Obama’s position is we hired him to do less, in the world.

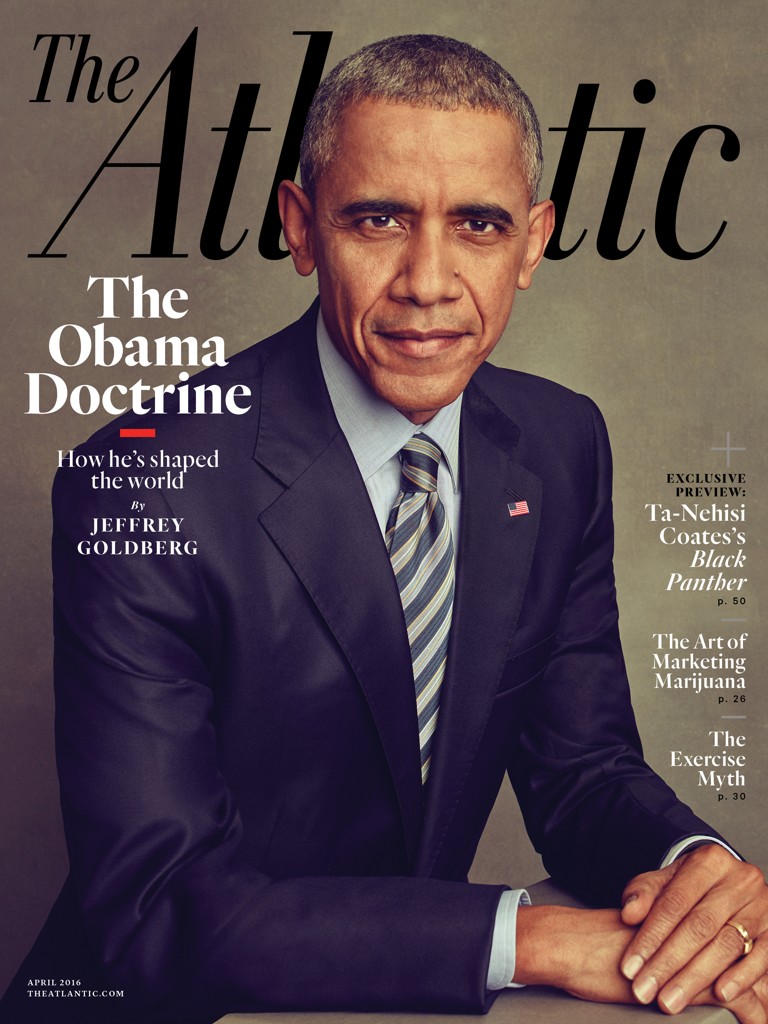

The Obama Doctrine

The U.S. president talks through his hardest decisions about America’s role in the world.

But Kerry’s rousing remarks on that August day, which had been drafted in part by Rhodes, were threaded with righteous anger and bold promises, including the barely concealed threat of imminent attack. Kerry, like Obama himself, was horrified by the sins committed by the Syrian regime in its attempt to put down a two-year-old rebellion. In the Damascus suburb of Ghouta nine days earlier, Assad’s army had murdered more than 1,400 civilians with sarin gas. The strong sentiment inside the Obama administration was that Assad had earned dire punishment. In Situation Room meetings that followed the attack on Ghouta, only the White House chief of staff, Denis McDonough, cautioned explicitly about the perils of intervention. John Kerry argued vociferously for action.

“As previous storms in history have gathered, when unspeakable crimes were within our power to stop them, we have been warned against the temptations of looking the other way,” Kerry said in his speech. “History is full of leaders who have warned against inaction, indifference, and especially against silence when it mattered most.”

Kerry counted President Obama among those leaders. A year earlier, when the administration suspected that the Assad regime was contemplating the use of chemical weapons, Obama had declared: “We have been very clear to the Assad regime … that a red line for us is we start seeing a whole bunch of chemical weapons moving around or being utilized. That would change my calculus. That would change my equation.”

Despite this threat, Obama seemed to many critics to be coldly detached from the suffering of innocent Syrians. Late in the summer of 2011, he had called for Assad’s departure. “For the sake of the Syrian people,” Obama said, “the time has come for President Assad to step aside.” But Obama initially did little to bring about Assad’s end.

He resisted demands to act in part because he assumed, based on the analysis of U.S. intelligence, that Assad would fall without his help. “He thought Assad would go the way Mubarak went,” Dennis Ross, a former Middle East adviser to Obama, told me, referring to the quick departure of Egyptian President Hosni Mubarak in early 2011, a moment that represented the acme of the Arab Spring. But as Assad clung to power, Obama’s resistance to direct intervention only grew. After several months of deliberation, he authorized the CIA to train and fund Syrian rebels, but he also shared the outlook of his former defense secretary, Robert Gates, who had routinely asked in meetings, “Shouldn’t we finish up the two wars we have before we look for another?”

The current U.S. ambassador to the United Nations, Samantha Power, who is the most dispositionally interventionist among Obama’s senior advisers, had argued early for arming Syria’s rebels. Power, who during this period served on the National Security Council staff, is the author of a celebrated book excoriating a succession of U.S. presidents for their failures to prevent genocide. The book, A Problem From Hell, published in 2002, drew Obama to Power while he was in the U.S. Senate, though the two were not an obvious ideological match. Power is a partisan of the doctrine known as “responsibility to protect,” which holds that sovereignty should not be considered inviolate when a country is slaughtering its own citizens. She lobbied him to endorse this doctrine in the speech he delivered when he accepted the Nobel Peace Prize in 2009, but he declined. Obama generally does not believe a president should place American soldiers at great risk in order to prevent humanitarian disasters, unless those disasters pose a direct security threat to the United States.

Power sometimes argued with Obama in front of other National Security Council officials, to the point where he could no longer conceal his frustration. “Samantha, enough, I’ve already read your book,” he once snapped.

Obama, unlike liberal interventionists, is an admirer of the foreign-policy realism of President George H. W. Bush and, in particular, of Bush’s national-security adviser, Brent Scowcroft (“I love that guy,” Obama once told me). Bush and Scowcroft removed Saddam Hussein’s army from Kuwait in 1991, and they deftly managed the disintegration of the Soviet Union; Scowcroft also, on Bush’s behalf, toasted the leaders of China shortly after the slaughter in Tiananmen Square. As Obama was writing his campaign manifesto, The Audacity of Hope, in 2006, Susan Rice, then an informal adviser, felt it necessary to remind him to include at least one line of praise for the foreign policy of President Bill Clinton, to partially balance the praise he showered on Bush and Scowcroft.

At the outset of the Syrian uprising, in early 2011, Power argued that the rebels, drawn from the ranks of ordinary citizens, deserved America’s enthusiastic support. Others noted that the rebels were farmers and doctors and carpenters, comparing these revolutionaries to the men who won America’s war for independence.

Obama flipped this plea on its head. “When you have a professional army,” he once told me, “that is well armed and sponsored by two large states”—Iran and Russia—“who have huge stakes in this, and they are fighting against a farmer, a carpenter, an engineer who started out as protesters and suddenly now see themselves in the midst of a civil conflict …” He paused. “The notion that we could have—in a clean way that didn’t commit U.S. military forces—changed the equation on the ground there was never true.” The message Obama telegraphed in speeches and interviews was clear: He would not end up like the second President Bush—a president who became tragically overextended in the Middle East, whose decisions filled the wards of Walter Reed with grievously wounded soldiers, who was helpless to stop the obliteration of his reputation, even when he recalibrated his policies in his second term. Obama would say privately that the first task of an American president in the post-Bush international arena was “Don’t do stupid shit.”

Obama’s reticence frustrated Power and others on his national-security team who had a preference for action. Hillary Clinton, when she was Obama’s secretary of state, argued for an early and assertive response to Assad’s violence. In 2014, after she left office, Clinton told me that “the failure to help build up a credible fighting force of the people who were the originators of the protests against Assad … left a big vacuum, which the jihadists have now filled.” When The Atlantic published this statement, and also published Clinton’s assessment that “great nations need organizing principles, and ‘Don’t do stupid stuff’ is not an organizing principle,” Obama became “rip-shit angry,” according to one of his senior advisers. The president did not understand how “Don’t do stupid shit” could be considered a controversial slogan. Ben Rhodes recalls that “the questions we were asking in the White House were ‘Who exactly is in the stupid-shit caucus? Who is pro–stupid shit?’ ” The Iraq invasion, Obama believed, should have taught Democratic interventionists like Clinton, who had voted for its authorization, the dangers of doing stupid shit. (Clinton quickly apologized to Obama for her comments, and a Clinton spokesman announced that the two would “hug it out” on Martha’s Vineyard when they crossed paths there later.)

