.

Part of Operation Inherent Resolve

These strikes were conducted as part of Operation Inherent Resolve, the operation to destroy ISIS in Iraq and Syria. The destruction of ISIS targets in Iraq and Syria also further limits the group’s ability to project terror and conduct external operations throughout the region and the rest of the world, task force officials said.

The list above contains all strikes conducted by fighter, attack, bomber, rotary-wing or remotely piloted aircraft; rocket-propelled artillery; and ground-based tactical artillery, officials noted.

A strike, as defined by the coalition, refers to one or more kinetic engagements that occur in roughly the same geographic location to produce a single or cumulative effect.

For example, task force officials explained, a single aircraft delivering a single weapon against a lone ISIS vehicle is one strike, but so is multiple aircraft delivering dozens of weapons against a group of ISIS-held buildings and weapon systems in a compound, having the cumulative effect of making that facility harder or impossible to use. Strike assessments are based on initial reports and may be refined, officials said.

The task force does not report the number or type of aircraft employed in a strike, the number of munitions dropped in each strike, or the number of individual munition impact points against a target.

Taking bets on whether there is a coup underway to force PM Theresa May to resign.

Taking bets on whether there is a coup underway to force PM Theresa May to resign.

A poppy farmer in Laghman Province scores a poppy to extract raw opium in April 2004. Afghan drug lords have pledged financial support to the Taliban in exchange for protection of their vast swaths of poppy and cannabis fields, drug processing labs and storage facilities. | Shah Marai/AFP/Getty Images

A poppy farmer in Laghman Province scores a poppy to extract raw opium in April 2004. Afghan drug lords have pledged financial support to the Taliban in exchange for protection of their vast swaths of poppy and cannabis fields, drug processing labs and storage facilities. | Shah Marai/AFP/Getty Images John Seaman

John Seaman A U.S soldier shows members of the Afghan media reconstruction projects in Panjshir Province, north of Kabul, in October 2007. The U.S. has spent billions of taxpayer dollars a year on its military campaign and reconstruction effort. But Congress earmarked just a tiny percentage of that spending for DEA efforts to counter the drug networks that bankroll the increasingly destructive attacks, records and interviews show. | Shah Marai/AFP/Getty Images

A U.S soldier shows members of the Afghan media reconstruction projects in Panjshir Province, north of Kabul, in October 2007. The U.S. has spent billions of taxpayer dollars a year on its military campaign and reconstruction effort. But Congress earmarked just a tiny percentage of that spending for DEA efforts to counter the drug networks that bankroll the increasingly destructive attacks, records and interviews show. | Shah Marai/AFP/Getty Images Tina Kaidanow: State Department deputy chief of mission in Afghanistan who issued an immediate stand-down order halting Operation Reciprocity after discovering Justice Department prosecutors in New York had approved building a narcoterrorism criminal conspiracy case against Taliban leader Mullah Omar and 25 top associates.

Tina Kaidanow: State Department deputy chief of mission in Afghanistan who issued an immediate stand-down order halting Operation Reciprocity after discovering Justice Department prosecutors in New York had approved building a narcoterrorism criminal conspiracy case against Taliban leader Mullah Omar and 25 top associates. Michael Marsac Drug Enforcement Administration regional director in Kabul who launched Operation Reciprocity to combine 10 years of DEA investigations tying Taliban leaders directly to the global heroin trade into one unprecedented prosecution in U.S. courts before President Barack Obama withdrew American forces from Afghanistan.

Michael Marsac Drug Enforcement Administration regional director in Kabul who launched Operation Reciprocity to combine 10 years of DEA investigations tying Taliban leaders directly to the global heroin trade into one unprecedented prosecution in U.S. courts before President Barack Obama withdrew American forces from Afghanistan. M. Ashraf Haidari Afghan counternarcotics official who lobbied Bush, Obama and Trump officials — mostly unsuccessfully — for more aggressive law enforcement efforts to take out drug kingpins and to stanch the flow of illicit narcotics proceeds that have fueled the Taliban insurgency and corrupted the Kabul government.

