Remember the accusations during the Trump impeachment trial that Ukraine had cleaned up corruption? President Trump withheld aid for a couple of very legitimate reasons including corruption in the Ukraine military, corruption in the banking system and money-laundering. The Democrats continued to place guilt of dying Ukrainians because of the military conflict with Russia in the lap of President Trump. Then there was that pesky Internet Research Agency in St. Petersburg that spread propaganda across the world.

Ladies and gentlemen…it is still happening over there…where is the media? Where is Shifty Schiff and Nasty Nadler? Maria Yovanovitch is retired but gotta wonder what she knew.

Anyway read on….this is yet but only part of what continues to go on in Ukraine…Rudy Giuliani is working many other channels.

Hat tip to the REAL investigative reporters on the case…well done.

Luxury cars line the parking lot of the upscale Mandarin Plaza mall in Kyiv, while their well-heeled owners flaunt their wealth in its jewellery and designer clothes stores.

But hidden on its upper floors, protected by armed guards and under the constant surveillance of security cameras, a very different product is being sold.

Sitting elbow-to-elbow under fluorescent lights, a multi-lingual army of call center staff hawk get-rich-quick dreams across the world in the form of cryptocurrency and stock investments for a company called Milton Group.

Now, a cache of documents handed to the Swedish daily Dagens Nyheter by a whistleblower from inside the call center, and shared with OCCRP, exposes the inner workings of this type of fraud: an old-fashioned boiler-room scam that leverages the power of social media to operate on a global scale.

Armed with a list of over 1,000 people targeted by the call center, reporters from 21 countries and dozens of media outlets spoke to more than 180 victims, revealing a trail of ruined lives from Sweden’s Arctic Circle to the Ecuadorian Amazon, passing through small industrial towns in the Balkans and major world cities like London and Sydney.

The stories were strikingly similar. Many first came into contact with the scam through Facebook ads promising remarkable returns on investments. After entering their contact details to find out more, victims would be deluged with high-pressure sales calls. They would make a small “investment” that quickly yielded impressive — but fake — profits. But requests to withdraw the full funds were not honored.

Those worst affected were preyed upon by the call center’s “retention” desk, whose job was to conjure up new ways to extract more money, often through brutal psychological pressure. Some were harassed into taking out huge loans, threatened by forged letters from UK financial regulators demanding taxes, or contacted by fake lawyers offering to help get their money back — for yet another fee. In the most extreme cases, Milton Group’s retention specialists would convince victims to install software on their computers that allowed the scammers to control them remotely, and steal more money in the process. Some lost more than $200,000.

The victims, fooled by foreign names and addresses, and assurances of sky-high returns, believed they were on the phone with a legitimate investment business based in Western Europe. They had no inkling that the people on the other end of the line were largely young Ukrainians or Middle Eastern and African migrants in Kyiv.

Some tried to report their losses to police in their countries, but law enforcement largely failed to connect the dots. Cyber-crime units in multiple countries affected by the call center, including Spain and Italy, told OCCRP and its partners that they were aware of such cross-border frauds, but that they are hard to detect, often go unreported, and require cooperation between law enforcement bodies across many jurisdictions.

However, Swedish authorities have now opened an investigation based on the whistleblower’s extensive evidence, and have been in touch with Europol about the allegations.

“This company what they do, everything is fake,” said Alexey, the whistleblower. (His real name cannot be used to protect his safety.) “They just steal money from people.”

He said staff were told the Kyiv center took in a massive 65 million euros in sales in 2019. To celebrate, the company’s leaders threw a lavish New Year’s party themed around the novel “The Great Gatsby,” about a Jazz-Age bootlegger and con artist. Under neon lights, hundreds of Milton staffers watched contortionists and fire-dancers perform, and were awarded prizes, including cars, cash, and free lodging, for especially good salesmanship.

Milton is apparently tied to other call centers in Albania, Georgia, and North Macedonia employing hundreds more staff.

While it is impossible to determine whether every investment that passed through the Kyiv center was fraudulent, reporters from DN and across OCCRP’s network spoke to more than 180 victims listed in Milton’s client database who confirmed they had lost their money in investment scams. A few had been able to withdraw some funds, likely in an attempt to encourage further investments, or remained hopeful they would be able to cash out their “earnings” one day.