Syria, for Obama, represented a slope potentially as slippery as Iraq. In his first term, he came to believe that only a handful of threats in the Middle East conceivably warranted direct U.S. military intervention. These included the threat posed by al‑Qaeda; threats to the continued existence of Israel (“It would be a moral failing for me as president of the United States” not to defend Israel, he once told me); and, not unrelated to Israel’s security, the threat posed by a nuclear-armed Iran. The danger to the United States posed by the Assad regime did not rise to the level of these challenges.

Given Obama’s reticence about intervention, the bright-red line he drew for Assad in the summer of 2012 was striking. Even his own advisers were surprised. “I didn’t know it was coming,” his secretary of defense at the time, Leon Panetta, told me. I was told that Vice President Joe Biden repeatedly warned Obama against drawing a red line on chemical weapons, fearing that it would one day have to be enforced.

Kerry, in his remarks on August 30, 2013, suggested that Assad should be punished in part because the “credibility and the future interests of the United States of America and our allies” were at stake. “It is directly related to our credibility and whether countries still believe the United States when it says something. They are watching to see if Syria can get away with it, because then maybe they too can put the world at greater risk.”

Ninety minutes later, at the White House, Obama reinforced Kerry’s message in a public statement: “It’s important for us to recognize that when over 1,000 people are killed, including hundreds of innocent children, through the use of a weapon that 98 or 99 percent of humanity says should not be used even in war, and there is no action, then we’re sending a signal that that international norm doesn’t mean much. And that is a danger to our national security.”

It appeared as though Obama had drawn the conclusion that damage to American credibility in one region of the world would bleed into others, and that U.S. deterrent credibility was indeed at stake in Syria. Assad, it seemed, had succeeded in pushing the president to a place he never thought he would have to go. Obama generally believes that the Washington foreign-policy establishment, which he secretly disdains, makes a fetish of “credibility”—particularly the sort of credibility purchased with force. The preservation of credibility, he says, led to Vietnam. Within the White House, Obama would argue that “dropping bombs on someone to prove that you’re willing to drop bombs on someone is just about the worst reason to use force.”

American national-security credibility, as it is conventionally understood in the Pentagon, the State Department, and the cluster of think tanks headquartered within walking distance of the White House, is an intangible yet potent force—one that, when properly nurtured, keeps America’s friends feeling secure and keeps the international order stable.

In White House meetings that crucial week in August, Biden, who ordinarily shared Obama’s worries about American overreach, argued passionately that “big nations don’t bluff.” America’s closest allies in Europe and across the Middle East believed Obama was threatening military action, and his own advisers did as well. At a joint press conference with Obama at the White House the previous May, David Cameron, the British prime minister, had said, “Syria’s history is being written in the blood of her people, and it is happening on our watch.” Cameron’s statement, one of his advisers told me, was meant to encourage Obama toward more-decisive action. “The prime minister was certainly under the impression that the president would enforce the red line,” the adviser told me. The Saudi ambassador in Washington at the time, Adel al-Jubeir, told friends, and his superiors in Riyadh, that the president was finally ready to strike. Obama “figured out how important this is,” Jubeir, who is now the Saudi foreign minister, told one interlocutor. “He will definitely strike.”

Obama had already ordered the Pentagon to develop target lists. Five Arleigh Burke–class destroyers were in the Mediterranean, ready to fire cruise missiles at regime targets. French President François Hollande, the most enthusiastically pro-intervention among Europe’s leaders, was preparing to strike as well. All week, White House officials had publicly built the case that Assad had committed a crime against humanity. Kerry’s speech would mark the culmination of this campaign.

But the president had grown queasy. In the days after the gassing of Ghouta, Obama would later tell me, he found himself recoiling from the idea of an attack unsanctioned by international law or by Congress. The American people seemed unenthusiastic about a Syria intervention; so too did one of the few foreign leaders Obama respects, Angela Merkel, the German chancellor. She told him that her country would not participate in a Syria campaign. And in a stunning development, on Thursday, August 29, the British Parliament denied David Cameron its blessing for an attack. John Kerry later told me that when he heard that, “internally, I went, Oops.”

Obama was also unsettled by a surprise visit early in the week from James Clapper, his director of national intelligence, who interrupted the President’s Daily Brief, the threat report Obama receives each morning from Clapper’s analysts, to make clear that the intelligence on Syria’s use of sarin gas, while robust, was not a “slam dunk.” He chose the term carefully. Clapper, the chief of an intelligence community traumatized by its failures in the run-up to the Iraq War, was not going to overpromise, in the manner of the onetime CIA director George Tenet, who famously guaranteed George W. Bush a “slam dunk” in Iraq.

While the Pentagon and the White House’s national-security apparatuses were still moving toward war (John Kerry told me he was expecting a strike the day after his speech), the president had come to believe that he was walking into a trap—one laid both by allies and by adversaries, and by conventional expectations of what an American president is supposed to do.

Many of his advisers did not grasp the depth of the president’s misgivings; his Cabinet and his allies were certainly unaware of them. But his doubts were growing. Late on Friday afternoon, Obama determined that he was simply not prepared to authorize a strike. He asked McDonough, his chief of staff, to take a walk with him on the South Lawn of the White House. Obama did not choose McDonough randomly: He is the Obama aide most averse to U.S. military intervention, and someone who, in the words of one of his colleagues, “thinks in terms of traps.” Obama, ordinarily a preternaturally confident man, was looking for validation, and trying to devise ways to explain his change of heart, both to his own aides and to the public. He and McDonough stayed outside for an hour. Obama told him he was worried that Assad would place civilians as “human shields” around obvious targets. He also pointed out an underlying flaw in the proposed strike: U.S. missiles would not be fired at chemical-weapons depots, for fear of sending plumes of poison into the air. A strike would target military units that had delivered these weapons, but not the weapons themselves.

Obama also shared with McDonough a long-standing resentment: He was tired of watching Washington unthinkingly drift toward war in Muslim countries. Four years earlier, the president believed, the Pentagon had “jammed” him on a troop surge for Afghanistan. Now, on Syria, he was beginning to feel jammed again.

When the two men came back to the Oval Office, the president told his national-security aides that he planned to stand down. There would be no attack the next day; he wanted to refer the matter to Congress for a vote. Aides in the room were shocked. Susan Rice, now Obama’s national-security adviser, argued that the damage to America’s credibility would be serious and lasting. Others had difficulty fathoming how the president could reverse himself the day before a planned strike. Obama, however, was completely calm. “If you’ve been around him, you know when he’s ambivalent about something, when it’s a 51–49 decision,” Ben Rhodes told me. “But he was completely at ease.”

Not long ago, I asked Obama to describe his thinking on that day. He listed the practical worries that had preoccupied him. “We had UN inspectors on the ground who were completing their work, and we could not risk taking a shot while they were there. A second major factor was the failure of Cameron to obtain the consent of his parliament.”

The third, and most important, factor, he told me, was “our assessment that while we could inflict some damage on Assad, we could not, through a missile strike, eliminate the chemical weapons themselves, and what I would then face was the prospect of Assad having survived the strike and claiming he had successfully defied the United States, that the United States had acted unlawfully in the absence of a UN mandate, and that that would have potentially strengthened his hand rather than weakened it.”

The fourth factor, he said, was of deeper philosophical importance. “This falls in the category of something that I had been brooding on for some time,” he said. “I had come into office with the strong belief that the scope of executive power in national-security issues is very broad, but not limitless.”

