The number of Cubans attempting to come to the Unites States via Texas has increased this year, thanks in large part to the thaw in political tensions between the U.S. and Cuba.

After President Obama and Cuban leader Raul Castro announced their plans to normalize relations between the two nations, many Cubans feared that the special migrant status they have enjoyed for over 50 years would come to an end. The current “wet foot, dry foot policy” allows anyone who has fled Cuba and entered the U.S. the ability to pursue residency and work in the country.

The Los Angles Times reports that at least 44,000 Cubans have reached the southern U.S. border during the fiscal year which ended in September. This figure is more than twice as many of the 17,466 Cubans who came through the southern border the year before. Full article here.

Tension Simmers as Cubans Breeze Across U.S. Border

LAREDO, Tex. — They are crossing the border here by the hundreds each day, approved to enter the United States in a matter of hours. Part of a fast-rising influx of Cubans, they walk out to a Laredo street and are greeted by volunteers from Cubanos en Libertad, or Cubans in Freedom, who help them arrange travel to their American destination — often Miami — and start applying for work permits and federal benefits like food stamps and Medicaid, available by law to Cubans immediately after their arrival.

The friendly reception given the Cubans, an artifact of hostile relations with the Castro government, is a stark contrast with the treatment of Central American families fleeing violence in their countries. And it is creating tensions in this predominantly Mexican-American city, where residents saw how Central American migrants, who came in an influx in 2014, were detained by the Border Patrol and ordered to appear in immigration courts.

“The people here are starting to feel resentment,” said Representative Henry Cuellar, Democrat of Texas, whose congressional district includes the city. “They are asking, is it fair that the Cubans get to stay and the Central Americans are being deported?”

The disparity will be in sharp relief next week when Pope Francis comes to the border at El Paso to offer prayers for the many migrants who have faced danger or arrest trying to cross the United States border.

Town officials have warned Cubans not to loiter in the streets. Local bus companies complain that Cubans are chartering special vans to travel. Some residents here have also begun to speak up.

A group of veterans from Afghanistan and Iraq held two protests by the border bridge in recent weeks, saying the federal government was spending money on Cubans when it was not meeting the needs of people here.

“We make everyone from Central America wait in line, while the Cubans walk in even though they are not refugees,” said Gabriel Lopez, a Mexican-American Navy veteran who is president of the group of veterans. “We are saying, don’t open the borders to Cubans and give them instant benefits while we have American veterans living on the streets.”

In coming weeks the number of Cubans is expected to spike, as more than 5,000 who have been stalled in Costa Rica since late last year will leave there on regular plane flights agreed to by governments in Central America and Mexico. Already about 12,100 Cubans entered through Laredo and other Texas border stations in the last three months of 2015, according to official figures. Border officials say as many as 48,000 Cubans could cross here this year, more than all those who came in the last two years combined.

Under the Cuban Adjustment Act, a law Congress passed in 1966 in the early years of enmity with Fidel Castro, any Cuban who sets foot on American soil is given permission to enter, known as parole. Cubans are also eligible for federal welfare benefits including financial assistance for nine months under separate policies from the 1980s. After a year, they can apply for permanent residency, a gateway to citizenship.

The recent exodus from Cuba began in mid-2014, even before President Obama in December of that year announced a restoration of diplomatic relations with the government, now led by Mr. Castro’s brother Raúl. In a major change, President Raúl Castro allowed Cubans to leave the country without exit visas. Many Cubans have said that rumors that the special entry to the United States would be canceled had caused them to pack up and go.

“The rumors are unfounded,” Alan Bersin, assistant secretary of Homeland Security, said in an interview, seeking to dispel the fears. “The Cuban Adjustment Act is still in effect and is part of the overall immigration policy and there is no intent presently to change that.”

Mr. Cuellar has called for the act to be repealed, but he acknowledges there is little prospect that Congress will act this year.

The recent influx is nothing like the chaotic rush of Cubans fleeing the Communist government that overwhelmed South Florida with the Mariel boatlift in 1980, and the rafter crisis in 1994. The federal border authorities, who have been watching the number of Cubans growing steadily, added officers and opened extra rooms in the border station, doubling their capacity to process them. Most Cubans move through in less than an hour, officials said.