The supposed investments were made by transferring funds through Western Union, bank accounts, credit cards, and cryptocurrencies. Milton salespeople received a higher commission if they could convince their clients to pay in bitcoins and other cryptocurrencies, since they are harder to trace. Many of the bank-to-bank transfers were routed through the private accounts of individuals with a UK financial company, with clear instructions not to indicate the money was for investing.

In many cases identified by OCCRP, online credit-card payments were handled by a Cyprus-based company called Naspay, which bills itself as a “state-of-the-art payment gateway” and is owned by David Todua — the same Georgian-Israeli man the whistleblower identified to law enforcement as the person behind Milton Group. (Todua vigorously denies holding any “formal or informal position” in the company, although he conceded that he had attended Milton Group’s New Year’s party as a guest. He also said that Naspay does not process payments, but merely “transfers information” between websites that accept payments and financial institutions. OCCRP did not find evidence Todua has any ownership of Milton.)

After their initial investments, some victims were told they needed to send additional fees in cash to individuals in far-flung countries such as Colombia and Uganda rather than company bank accounts.

Leif Nixon, a Swedish cryptocurrency expert who helps law enforcement investigate bitcoin-related crime, analyzed the bitcoin addresses used by Milton Group to accept payments from its customers. He said the set-up did not appear to be that of a legitimate operator.

He noted several indications that clients’ money was not being invested as promised, including the fact that many different people were told to send their bitcoins to the same few addresses. Clients were also given different addresses each time they made a payment.

“It’s like opening a bank account, but you don’t get an account number; instead, for every deposit you make you get a different account number,” Nixon explained.

Ultimately, he said, $5.9 million in bitcoins from seven of Milton Group’s addresses disappeared into East Asian exchanges in 2019.

“I can’t see why a legitimate operation would make these kinds of transactions,” he said. “It doesn’t make any sense.”

Call center staff were well aware that their job was to steal, the whistleblower says. Alexey told DN that on one of his first days at Milton, the sales manager joked that even when she was as young as six, she dreamed of being a “motherfucker and stealing people’s money.”

At a training session for new staff at a Tbilisi call center linked to the Milton Group, attended by an undercover reporter last month, a trainer explained that the company’s goal was for customers “to lose their money in a realistic way.” Asked why, she laughed: “It’s naive to ask, to be honest. When they lose the money, it stays with us.”

An internal customer database reviewed by reporters is laced with expletives about “fucking” clients out of money, as well as highlighting their vulnerabilities and how they might best be targeted. In one note from October 2019, a Milton staff member wrote of a 67-year-old Swedish woman: “Sold her home to pay, no money, crying.”

That woman, reached by Dagens Nyheter in a rural part of central Sweden, told journalists she was tricked into investing over $100,000 by Milton staff who took out loans on her behalf.

She, like many other victims, was initially sucked in by the illusion that she was making huge profits: “You become hypnotized and brainwashed.”

But when she wanted to withdraw her supposed earnings, “they disappeared.” Today she cannot afford to buy food or pay her rent. “I have nothing to live for,” she said. While Milton Group’s fake investments have brought its victims financial ruin, the picture is very different for the firm’s alleged managers.

A review of their social media profiles shows that they have a penchant for expensive cars, foreign holidays, and guns. Some also have high-level political connections.

The CEO of Milton Group is Jacob Keselman, who declares himself “the Wolf of Kiev” on his Instagram account, a nod to “The Wolf of Wall Street,” the Hollywood film about a notorious penny-stock scammer. His social media profiles are replete with photos of luxury cars, foreign holidays, and the occasional gun. In one photo he can be seen working in a room with a spectacular view of the Eiffel Tower. He writes: “The one who loves his job is truly happy.”

OCCRP could not obtain official information about Keselman’s national origin, but on his LinkedIn profile he writes that his native language is Russian, he attended university in Kyiv, and he did two stints in sales in Israel before joining Milton Group.

Contacted for comment, Keselman denied that Milton Group had defrauded anyone. “You know how it is working, investment and forex brands … a lot of clients lose money because they don’t understand how it’s working,” he said. He went on to claim that Milton only provided IT support for companies selling investments. He did not respond to follow-up questions.