Obama knew his decision not to bomb Syria would likely upset America’s allies. It did. The prime minister of France, Manuel Valls, told me that his government was already worried about the consequences of earlier inaction in Syria when word came of the stand-down. “By not intervening early, we have created a monster,” Valls told me. “We were absolutely certain that the U.S. administration would say yes. Working with the Americans, we had already seen the targets. It was a great surprise. If we had bombed as was planned, I think things would be different today.” The crown prince of Abu Dhabi, Mohammed bin Zayed al-Nahyan, who was already upset with Obama for “abandoning” Hosni Mubarak, the former president of Egypt, fumed to American visitors that the U.S. was led by an “untrustworthy” president. The king of Jordan, Abdullah II—already dismayed by what he saw as Obama’s illogical desire to distance the U.S. from its traditional Sunni Arab allies and create a new alliance with Iran, Assad’s Shia sponsor—complained privately, “I think I believe in American power more than Obama does.” The Saudis, too, were infuriated. They had never trusted Obama—he had, long before he became president, referred to them as a “so-called ally” of the U.S. “Iran is the new great power of the Middle East, and the U.S. is the old,” Jubeir, the Saudi ambassador in Washington, told his superiors in Riyadh.

Obama’s decision caused tremors across Washington as well. John McCain and Lindsey Graham, the two leading Republican hawks in the Senate, had met with Obama in the White House earlier in the week and had been promised an attack. They were angered by the about-face. Damage was done even inside the administration. Neither Chuck Hagel, then the secretary of defense, nor John Kerry was in the Oval Office when the president informed his team of his thinking. Kerry would not learn about the change until later that evening. “I just got fucked over,” he told a friend shortly after talking to the president that night. (When I asked Kerry recently about that tumultuous night, he said, “I didn’t stop to analyze it. I figured the president had a reason to make a decision and, honestly, I understood his notion.”)

The next few days were chaotic. The president asked Congress to authorize the use of force—the irrepressible Kerry served as chief lobbyist—and it quickly became apparent in the White House that Congress had little interest in a strike. When I spoke with Biden recently about the red-line decision, he made special note of this fact. “It matters to have Congress with you, in terms of your ability to sustain what you set out to do,” he said. Obama “didn’t go to Congress to get himself off the hook. He had his doubts at that point, but he knew that if he was going to do anything, he better damn well have the public with him, or it would be a very short ride.” Congress’s clear ambivalence convinced Biden that Obama was correct to fear the slippery slope. “What happens when we get a plane shot down? Do we not go in and rescue?,” Biden asked. “You need the support of the American people.”

Amid the confusion, a deus ex machina appeared in the form of the Russian president, Vladimir Putin. At the G20 summit in St. Petersburg, which was held the week after the Syria reversal, Obama pulled Putin aside, he recalled to me, and told the Russian president “that if he forced Assad to get rid of the chemical weapons, that that would eliminate the need for us taking a military strike.” Within weeks, Kerry, working with his Russian counterpart, Sergey Lavrov, would engineer the removal of most of Syria’s chemical-weapons arsenal—a program whose existence Assad until then had refused to even acknowledge.

The arrangement won the president praise from, of all people, Benjamin Netanyahu, the Israeli prime minister, with whom he has had a consistently contentious relationship. The removal of Syria’s chemical-weapons stockpiles represented “the one ray of light in a very dark region,” Netanyahu told me not long after the deal was announced. John Kerry today expresses no patience for those who argue, as he himself once did, that Obama should have bombed Assad-regime sites in order to buttress America’s deterrent capability. “You’d still have the weapons there, and you’d probably be fighting isil” for control of the weapons, he said, referring to the Islamic State, the terror group also known as isis. “It just doesn’t make sense. But I can’t deny to you that this notion about the red line being crossed and [Obama’s] not doing anything gained a life of its own.”

Obama understands that the decision he made to step back from air strikes, and to allow the violation of a red line he himself had drawn to go unpunished, will be interrogated mercilessly by historians. But today that decision is a source of deep satisfaction for him.

“I’m very proud of this moment,” he told me. “The overwhelming weight of conventional wisdom and the machinery of our national-security apparatus had gone fairly far. The perception was that my credibility was at stake, that America’s credibility was at stake. And so for me to press the pause button at that moment, I knew, would cost me politically. And the fact that I was able to pull back from the immediate pressures and think through in my own mind what was in America’s interest, not only with respect to Syria but also with respect to our democracy, was as tough a decision as I’ve made—and I believe ultimately it was the right decision to make.”

This was the moment the president believes he finally broke with what he calls, derisively, the “Washington playbook.”

“Where am I controversial? When it comes to the use of military power,” he said. “That is the source of the controversy. There’s a playbook in Washington that presidents are supposed to follow. It’s a playbook that comes out of the foreign-policy establishment. And the playbook prescribes responses to different events, and these responses tend to be militarized responses. Where America is directly threatened, the playbook works. But the playbook can also be a trap that can lead to bad decisions. In the midst of an international challenge like Syria, you get judged harshly if you don’t follow the playbook, even if there are good reasons why it does not apply.”

I have come to believe that, in Obama’s mind, August 30, 2013, was his liberation day, the day he defied not only the foreign-policy establishment and its cruise-missile playbook, but also the demands of America’s frustrating, high-maintenance allies in the Middle East—countries, he complains privately to friends and advisers, that seek to exploit American “muscle” for their own narrow and sectarian ends. By 2013, Obama’s resentments were well developed. He resented military leaders who believed they could fix any problem if the commander in chief would simply give them what they wanted, and he resented the foreign-policy think-tank complex. A widely held sentiment inside the White House is that many of the most prominent foreign-policy think tanks in Washington are doing the bidding of their Arab and pro-Israel funders. I’ve heard one administration official refer to Massachusetts Avenue, the home of many of these think tanks, as “Arab-occupied territory.” For some foreign-policy experts, even within his own administration, Obama’s about-face on enforcing the red line was a dispiriting moment in which he displayed irresolution and naïveté, and did lasting damage to America’s standing in the world. “Once the commander in chief draws that red line,” Leon Panetta, who served as CIA director and then as secretary of defense in Obama’s first term, told me recently, “then I think the credibility of the commander in chief and this nation is at stake if he doesn’t enforce it.” Right after Obama’s reversal, Hillary Clinton said privately, “If you say you’re going to strike, you have to strike. There’s no choice.”

“Assad is effectively being rewarded for the use of chemical weapons, rather than ‘punished’ as originally planned.” Shadi Hamid, a scholar at the Brookings Institution, wrote for The Atlantic at the time. “He has managed to remove the threat of U.S. military action while giving very little up in return.”

Since that first meeting in 2006, I’ve interviewed Obama periodically, mainly on matters related to the Middle East. But over the past few months, I’ve spent several hours talking with him about the broadest themes of his “long game” foreign policy, including the themes he is most eager to discuss—namely, the ones that have nothing to do with the Middle East.

“isis is not an existential threat to the United States,” he told me in one of these conversations. “Climate change is a potential existential threat to the entire world if we don’t do something about it.” Obama explained that climate change worries him in particular because “it is a political problem perfectly designed to repel government intervention. It involves every single country, and it is a comparatively slow-moving emergency, so there is always something seemingly more urgent on the agenda.”

At the moment, of course, the most urgent of the “seemingly more urgent” issues is Syria. But at any given moment, Obama’s entire presidency could be upended by North Korean aggression, or an assault by Russia on a member of nato, or an isis-planned attack on U.S. soil. Few presidents have faced such diverse tests on the international stage as Obama has, and the challenge for him, as for all presidents, has been to distinguish the merely urgent from the truly important, and to focus on the important.

My goal in our recent conversations was to see the world through Obama’s eyes, and to understand what he believes America’s role in the world should be. This article is informed by our recent series of conversations, which took place in the Oval Office; over lunch in his dining room; aboard Air Force One; and in Kuala Lumpur during his most recent visit to Asia, in November. It is also informed by my previous interviews with him and by his speeches and prolific public ruminations, as well as by conversations with his top foreign-policy and national-security advisers, foreign leaders and their ambassadors in Washington, friends of the president and others who have spoken with him about his policies and decisions, and his adversaries and critics.