Frank Longoria, assistant director of field operations for United States Customs and Border Protection, said that despite their numbers, the Cubans’ entry has not affected the huge flows of people and freight trucks each day through Laredo, the country’s largest land port of entry.

At the border, Cubans are fingerprinted and pass through routine criminal and terrorism background checks. There is no special vetting for Cubans, and there are no medical examinations or vaccination requirements.

“Right now I feel like the freest Cuban in the whole world,” said Rodny Nápoles, 39, a coach of the Cuban national women’s water polo team who crossed into Laredo this week.

This week, the first direct flights from northern Costa Rica to the Mexican city just across the border brought more than 300 Cubans, including at least 41 pregnant women and their families.

One of them, Yadelys Rodríguez Martín, 28, who was 19 weeks pregnant, sat down to rest and enjoy a moment of relief on the front steps of Cubanos en Libertad, right after emerging from the border station. After traveling through Ecuador and being stuck for three months in Costa Rica because of a political dispute in the region, she said she was stunned by how quickly she had been admitted into the United States.

“We are not used to things happening so fast,” Ms. Rodríguez said. More here.

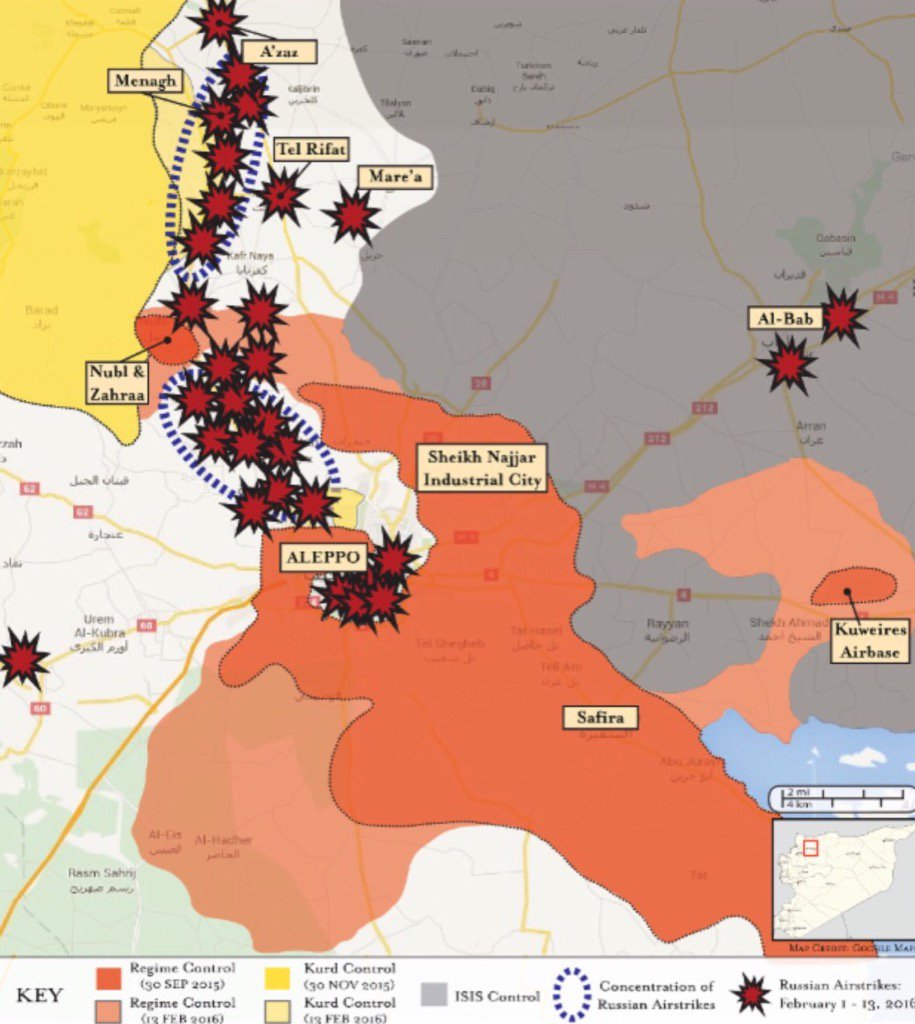

Russian airstrikes in areas around Aleppo.

Russian airstrikes in areas around Aleppo.