David Todua, a 38-year-old Georgian-born Israeli citizen, is a frequent visitor to the call center office in Mandarin Plaza, where according to Alexey the staff knew him as one of Milton Group’s owners.

Alexey said he saw Todua there at least six times, including once in November 2019, when he congratulated the staff on their performance and said Milton had brought in $50 million that year to date. The whistleblower said Todua always travelled with multiple bodyguards.

No official documents connect Todua to the scam call center, which on paper is owned by a different Georgian, Irakli Dadivadze. OCCRP was unable to track down any information about him.

However, Todua does own Naspay, a Cyprus-based payment platform through which Milton processes many of its “investments,” internal documents show.

At the firm’s New Year’s party, a man named David was called up to the stage by Keselman, the CEO, identified as the company’s “father,” and presented with a cake with three candles in it, representing the three years Milton Group had been in operation. The whistleblower identified this “father” as David Todua.

“In December, the company turned three years old,” Keselman said, according to an audio recording of the event obtained by OCCRP. “We are big kids, and our father is proud of us, while we are proud of him. And firstly [we] want to say a big thank you, David. And we want to give a cake, because what birthday is without a cake? And David will blow out the candle today.”

Todua told OCCRP he had been at the firm’s New Year’s party as a guest of Keselman, but denied holding any role in the company. “I am not father of any company, I am a proud father of 5 children,” he said.

On Instagram, he calls himself david_todua_007 and poses with a golden Kalashnikov, shoots with a sniper rifle, celebrates birthdays with a champagne tower, and posts photos of expensive cars parked outside his home. (“Hunting is indeed one of my hobbies,” he told OCCRP.)

He also has business ties with a surprising number of politicians from several countries, including ministers and other figures from the United National Movement party, which governed Georgia under President Mikheil Saakashvili for almost a decade until 2012. Saakashvili later became a Ukrainian citizen and forged a political career in the country.

Little is known about Todua’s life in Israel, where he migrated with his family in 1993, but court records and posts from his social media accounts show that he lived until recently in a villa near Tel Aviv. Today he lives in Cyprus.

In Albania, which boasts a 400-strong call center that also appears to be linked to Milton Group, the company operating it is owned by an adviser to a senior minister.

?The Georgian Connections

Although David Todua’s family left Georgia for Israel when he was just 11, as an adult he has ties to a surprising number of prominent political figures from his home country.

Most notably, his business partner in two Ukrainian companies is Davit Kezerashvili, an ex-defense minister and former chief of Georgia’s financial police under Saakashvili.

Todua and Kezerashivili co-own Project Partners, a real-estate and construction firm that is based out of a neighboring office building in Kyiv as Milton Group. Its head is Gia Getsadze, a former deputy justice minister in both Georgia and Ukraine.

Project Partners, in turn, co-owns a construction and civil engineering firm, Elitekomfortbud, with another former Georgian official, Petre Tsiskarishvili, a minister of agriculture under Saakashvili and a former leader of his United National Movement party.

Kezerashvili was charged in 2013 with accepting some $12 million in bribes to turn a blind eye to massive smuggling of alcohol from Ukraine to Georgia. He was ultimately cleared of the charges, which he says were politically motivated, but continues to live outside Georgia.

OCCRP has found no evidence that any of the former ministers are involved in the call center. In an email, Kezerashvili said he had never heard of Milton Group and had no knowledge of its activities, but confirmed that he was a business partner of Todua.

“You Will Never Regret This Decision”

Milton Group’s Kyiv call center does not appear unusual at first glance: Hundreds of phone sellers sit side by side, headsets on, using modern telephone and customer management systems.

Workers make up to 300 calls a day to clients around the world in an attempt to reach their monthly sales targets and secure bonuses.

The center is split into different sales desks by language — including Russian, English, Italian, and Spanish — each targeting their own areas of the world. Sellers use so-called “stage names” to build trust with the person on the other end of the call: A Senegalese man on the German desk goes by the name “Todd Kaiser,” while a Ukrainian woman whose real name is Daria calls herself “Diana Swan” or “Kira Lively.”

But undercover footage from inside Mandarin Plaza, as well as leaked internal documents, confirm that Milton was no ordinary call center.”