Over the course of our conversations, I came to see Obama as a president who has grown steadily more fatalistic about the constraints on America’s ability to direct global events, even as he has, late in his presidency, accumulated a set of potentially historic foreign-policy achievements—controversial, provisional achievements, to be sure, but achievements nonetheless: the opening to Cuba, the Paris climate-change accord, the Trans-Pacific Partnership trade agreement, and, of course, the Iran nuclear deal. These he accomplished despite his growing sense that larger forces—the riptide of tribal feeling in a world that should have already shed its atavism; the resilience of small men who rule large countries in ways contrary to their own best interests; the persistence of fear as a governing human emotion—frequently conspire against the best of America’s intentions. But he also has come to learn, he told me, that very little is accomplished in international affairs without U.S. leadership.

Obama talked me through this apparent contradiction. “I want a president who has the sense that you can’t fix everything,” he said. But on the other hand, “if we don’t set the agenda, it doesn’t happen.” He explained what he meant. “The fact is, there is not a summit I’ve attended since I’ve been president where we are not setting the agenda, where we are not responsible for the key results,” he said. “That’s true whether you’re talking about nuclear security, whether you’re talking about saving the world financial system, whether you’re talking about climate.”

One day, over lunch in the Oval Office dining room, I asked the president how he thought his foreign policy might be understood by historians. He started by describing for me a four-box grid representing the main schools of American foreign-policy thought. One box he called isolationism, which he dismissed out of hand. “The world is ever-shrinking,” he said. “Withdrawal is untenable.” The other boxes he labeled realism, liberal interventionism, and internationalism. “I suppose you could call me a realist in believing we can’t, at any given moment, relieve all the world’s misery,” he said. “We have to choose where we can make a real impact.” He also noted that he was quite obviously an internationalist, devoted as he is to strengthening multilateral organizations and international norms.

I told him my impression was that the various traumas of the past seven years have, if anything, intensified his commitment to realist-driven restraint. Had nearly two full terms in the White House soured him on interventionism?

“For all of our warts, the United States has clearly been a force for good in the world,” he said. “If you compare us to previous superpowers, we act less on the basis of naked self-interest, and have been interested in establishing norms that benefit everyone. If it is possible to do good at a bearable cost, to save lives, we will do it.”

If a crisis, or a humanitarian catastrophe, does not meet his stringent standard for what constitutes a direct national-security threat, Obama said, he doesn’t believe that he should be forced into silence. He is not so much the realist, he suggested, that he won’t pass judgment on other leaders. Though he has so far ruled out the use of direct American power to depose Assad, he was not wrong, he argued, to call on Assad to go. “Oftentimes when you get critics of our Syria policy, one of the things that they’ll point out is ‘You called for Assad to go, but you didn’t force him to go. You did not invade.’ And the notion is that if you weren’t going to overthrow the regime, you shouldn’t have said anything. That’s a weird argument to me, the notion that if we use our moral authority to say ‘This is a brutal regime, and this is not how a leader should treat his people,’ once you do that, you are obliged to invade the country and install a government you prefer.”

“I am very much the internationalist,” Obama said in a later conversation. “And I am also an idealist insofar as I believe that we should be promoting values, like democracy and human rights and norms and values, because not only do they serve our interests the more people adopt values that we share—in the same way that, economically, if people adopt rule of law and property rights and so forth, that is to our advantage—but because it makes the world a better place. And I’m willing to say that in a very corny way, and in a way that probably Brent Scowcroft would not say.

“Having said that,” he continued, “I also believe that the world is a tough, complicated, messy, mean place, and full of hardship and tragedy. And in order to advance both our security interests and those ideals and values that we care about, we’ve got to be hardheaded at the same time as we’re bighearted, and pick and choose our spots, and recognize that there are going to be times where the best that we can do is to shine a spotlight on something that’s terrible, but not believe that we can automatically solve it. There are going to be times where our security interests conflict with our concerns about human rights. There are going to be times where we can do something about innocent people being killed, but there are going to be times where we can’t.”

If Obama ever questioned whether America really is the world’s one indispensable nation, he no longer does so. But he is the rare president who seems at times to resent indispensability, rather than embrace it. “Free riders aggravate me,” he told me. Recently, Obama warned that Great Britain would no longer be able to claim a “special relationship” with the United States if it did not commit to spending at least 2 percent of its GDP on defense. “You have to pay your fair share,” Obama told David Cameron, who subsequently met the 2 percent threshold.

Part of his mission as president, Obama explained, is to spur other countries to take action for themselves, rather than wait for the U.S. to lead. The defense of the liberal international order against jihadist terror, Russian adventurism, and Chinese bullying depends in part, he believes, on the willingness of other nations to share the burden with the U.S. This is why the controversy surrounding the assertion—made by an anonymous administration official to The New Yorker during the Libya crisis of 2011—that his policy consisted of “leading from behind” perturbed him. “We don’t have to always be the ones who are up front,” he told me. “Sometimes we’re going to get what we want precisely because we are sharing in the agenda. The irony is that it was precisely in order to prevent the Europeans and the Arab states from holding our coats while we did all the fighting that we, by design, insisted” that they lead during the mission to remove Muammar Qaddafi from power in Libya. “It was part of the anti–free rider campaign.”

The president also seems to believe that sharing leadership with other countries is a way to check America’s more unruly impulses. “One of the reasons I am so focused on taking action multilaterally where our direct interests are not at stake is that multilateralism regulates hubris,” he explained. He consistently invokes what he understands to be America’s past failures overseas as a means of checking American self-righteousness. “We have history,” he said. “We have history in Iran, we have history in Indonesia and Central America. So we have to be mindful of our history when we start talking about intervening, and understand the source of other people’s suspicions.”

In his efforts to off-load some of America’s foreign-policy responsibilities to its allies, Obama appears to be a classic retrenchment president in the manner of Dwight D. Eisenhower and Richard Nixon. Retrenchment, in this context, is defined as “pulling back, spending less, cutting risk, and shifting burdens to allies,” Stephen Sestanovich, an expert on presidential foreign policy at the Council on Foreign Relations, explained to me. “If John McCain had been elected in 2008, you would still have seen some degree of retrenchment,” Sestanovich said. “It’s what the country wanted. If you come into office in the middle of a war that is not going well, you’re convinced that the American people have hired you to do less.” One difference between Eisenhower and Nixon, on the one hand, and Obama, on the other, Sestanovich said, is that Obama “appears to have had a personal, ideological commitment to the idea that foreign policy had consumed too much of the nation’s attention and resources.”

I asked Obama about retrenchment. “Almost every great world power has succumbed” to overextension, he said. “What I think is not smart is the idea that every time there is a problem, we send in our military to impose order. We just can’t do that.”

But once he decides that a particular challenge represents a direct national-security threat, he has shown a willingness to act unilaterally. This is one of the larger ironies of the Obama presidency: He has relentlessly questioned the efficacy of force, but he has also become the most successful terrorist-hunter in the history of the presidency, one who will hand to his successor a set of tools an accomplished assassin would envy. “He applies different standards to direct threats to the U.S.,” Ben Rhodes says. “For instance, despite his misgivings about Syria, he has not had a second thought about drones.” Some critics argue he should have had a few second thoughts about what they see as the overuse of drones. But John Brennan, Obama’s CIA director, told me recently that he and the president “have similar views. One of them is that sometimes you have to take a life to save even more lives. We have a similar view of just-war theory. The president requires near-certainty of no collateral damage. But if he believes it is necessary to act, he doesn’t hesitate.”

Those who speak with Obama about jihadist thought say that he possesses a no-illusions understanding of the forces that drive apocalyptic violence among radical Muslims, but he has been careful about articulating that publicly, out of concern that he will exacerbate anti-Muslim xenophobia. He has a tragic realist’s understanding of sin, cowardice, and corruption, and a Hobbesian appreciation of how fear shapes human behavior. And yet he consistently, and with apparent sincerity, professes optimism that the world is bending toward justice. He is, in a way, a Hobbesian optimist.