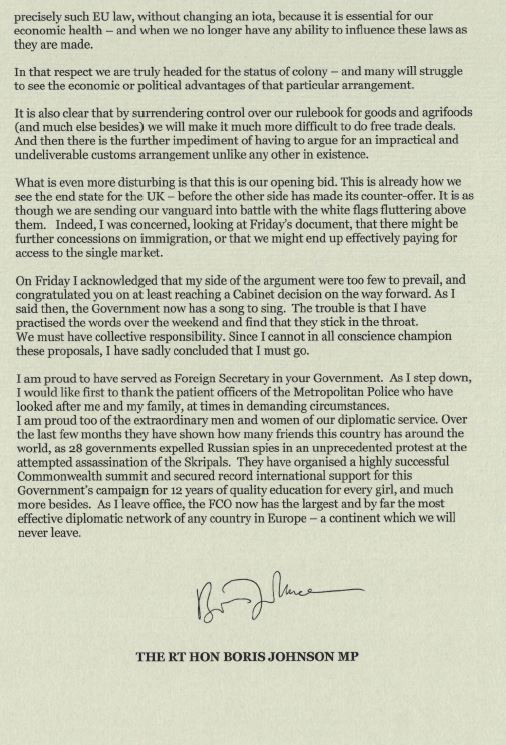

M. Ashraf Haidari Afghan counternarcotics official who lobbied Bush, Obama and Trump officials — mostly unsuccessfully — for more aggressive law enforcement efforts to take out drug kingpins and to stanch the flow of illicit narcotics proceeds that have fueled the Taliban insurgency and corrupted the Kabul government. CONTINUED VIOLENCE: A U.S. soldier and Afghan policemen (top) are seen through the broken window of a suicide bomber‘s car in Kabul in February 2013. Bottom left, an Afghan patient is wheeled on a trolley at Salang Hospital, north of Kabul, in September 2016. Bottom right, an Afghan amputee practices walking with her prosthetic leg at a Red Cross hospital in Kabul in April 2016. President Ashraf Ghani said recently that Afghanistan’s military — and the government — would be in danger of collapse, perhaps within days, if U.S. assistance stops. | Shah Marai/AFP/Getty Images

CONTINUED VIOLENCE: A U.S. soldier and Afghan policemen (top) are seen through the broken window of a suicide bomber‘s car in Kabul in February 2013. Bottom left, an Afghan patient is wheeled on a trolley at Salang Hospital, north of Kabul, in September 2016. Bottom right, an Afghan amputee practices walking with her prosthetic leg at a Red Cross hospital in Kabul in April 2016. President Ashraf Ghani said recently that Afghanistan’s military — and the government — would be in danger of collapse, perhaps within days, if U.S. assistance stops. | Shah Marai/AFP/Getty Images

Afghan counternarcotics forces inspect sacks containing opium after they were discovered in a fuel tanker traveling to Kabul in May 2005. Even after the U.S. and other NATO countries began adding troops in 2006, the Afghan police and military counternarcotics forces were outgunned, outnumbered and outspent by the drug traffickers and their Taliban protectors, according to documents and interviews. | Shah Marai/AFP/Getty Images

Afghan counternarcotics forces inspect sacks containing opium after they were discovered in a fuel tanker traveling to Kabul in May 2005. Even after the U.S. and other NATO countries began adding troops in 2006, the Afghan police and military counternarcotics forces were outgunned, outnumbered and outspent by the drug traffickers and their Taliban protectors, according to documents and interviews. | Shah Marai/AFP/Getty Images Afghan policemen guard a pile of seized drugs that was burned outside Kabul in October 2006. The DEA’s primary mission was to disrupt and dismantle the most significant drug trafficking organizations posing a threat to the United States. Another mission was to train Afghan authorities in the nuts and bolts of counternarcotics work so that they could take on the drug networks themselves. | Shah Marai/AFP/Getty Images

Afghan policemen guard a pile of seized drugs that was burned outside Kabul in October 2006. The DEA’s primary mission was to disrupt and dismantle the most significant drug trafficking organizations posing a threat to the United States. Another mission was to train Afghan authorities in the nuts and bolts of counternarcotics work so that they could take on the drug networks themselves. | Shah Marai/AFP/Getty Images An Afghan government official (left) and two Afghan National Army soldiers cut down opium poppies in Bihsud District, north of Jalalabad, in April 2004. Afghan prosecutors, with help from the DEA and the Justice Department, were able to put away 90 percent of those charged with narcotics crimes. But most were two-bit drug runners whose convictions didn’t disrupt the flow of drug money, records show. | Shah Marai/AFP/Getty Images

An Afghan government official (left) and two Afghan National Army soldiers cut down opium poppies in Bihsud District, north of Jalalabad, in April 2004. Afghan prosecutors, with help from the DEA and the Justice Department, were able to put away 90 percent of those charged with narcotics crimes. But most were two-bit drug runners whose convictions didn’t disrupt the flow of drug money, records show. | Shah Marai/AFP/Getty Images David Schwendiman

David Schwendiman Stephen McFarland

Stephen McFarland