It is protected by burly guards and personal mobile phones are forbidden.

On the walls, next to posters of sports cars, a whiteboard sets out sellers’ monthly targets: $40,000 for the Russian market; $60,000 for Spanish, and $100,000 for those working the English-speaking desk.

The staffers in the sales department are provided with a set of notes explaining exactly how to target “clients” by nationality.

Scandinavians, the notes say, are mostly “old people and they really need someone to talk to.”

People from the UK, Australia, and New Zealand, on the other hand, like to believe they know everything and are certain that their countries are the best in the world, so call center workers are advised to pump them up.

“The only way to Handle [sic] such people is not to argue with them on whatever direction they take and make them feel that they are intelligent,” the notes explain.

“Later talk to them about how important the financial market has become because of great countries like Australia, UK, and New Zealand.”

“You will never regret this decision” is another line suggested to entice customers.

Those targeted by Milton Group are offered the chance to invest in cryptocurrency, stocks, or foreign currencies through a variety of different “brands,” all of which have generic-sounding names and similar websites, and are moved out of the rotation over time. Recently, Milton Group’s brands have included CryptoMB, Cryptobase, and VetoroBanc. All have been subject to recent investor warnings from regulators in the UK, Italy, and Spain.

The precise relationship between the call center and the brands they market is not always clear. Brands are sometimes not associated with any legal entity; when they are, they hide behind offshore secrecy. CryptoMB and VetoroBanc are run by offshore firms in the Marshall Islands and St. Vincent & Grenadines, respectively, while OCCRP could find no evidence that Cryptobase was tied to any specific company.

Alexey told journalists that the supposed VetoroBanc was entirely fabricated inside the Milton offices, with the name chosen by the Italian retention manager because it sounded “like one of the Italian banks.” The VetoroBanc website uses stock images for its staff that appear to have been taken from the internet. “Sylvia Moreno,” a supposed market analyst, is in fact an American pediatrician.

Alexey explained that staff had no specific expertise in financial products, but were carefully taught to sell “emotions.”

“It doesn’t matter which emotions, positive or negative: You can sell those fake products if people are really thinking about that,” he explained.

Clients were often shown huge profits to encourage them to invest further funds, but the money was always just numbers on a screen, the whistleblower explained. The only time victims were allowed to receive any of their funds back was in order to encourage an even bigger investment.

The most promising — and vulnerable — investors were passed on to the “retention team,” where the top salesmen work.

Their job is to “squeeze the money from the clients to the last cent,” Alexey explained, pushing them to borrow money and sell their cars and apartments. In one case, he said, a heavily pregnant Russian woman was convinced to hand over the small nest egg she had scraped together for her baby.

The most prolific and ingenious scammer at Milton Group is a man on the retention team who tells prospective investors his name is “William Bradley.”

In fact, he is a young Iranian who uses images of well-known US salesman and motivational speaker Marc Wayshak — who dubs himself “America’s sales strategist” — to disguise his identity on video calls.

OCCRP was unable to verify his real name, but at work and on social media he goes by “Hamze” and speaks fluent Farsi. Alexey claimed he takes in a massive $450,000 a month.

The call center’s internal customer database tracks how much each client has “invested,” as well as the potential to extract more money from them. Comments seen by OCCRP are laced with profanities and details of clients’ vulnerabilities.

One reads: “I saw 800 EUR in his bank and he is sick, he have problem and he told me I want someone fuck me and I said Foster [another call center operator] will fuck you.”

Another reads: “Getting fucked every month for at least 1000 EUR. Gets pension on the 20th/works every tuesday.”