The contradictions do not end there. Though he has a reputation for prudence, he has also been eager to question some of the long-standing assumptions undergirding traditional U.S. foreign-policy thinking. To a remarkable degree, he is willing to question why America’s enemies are its enemies, or why some of its friends are its friends. He overthrew half a century of bipartisan consensus in order to reestablish ties with Cuba. He questioned why the U.S. should avoid sending its forces into Pakistan to kill al-Qaeda leaders, and he privately questions why Pakistan, which he believes is a disastrously dysfunctional country, should be considered an ally of the U.S. at all. According to Leon Panetta, he has questioned why the U.S. should maintain Israel’s so-called qualitative military edge, which grants it access to more sophisticated weapons systems than America’s Arab allies receive; but he has also questioned, often harshly, the role that America’s Sunni Arab allies play in fomenting anti-American terrorism. He is clearly irritated that foreign-policy orthodoxy compels him to treat Saudi Arabia as an ally. And of course he decided early on, in the face of great criticism, that he wanted to reach out to America’s most ardent Middle Eastern foe, Iran. The nuclear deal he struck with Iran proves, if nothing else, that Obama is not risk-averse. He has bet global security and his own legacy that one of the world’s leading state sponsors of terrorism will adhere to an agreement to curtail its nuclear program.

It is assumed, at least among his critics, that Obama sought the Iran deal because he has a vision of a historic American-Persian rapprochement. But his desire for the nuclear agreement was born of pessimism as much as it was of optimism. “The Iran deal was never primarily about trying to open a new era of relations between the U.S. and Iran,” Susan Rice told me. “It was far more pragmatic and minimalist. The aim was very simply to make a dangerous country substantially less dangerous. No one had any expectation that Iran would be a more benign actor.”

I once mentioned to Obama a scene from The Godfather: Part III, in which Michael Corleone complains angrily about his failure to escape the grasp of organized crime. I told Obama that the Middle East is to his presidency what the Mob is to Corleone, and I started to quote the Al Pacino line: “Just when I thought I was out—”

“It pulls you back in,” Obama said, completing the thought.

The story of Obama’s encounter with the Middle East follows an arc of disenchantment. In his first extended spree of fame, as a presidential candidate in 2008, Obama often spoke with hope about the region. In Berlin that summer, in a speech to 200,000 adoring Germans, he said, “This is the moment we must help answer the call for a new dawn in the Middle East.”

The next year, as president, he gave a speech in Cairo meant to reset U.S. relations with the world’s Muslims. He spoke about Muslims in his own family, and his childhood years in Indonesia, and confessed America’s sins even as he criticized those in the Muslim world who demonized the U.S. What drew the most attention, though, was his promise to address the Israeli-Palestinian conflict, which was then thought to be the central animating concern of Arab Muslims. His sympathy for the Palestinians moved the audience, but complicated his relations with Benjamin Netanyahu, the Israeli prime minister—especially because Obama had also decided to bypass Jerusalem on his first presidential visit to the Middle East.

When I asked Obama recently what he had hoped to accomplish with his Cairo reset speech, he said that he had been trying—unsuccessfully, he acknowledged—to persuade Muslims to more closely examine the roots of their unhappiness.

“My argument was this: Let’s all stop pretending that the cause of the Middle East’s problems is Israel,” he told me. “We want to work to help achieve statehood and dignity for the Palestinians, but I was hoping that my speech could trigger a discussion, could create space for Muslims to address the real problems they are confronting—problems of governance, and the fact that some currents of Islam have not gone through a reformation that would help people adapt their religious doctrines to modernity. My thought was, I would communicate that the U.S. is not standing in the way of this progress, that we would help, in whatever way possible, to advance the goals of a practical, successful Arab agenda that provided a better life for ordinary people.”

Through the first flush of the Arab Spring, in 2011, Obama continued to speak optimistically about the Middle East’s future, coming as close as he ever would to embracing the so-called freedom agenda of George W. Bush, which was characterized in part by the belief that democratic values could be implanted in the Middle East. He equated protesters in Tunisia and Tahrir Square with Rosa Parks and the “patriots of Boston.”

“After decades of accepting the world as it is in the region, we have a chance to pursue the world as it should be,” he said in a speech at the time. “The United States supports a set of universal rights. And these rights include free speech, the freedom of peaceful assembly, the freedom of religion, equality for men and women under the rule of law, and the right to choose your own leaders … Our support for these principles is not a secondary interest.”

But over the next three years, as the Arab Spring gave up its early promise, and brutality and dysfunction overwhelmed the Middle East, the president grew disillusioned. Some of his deepest disappointments concern Middle Eastern leaders themselves. Benjamin Netanyahu is in his own category: Obama has long believed that Netanyahu could bring about a two-state solution that would protect Israel’s status as a Jewish-majority democracy, but is too fearful and politically paralyzed to do so. Obama has also not had much patience for Netanyahu and other Middle Eastern leaders who question his understanding of the region. In one of Netanyahu’s meetings with the president, the Israeli prime minister launched into something of a lecture about the dangers of the brutal region in which he lives, and Obama felt that Netanyahu was behaving in a condescending fashion, and was also avoiding the subject at hand: peace negotiations. Finally, the president interrupted the prime minister: “Bibi, you have to understand something,” he said. “I’m the African American son of a single mother, and I live here, in this house. I live in the White House. I managed to get elected president of the United States. You think I don’t understand what you’re talking about, but I do.” Other leaders also frustrate him immensely. Early on, Obama saw Recep Tayyip Erdoğan, the president of Turkey, as the sort of moderate Muslim leader who would bridge the divide between East and West—but Obama now considers him a failure and an authoritarian, one who refuses to use his enormous army to bring stability to Syria. And on the sidelines of a nato summit in Wales in 2014, Obama pulled aside King Abdullah II of Jordan. Obama said he had heard that Abdullah had complained to friends in the U.S. Congress about his leadership, and told the king that if he had complaints, he should raise them directly. The king denied that he had spoken ill of him.

In recent days, the president has taken to joking privately, “All I need in the Middle East is a few smart autocrats.” Obama has always had a fondness for pragmatic, emotionally contained technocrats, telling aides, “If only everyone could be like the Scandinavians, this would all be easy.”

The unraveling of the Arab Spring darkened the president’s view of what the U.S. could achieve in the Middle East, and made him realize how much the chaos there was distracting from other priorities. “The president recognized during the course of the Arab Spring that the Middle East was consuming us,” John Brennan, who served in Obama’s first term as his chief counterterrorism adviser, told me recently.

But what sealed Obama’s fatalistic view was the failure of his administration’s intervention in Libya, in 2011. That intervention was meant to prevent the country’s then-dictator, Muammar Qaddafi, from slaughtering the people of Benghazi, as he was threatening to do. Obama did not want to join the fight; he was counseled by Joe Biden and his first-term secretary of defense Robert Gates, among others, to steer clear. But a strong faction within the national-security team—Secretary of State Hillary Clinton and Susan Rice, who was then the ambassador to the United Nations, along with Samantha Power, Ben Rhodes, and Antony Blinken, who was then Biden’s national-security adviser—lobbied hard to protect Benghazi, and prevailed. (Biden, who is acerbic about Clinton’s foreign-policy judgment, has said privately, “Hillary just wants to be Golda Meir.”) American bombs fell, the people of Benghazi were spared from what may or may not have been a massacre, and Qaddafi was captured and executed.

But Obama says today of the intervention, “It didn’t work.” The U.S., he believes, planned the Libya operation carefully—and yet the country is still a disaster.

Why, given what seems to be the president’s natural reticence toward getting militarily ensnarled where American national security is not directly at stake, did he accept the recommendation of his more activist advisers to intervene?

“The social order in Libya has broken down,” Obama said, explaining his thinking at the time. “You have massive protests against Qaddafi. You’ve got tribal divisions inside of Libya. Benghazi is a focal point for the opposition regime. And Qaddafi is marching his army toward Benghazi, and he has said, ‘We will kill them like rats.’

“Now, option one would be to do nothing, and there were some in my administration who said, as tragic as the Libyan situation may be, it’s not our problem. The way I looked at it was that it would be our problem if, in fact, complete chaos and civil war broke out in Libya. But this is not so at the core of U.S. interests that it makes sense for us to unilaterally strike against the Qaddafi regime. At that point, you’ve got Europe and a number of Gulf countries who despise Qaddafi, or are concerned on a humanitarian basis, who are calling for action. But what has been a habit over the last several decades in these circumstances is people pushing us to act but then showing an unwillingness to put any skin in the game.”

“Free riders?,” I interjected.

“Free riders,” he said, and continued. “So what I said at that point was, we should act as part of an international coalition. But because this is not at the core of our interests, we need to get a UN mandate; we need Europeans and Gulf countries to be actively involved in the coalition; we will apply the military capabilities that are unique to us, but we expect others to carry their weight. And we worked with our defense teams to ensure that we could execute a strategy without putting boots on the ground and without a long-term military commitment in Libya.

“So we actually executed this plan as well as I could have expected: We got a UN mandate, we built a coalition, it cost us $1 billion—which, when it comes to military operations, is very cheap. We averted large-scale civilian casualties, we prevented what almost surely would have been a prolonged and bloody civil conflict. And despite all that, Libya is a mess.”

Mess is the president’s diplomatic term; privately, he calls Libya a “shit show,” in part because it’s subsequently become an isis haven—one that he has already targeted with air strikes. It became a shit show, Obama believes, for reasons that had less to do with American incompetence than with the passivity of America’s allies and with the obdurate power of tribalism.

“When I go back and I ask myself what went wrong,” Obama said, “there’s room for criticism, because I had more faith in the Europeans, given Libya’s proximity, being invested in the follow-up,” he said. He noted that Nicolas Sarkozy, the French president, lost his job the following year. And he said that British Prime Minister David Cameron soon stopped paying attention, becoming “distracted by a range of other things.” Of France, he said, “Sarkozy wanted to trumpet the flights he was taking in the air campaign, despite the fact that we had wiped out all the air defenses and essentially set up the entire infrastructure” for the intervention. This sort of bragging was fine, Obama said, because it allowed the U.S. to “purchase France’s involvement in a way that made it less expensive for us and less risky for us.” In other words, giving France extra credit in exchange for less risk and cost to the United States was a useful trade-off—except that “from the perspective of a lot of the folks in the foreign-policy establishment, well, that was terrible. If we’re going to do something, obviously we’ve got to be up front, and nobody else is sharing in the spotlight.”

Obama also blamed internal Libyan dynamics. “The degree of tribal division in Libya was greater than our analysts had expected. And our ability to have any kind of structure there that we could interact with and start training and start providing resources broke down very quickly.”

Libya proved to him that the Middle East was best avoided. “There is no way we should commit to governing the Middle East and North Africa,” he recently told a former colleague from the Senate. “That would be a basic, fundamental mistake.”

President Obama did not come into office preoccupied by the Middle East. He is the first child of the Pacific to become president—born in Hawaii, raised there and, for four years, in Indonesia—and he is fixated on turning America’s attention to Asia. For Obama, Asia represents the future. Africa and Latin America, in his view, deserve far more U.S. attention than they receive. Europe, about which he is unromantic, is a source of global stability that requires, to his occasional annoyance, American hand-holding. And the Middle East is a region to be avoided—one that, thanks to America’s energy revolution, will soon be of negligible relevance to the U.S. economy.

It is not oil but another of the Middle East’s exports, terrorism, that shapes Obama’s understanding of his responsibilities there. Early in 2014, Obama’s intelligence advisers told him that isis was of marginal importance. According to administration officials, General Lloyd Austin, then the commander of Central Command, which oversees U.S. military operations in the Middle East, told the White House that the Islamic State was “a flash in the pan.” This analysis led Obama, in an interview with The New Yorker, to describe the constellation of jihadist groups in Iraq and Syria as terrorism’s “jayvee team.” (A spokesman for Austin told me, “At no time has General Austin ever considered isil a ‘flash in the pan’ phenomenon.”)

But by late spring of 2014, after isis took the northern-Iraq city of Mosul, he came to believe that U.S. intelligence had failed to appreciate the severity of the threat and the inadequacies of the Iraqi army, and his view shifted. After isis beheaded three American civilians in Syria, it became obvious to Obama that defeating the group was of more immediate urgency to the U.S. than overthrowing Bashar al-Assad.

Advisers recall that Obama would cite a pivotal moment in The Dark Knight, the 2008 Batman movie, to help explain not only how he understood the role of isis, but how he understood the larger ecosystem in which it grew. “There’s a scene in the beginning in which the gang leaders of Gotham are meeting,” the president would say. “These are men who had the city divided up. They were thugs, but there was a kind of order. Everyone had his turf. And then the Joker comes in and lights the whole city on fire. isil is the Joker. It has the capacity to set the whole region on fire. That’s why we have to fight it.”

The rise of the Islamic State deepened Obama’s conviction that the Middle East could not be fixed—not on his watch, and not for a generation to come.

On a rainy Wednesday in mid-November, President Obama appeared on a stage at the Asia-Pacific Economic Cooperation (apec) summit in Manila with Jack Ma, the founder of the Chinese e-commerce company Alibaba, and a 31-year-old Filipina inventor named Aisa Mijeno. The ballroom was crowded with Asian CEOs, American business leaders, and government officials from across the region. Obama, who was greeted warmly, first delivered informal remarks from behind a podium, mainly about the threat of climate change.

Obama made no mention of the subject preoccupying much of the rest of the world—the isis attacks in Paris five days earlier, which had killed 130 people. Obama had arrived in Manila the day before from a G20 summit held in Antalya, Turkey. The Paris attacks had been a main topic of conversation in Antalya, where Obama held a particularly contentious press conference on the subject.

The traveling White House press corps was unrelenting: “Isn’t it time for your strategy to change?” one reporter asked. This was followed by “Could I ask you to address your critics who say that your reluctance to enter another Middle East war, and your preference of diplomacy over using the military, makes the United States weaker and emboldens our enemies?” And then came this imperishable question, from a CNN reporter: “If you’ll forgive the language—why can’t we take out these bastards?” Which was followed by “Do you think you really understand this enemy well enough to defeat them and to protect the homeland?”

As the questions unspooled, Obama became progressively more irritated. He described his isis strategy at length, but the only time he exhibited an emotion other than disdain was when he addressed an emerging controversy about America’s refugee policy. Republican governors and presidential candidates had suddenly taken to demanding that the United States block Syrian refugees from coming to America. Ted Cruz had proposed accepting only Christian Syrians. Chris Christie had said that all refugees, including “orphans under 5,” should be banned from entry until proper vetting procedures had been put in place.

This rhetoric appeared to frustrate Obama immensely. “When I hear folks say that, well, maybe we should just admit the Christians but not the Muslims; when I hear political leaders suggesting that there would be a religious test for which person who’s fleeing from a war-torn country is admitted,” Obama told the assembled reporters, “that’s not American. That’s not who we are. We don’t have religious tests to our compassion.”

Air Force One departed Antalya and arrived 10 hours later in Manila. That’s when the president’s advisers came to understand, in the words of one official, that “everyone back home had lost their minds.” Susan Rice, trying to comprehend the rising anxiety, searched her hotel television in vain for CNN, finding only the BBC and Fox News. She toggled between the two, looking for the mean, she told people on the trip.

Later, the president would say that he had failed to fully appreciate the fear many Americans were experiencing about the possibility of a Paris-style attack in the U.S. Great distance, a frantic schedule, and the jet-lag haze that envelops a globe-spanning presidential trip were working against him. But he has never believed that terrorism poses a threat to America commensurate with the fear it generates. Even during the period in 2014 when isis was executing its American captives in Syria, his emotions were in check. Valerie Jarrett, Obama’s closest adviser, told him people were worried that the group would soon take its beheading campaign to the U.S. “They’re not coming here to chop our heads off,” he reassured her. Obama frequently reminds his staff that terrorism takes far fewer lives in America than handguns, car accidents, and falls in bathtubs do. Several years ago, he expressed to me his admiration for Israelis’ “resilience” in the face of constant terrorism, and it is clear that he would like to see resilience replace panic in American society. Nevertheless, his advisers are fighting a constant rearguard action to keep Obama from placing terrorism in what he considers its “proper” perspective, out of concern that he will seem insensitive to the fears of the American people.The frustration among Obama’s advisers spills over into the Pentagon and the State Department. John Kerry, for one, seems more alarmed about isis than the president does. Recently, when I asked the secretary of state a general question—is the Middle East still important to the U.S.?—he answered by talking exclusively about isis. “This is a threat to everybody in the world,” he said, a group “overtly committed to destroying people in the West and in the Middle East. Imagine what would happen if we don’t stand and fight them, if we don’t lead a coalition—as we are doing, by the way. If we didn’t do that, you could have allies and friends of ours fall. You could have a massive migration into Europe that destroys Europe, leads to the pure destruction of Europe, ends the European project, and everyone runs for cover and you’ve got the 1930s all over again, with nationalism and fascism and other things breaking out. Of course we have an interest in this, a huge interest in this.”