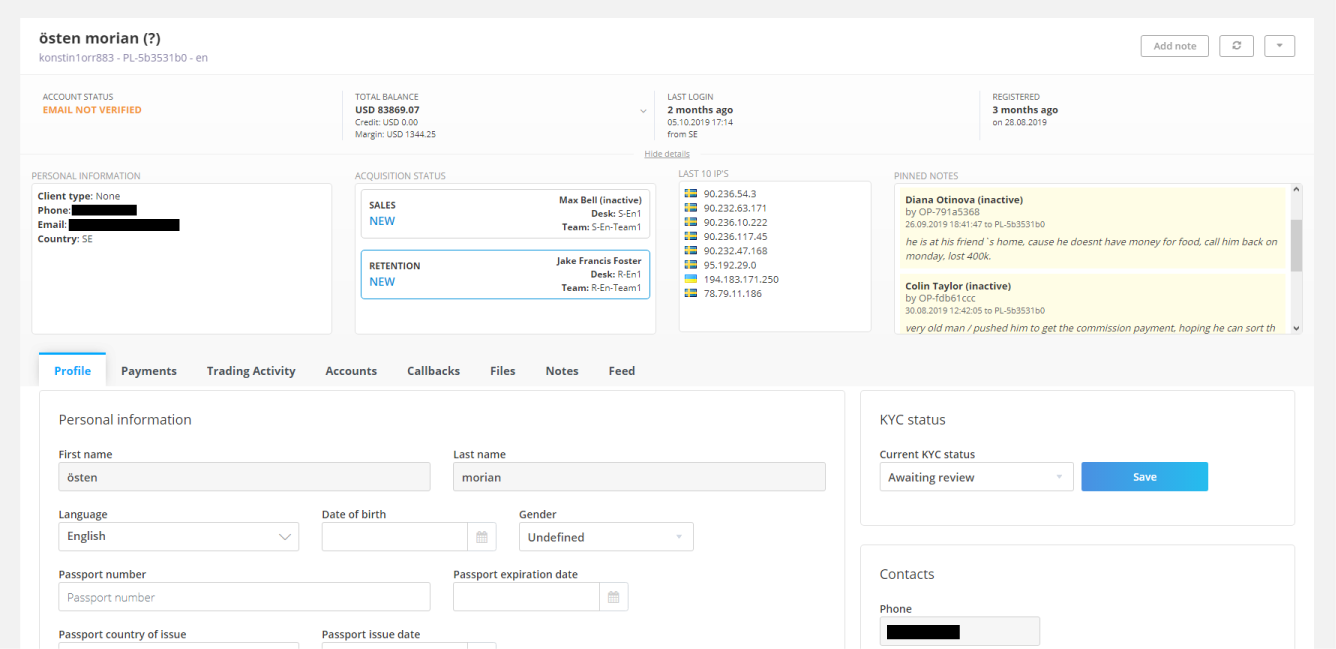

Notes from the Milton Group’s internal customer database describing the situation of one of their victims, Östen Morian. Credit: Alexander Mahmoud/DN

Notes from the Milton Group’s internal customer database describing the situation of one of their victims, Östen Morian. Credit: Alexander Mahmoud/DNOf another man, a call center staffer wrote: “Very Old man/pushed him to get the commission payment, hoping he can sort that out today, should call back at 3pm Sweden time.”

A month later, another note appears: “He is at his friend’s home because he doesn’t have money for food. Call him back on Monday, lost 400 k.”

That client was 75-year-old Östen Morian, a retired carpenter who lives close to the Arctic Circle in remote northern Sweden.

Contacted by DN, Morian confirmed he had lost around 400,000 Swedish krona (about $41,000) to the scammers after taking out loans, at 39 percent interest, to make what turned out to be fake investments. He was left heavily indebted.

“I don’t know what I can do,” he said. “Wait to die only.”

FILE – In this Tuesday, March 20, 2018 file photo, Attorney General Jeff Sessions, left, speaks during a roundtable talks on sanctuary cities hosted by President Donald Trump, third from right, in the Roosevelt Room of the White House, in Washington. The Trump administration can withhold millions of dollars in law enforcement grants to force states to cooperate with U.S. immigration enforcement, a federal appeals court in New York ruled Wednesday, Feb. 26, 2020 in a decision that conflicted with three other federal appeals courts. (AP Photo/Manuel Balce Ceneta)

FILE – In this Tuesday, March 20, 2018 file photo, Attorney General Jeff Sessions, left, speaks during a roundtable talks on sanctuary cities hosted by President Donald Trump, third from right, in the Roosevelt Room of the White House, in Washington. The Trump administration can withhold millions of dollars in law enforcement grants to force states to cooperate with U.S. immigration enforcement, a federal appeals court in New York ruled Wednesday, Feb. 26, 2020 in a decision that conflicted with three other federal appeals courts. (AP Photo/Manuel Balce Ceneta)