When I noted to Kerry that the president’s rhetoric doesn’t match his, he said, “President Obama sees all of this, but he doesn’t gin it up into this kind of—he thinks we are on track. He has escalated his efforts. But he’s not trying to create hysteria … I think the president is always inclined to try to keep things on an appropriate equilibrium. I respect that.”

Obama modulates his discussion of terrorism for several reasons: He is, by nature, Spockian. And he believes that a misplaced word, or a frightened look, or an ill-considered hyperbolic claim, could tip the country into panic. The sort of panic he worries about most is the type that would manifest itself in anti-Muslim xenophobia or in a challenge to American openness and to the constitutional order

The president also gets frustrated that terrorism keeps swamping his larger agenda, particularly as it relates to rebalancing America’s global priorities. For years, the “pivot to Asia” has been a paramount priority of his. America’s economic future lies in Asia, he believes, and the challenge posed by China’s rise requires constant attention. From his earliest days in office, Obama has been focused on rebuilding the sometimes-threadbare ties between the U.S. and its Asian treaty partners, and he is perpetually on the hunt for opportunities to draw other Asian nations into the U.S. orbit. His dramatic opening to Burma was one such opportunity; Vietnam and the entire constellation of Southeast Asian countries fearful of Chinese domination presented others.

In Manila, at apec, Obama was determined to keep the conversation focused on this agenda, and not on what he viewed as the containable challenge presented by isis. Obama’s secretary of defense, Ashton Carter, told me not long ago that Obama has maintained his focus on Asia even as Syria and other Middle Eastern conflicts continue to flare. Obama believes, Carter said, that Asia “is the part of the world of greatest consequence to the American future, and that no president can take his eye off of this.” He added, “He consistently asks, even in the midst of everything else that’s going on, ‘Where are we in the Asia-Pacific rebalance? Where are we in terms of resources?’ He’s been extremely consistent about that, even in times of Middle East tension.”

After Obama finished his presentation on climate change, he joined Ma and Mijeno, who had seated themselves on nearby armchairs, where Obama was preparing to interview them in the manner of a daytime talk-show host—an approach that seemed to induce a momentary bout of status-inversion vertigo in an audience not accustomed to such behavior in their own leaders. Obama began by asking Ma a question about climate change. Ma, unsurprisingly, agreed with Obama that it was a very important issue. Then Obama turned to Mijeno. A laboratory operating in the hidden recesses of the West Wing could not have fashioned a person more expertly designed to appeal to Obama’s wonkish enthusiasms than Mijeno, a young engineer who, with her brother, had invented a lamp that is somehow powered by salt water.

“Just to be clear, Aisa, so with some salt water, the device that you’ve set up can provide—am I right?—about eight hours of lighting?,” Obama asked.

“Eight hours of lighting,” she responded.

Obama: “And the lamp is $20—”

Mijeno: “Around $20.”

“I think Aisa is a perfect example of what we’re seeing in a lot of countries—young entrepreneurs coming up with leapfrog technologies, in the same ways that in large portions of Asia and Africa, the old landline phones never got set up,” Obama said, because those areas jumped straight to mobile phones. Obama encouraged Jack Ma to fund her work. “She’s won, by the way, a lot of prizes and gotten a lot of attention, so this is not like one of those infomercials where you order it, and you can’t make the thing work,” he said, to laughter.

The next day, aboard Air Force One en route to Kuala Lumpur, I mentioned to Obama that he seemed genuinely happy to be onstage with Ma and Mijeno, and then I pivoted away from Asia, asking him if anything about the Middle East makes him happy.

“Right now, I don’t think that anybody can be feeling good about the situation in the Middle East,” he said. “You have countries that are failing to provide prosperity and opportunity for their people. You’ve got a violent, extremist ideology, or ideologies, that are turbocharged through social media. You’ve got countries that have very few civic traditions, so that as autocratic regimes start fraying, the only organizing principles are sectarian.”

He went on, “Contrast that with Southeast Asia, which still has huge problems—enormous poverty, corruption—but is filled with striving, ambitious, energetic people who are every single day scratching and clawing to build businesses and get education and find jobs and build infrastructure. The contrast is pretty stark.”

In Asia, as well as in Latin America and Africa, Obama says, he sees young people yearning for self-improvement, modernity, education, and material wealth.

“They are not thinking about how to kill Americans,” he says. “What they’re thinking about is How do I get a better education? How do I create something of value?”

He then made an observation that I came to realize was representative of his bleakest, most visceral understanding of the Middle East today—not the sort of understanding that a White House still oriented around themes of hope and change might choose to advertise. “If we’re not talking to them,” he said, referring to young Asians and Africans and Latin Americans, “because the only thing we’re doing is figuring out how to destroy or cordon off or control the malicious, nihilistic, violent parts of humanity, then we’re missing the boat.”

Obama’s critics argue that he is ineffective in cordoning off the violent nihilists of radical Islam because he doesn’t understand the threat. He does resist refracting radical Islam through the “clash of civilizations” prism popularized by the late political scientist Samuel Huntington. But this is because, he and his advisers argue, he does not want to enlarge the ranks of the enemy. “The goal is not to force a Huntington template onto this conflict,” said John Brennan, the CIA director.

Both François Hollande and David Cameron have spoken about the threat of radical Islam in more Huntingtonesque terms, and I’ve heard that both men wish Obama would use more-direct language in discussing the threat. When I mentioned this to Obama he said, “Hollande and Cameron have used phrases, like radical Islam, that we have not used on a regular basis as our way of targeting terrorism. But I’ve never had a conversation when they said, ‘Man, how come you’re not using this phrase the way you hear Republicans say it?’ ” Obama says he has demanded that Muslim leaders do more to eliminate the threat of violent fundamentalism. “It is very clear what I mean,” he told me, “which is that there is a violent, radical, fanatical, nihilistic interpretation of Islam by a faction—a tiny faction—within the Muslim community that is our enemy, and that has to be defeated.”

He then offered a critique that sounded more in line with the rhetoric of Cameron and Hollande. “There is also the need for Islam as a whole to challenge that interpretation of Islam, to isolate it, and to undergo a vigorous discussion within their community about how Islam works as part of a peaceful, modern society,” he said. But he added, “I do not persuade peaceful, tolerant Muslims to engage in that debate if I’m not sensitive to their concern that they are being tagged with a broad brush.”

In private encounters with other world leaders, Obama has argued that there will be no comprehensive solution to Islamist terrorism until Islam reconciles itself to modernity and undergoes some of the reforms that have changed Christianity.

Though he has argued, controversially, that the Middle East’s conflicts “date back millennia,” he also believes that the intensified Muslim fury of recent years was encouraged by countries considered friends of the U.S. In a meeting during apec with Malcolm Turnbull, the new prime minister of Australia, Obama described how he has watched Indonesia gradually move from a relaxed, syncretistic Islam to a more fundamentalist, unforgiving interpretation; large numbers of Indonesian women, he observed, have now adopted the hijab, the Muslim head covering.

Why, Turnbull asked, was this happening?

Because, Obama answered, the Saudis and other Gulf Arabs have funneled money, and large numbers of imams and teachers, into the country. In the 1990s, the Saudis heavily funded Wahhabist madrassas, seminaries that teach the fundamentalist version of Islam favored by the Saudi ruling family, Obama told Turnbull. Today, Islam in Indonesia is much more Arab in orientation than it was when he lived there, he said.

“Aren’t the Saudis your friends?,” Turnbull asked.

Obama smiled. “It’s complicated,” he said.

Obama’s patience with Saudi Arabia has always been limited. In his first foreign-policy commentary of note, that 2002 speech at the antiwar rally in Chicago, he said, “You want a fight, President Bush? Let’s fight to make sure our so-called allies in the Middle East—the Saudis and the Egyptians—stop oppressing their own people, and suppressing dissent, and tolerating corruption and inequality.” In the White House these days, one occasionally hears Obama’s National Security Council officials pointedly reminding visitors that the large majority of 9/11 hijackers were not Iranian, but Saudi—and Obama himself rails against Saudi Arabia’s state-sanctioned misogyny, arguing in private that “a country cannot function in the modern world when it is repressing half of its population.” In meetings with foreign leaders, Obama has said, “You can gauge the success of a society by how it treats its women.”

His frustration with the Saudis informs his analysis of Middle Eastern power politics. At one point I observed to him that he is less likely than previous presidents to axiomatically side with Saudi Arabia in its dispute with its archrival, Iran. He didn’t disagree.

“Iran, since 1979, has been an enemy of the United States, and has engaged in state-sponsored terrorism, is a genuine threat to Israel and many of our allies, and engages in all kinds of destructive behavior,” the president said. “And my view has never been that we should throw our traditional allies”—the Saudis—“overboard in favor of Iran.”

But he went on to say that the Saudis need to “share” the Middle East with their Iranian foes. “The competition between the Saudis and the Iranians—which has helped to feed proxy wars and chaos in Syria and Iraq and Yemen—requires us to say to our friends as well as to the Iranians that they need to find an effective way to share the neighborhood and institute some sort of cold peace,” he said. “An approach that said to our friends ‘You are right, Iran is the source of all problems, and we will support you in dealing with Iran’ would essentially mean that as these sectarian conflicts continue to rage and our Gulf partners, our traditional friends, do not have the ability to put out the flames on their own or decisively win on their own, and would mean that we have to start coming in and using our military power to settle scores. And that would be in the interest neither of the United States nor of the Middle East.”

One of the most destructive forces in the Middle East, Obama believes, is tribalism—a force no president can neutralize. Tribalism, made manifest in the reversion to sect, creed, clan, and village by the desperate citizens of failing states, is the source of much of the Muslim Middle East’s problems, and it is another source of his fatalism. Obama has deep respect for the destructive resilience of tribalism—part of his memoir, Dreams From My Father, concerns the way in which tribalism in post-colonial Kenya helped ruin his father’s life—which goes some distance in explaining why he is so fastidious about avoiding entanglements in tribal conflicts.

“It is literally in my DNA to be suspicious of tribalism,” he told me. “I understand the tribal impulse, and acknowledge the power of tribal division. I’ve been navigating tribal divisions my whole life. In the end, it’s the source of a lot of destructive acts.”

While flying to Kuala Lumpur with the president, I recalled a passing reference he had once made to me about the Hobbesian argument for strong government as an antidote to the unforgiving state of nature. When Obama looks at swathes of the Middle East, Hobbes’s “war of all against all” is what he sees. “I have a recognition that us serving as the Leviathan clamps down and tames some of these impulses,” Obama had said. So I tried to reopen this conversation with an unfortunately prolix question about, among other things, “the Hobbesian notion that people organize themselves into collectives to stave off their supreme fear, which is death.”

Ben Rhodes and Joshua Earnest, the White House spokesman, who were seated on a couch to the side of Obama’s desk on Air Force One, could barely suppress their amusement at my discursiveness. I paused and said, “I bet if I asked that in a press conference my colleagues would just throw me out of the room.”

“I would be really into it,” Obama said, “but everybody else would be rolling their eyes.”

Rhodes interjected: “Why can’t we get the bastards?” That question, the one put to the president by the CNN reporter at the press conference in Turkey, had become a topic of sardonic conversation during the trip.

I turned to the president: “Well, yeah, and also, why can’t we get the bastards?”

He took the first question.

“Look, I am not of the view that human beings are inherently evil,” he said. “I believe that there’s more good than bad in humanity. And if you look at the trajectory of history, I am optimistic.

“I believe that overall, humanity has become less violent, more tolerant, healthier, better fed, more empathetic, more able to manage difference. But it’s hugely uneven. And what has been clear throughout the 20th and 21st centuries is that the progress we make in social order and taming our baser impulses and steadying our fears can be reversed very quickly. Social order starts breaking down if people are under profound stress. Then the default position is tribe—us/them, a hostility toward the unfamiliar or the unknown.”

He continued, “Right now, across the globe, you’re seeing places that are undergoing severe stress because of globalization, because of the collision of cultures brought about by the Internet and social media, because of scarcities—some of which will be attributable to climate change over the next several decades—because of population growth. And in those places, the Middle East being Exhibit A, the default position for a lot of folks is to organize tightly in the tribe and to push back or strike out against those who are different.

“A group like isil is the distillation of every worst impulse along these lines. The notion that we are a small group that defines ourselves primarily by the degree to which we can kill others who are not like us, and attempting to impose a rigid orthodoxy that produces nothing, that celebrates nothing, that really is contrary to every bit of human progress—it indicates the degree to which that kind of mentality can still take root and gain adherents in the 21st century.”

So your appreciation for tribalism’s power makes you want to stay away?, I asked. “In other words, when people say ‘Why don’t you just go get the bastards?,’ you step back?”

“We have to determine the best tools to roll back those kinds of attitudes,” he said. “There are going to be times where either because it’s not a direct threat to us or because we just don’t have the tools in our toolkit to have a huge impact that, tragically, we have to refrain from jumping in with both feet.”

I asked Obama whether he would have sent the Marines to Rwanda in 1994 to stop the genocide as it was happening, had he been president at the time. “Given the speed with which the killing took place, and how long it takes to crank up the machinery of the U.S. government, I understand why we did not act fast enough,” he said. “Now, we should learn from that. I actually think that Rwanda is an interesting test case because it’s possible—not guaranteed, but it’s possible—that this was a situation where the quick application of force might have been enough.”

He related this to Syria: “Ironically, it’s probably easier to make an argument that a relatively small force inserted quickly with international support would have resulted in averting genocide [more successfully in Rwanda] than in Syria right now, where the degree to which the various groups are armed and hardened fighters and are supported by a whole host of external actors with a lot of resources requires a much larger commitment of forces.”

Obama-administration officials argue that he has a comprehensible approach to fighting terrorism: a drone air force, Special Forces raids, a clandestine CIA-aided army of 10,000 rebels battling in Syria. So why does Obama stumble when explaining to the American people that he, too, cares about terrorism? The Turkey press conference, I told him, “was a moment for you as a politician to say, ‘Yeah, I hate the bastards too, and by the way, I am taking out the bastards.’ ” The easy thing to do would have been to reassure Americans in visceral terms that he will kill the people who want to kill them. Does he fear a knee-jerk reaction in the direction of another Middle East invasion? Or is he just inalterably Spockian?

“Every president has strengths and weaknesses,” he answered. “And there is no doubt that there are times where I have not been attentive enough to feelings and emotions and politics in communicating what we’re doing and how we’re doing it.”

But for America to be successful in leading the world, he continued, “I believe that we have to avoid being simplistic. I think we have to build resilience and make sure that our political debates are grounded in reality. It’s not that I don’t appreciate the value of theater in political communications; it’s that the habits we—the media, politicians—have gotten into, and how we talk about these issues, are so detached so often from what we need to be doing that for me to satisfy the cable news hype-fest would lead to us making worse and worse decisions over time.”

As Air Force One began its descent toward Kuala Lumpur, the president mentioned the successful U.S.-led effort to stop the Ebola epidemic in West Africa as a positive example of steady, nonhysterical management of a terrifying crisis.

“During the couple of months in which everybody was sure Ebola was going to destroy the Earth and there was 24/7 coverage of Ebola, if I had fed the panic or in any way strayed from ‘Here are the facts, here’s what needs to be done, here’s how we’re handling it, the likelihood of you getting Ebola is very slim, and here’s what we need to do both domestically and overseas to stamp out this epidemic,’ ” then “maybe people would have said ‘Obama is taking this as seriously as he needs to be.’ ” But feeding the panic by overreacting could have shut down travel to and from three African countries that were already cripplingly poor, in ways that might have destroyed their economies—which would likely have meant, among other things, a recurrence of Ebola. He added, “It would have also meant that we might have wasted a huge amount of resources in our public-health systems that need to be devoted to flu vaccinations and other things that actually kill people” in large numbers in America.