Read the text here. The ‘voting rights’ division at the Justice Department may just have an issue with this, but the commission should happen along with a technology fix going into the future. We cannot forget that DHS contacted several states prior to the voting season last Fall concerning registration databases and voting machines. Some states cooperated while others frankly did not only not trust government intrusion but DHS.

Trump signs executive order launching voter fraud commission

President Trump signed an executive order on Thursday to launch a commission to review alleged voter fraud, a White House official confirmed to Fox News, after months of claiming voter fraud in the 2016 presidential election.

The order, titled “Presidential Commission on Election Integrity,” would establish a bipartisan commission, chaired by Vice President Mike Pence, to review alleged voter fraud and suppression. Kansas Secretary of State Kris Kobach, who has investigated voter fraud in Kansas, will serve as vice chair.

“The commission will also include individuals with knowledge and experience in election management and voter integrity,” White House Deputy Press Secretary Sarah Huckabee-Sanders said on Thursday at the White House daily press briefing. “The commission will review policies and practices that enhance or undermine confidence in elections and identify system vulnerabilities.”

Huckabee-Sanders announced five members to the commission on Thursday: Indiana Secretary of State Connie Lawson (R), New Hampshire Secretary of State Bill Gardner (D), Maine Secretary of State Matthew Dunlap (D), Christie McCormick, commissioner of the election assistance commission, and former Ohio Secretary of State Ken Blackwell(R).

The White House said the commission will review practices that affect the integrity of federal elections–spanning improper registrations, improper voting, fraudulent registrations, fraudulent voting and voting suppression.

“We expect the report to be complete by 2018,” Huckabee-Sanders said. “The experts will follow the facts where they lead–we’ll share updates as we have them.”

Trump originally vowed to create such a commission in January. Days after his inauguration, Trump took to Twitter calling for a “major investigation into VOTER FRAUD,” saying that depending on the results of the investigation, “we will strengthen up voting procedures!” He cited “illegal” voters and “those registered to vote who are dead (and many for a long time)” which he claimed cost him the popular vote, which Hillary Clinton won by 3 million votes.

But on Thursday, Senate Minority Leader Charles Schumer, D-N.Y., slammed the commission.

“Putting an extremist like Mr. Kobach at the helm of this commission is akin to putting an arsonist in charge of the fire department,” Schumer said. “President Trump has decided to waste taxpayer dollars chasing a unicorn and perpetuating the dangerous myth that widespread voter fraud exists.”

Voting experts and many lawmakers have said they haven’t seen anything to suggest that millions of people voted illegally, including House Oversight Committee Chairman Jason Chaffetz. The Utah Republican said his committee won’t be investigating voter fraud.

In a lunch meeting with senators in February, Trump said that he and former Republican Sen. Kelly Ayotte would have won in New Hampshire if not for voters bused in from out of state. New Hampshire officials have said there was no evidence of major voter fraud in the state.

In a February interview with Bill O’Reilly, Trump said the main issue of voter fraud was registration, and vowed to look at the situation “very, very carefully.”

“When you look at the registration and you see dead people that have voted, when you see people that are registered in two states, that have voted in two states, when you see other things, when you see illegals, people that are not citizens and they are on registration roles,” Trump said. “We can be babies, but you take a look at registration, you have illegals, you have dead people, you have this, it’s a really bad situation, it’s really bad.”

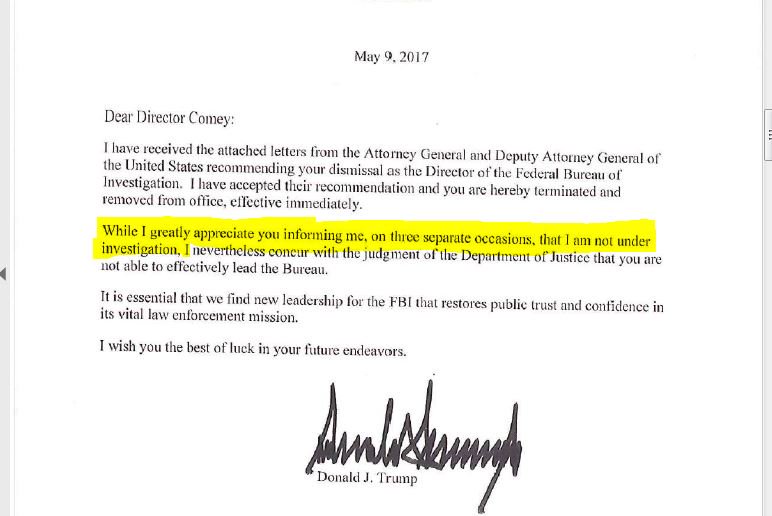

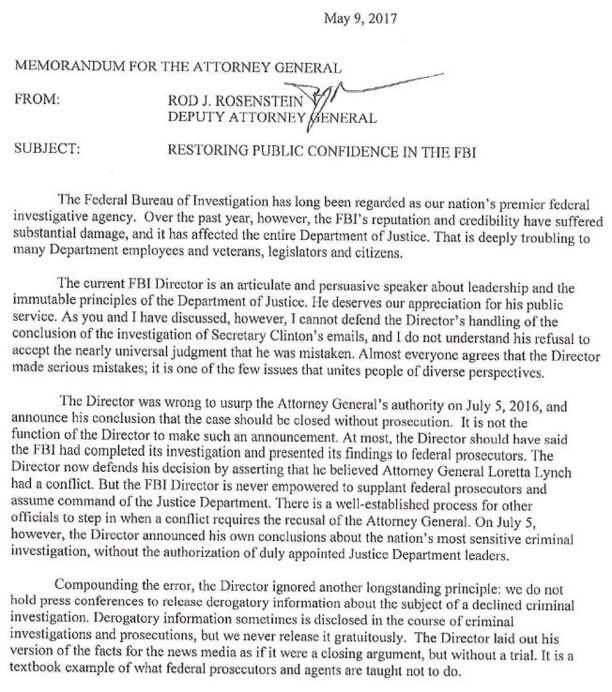

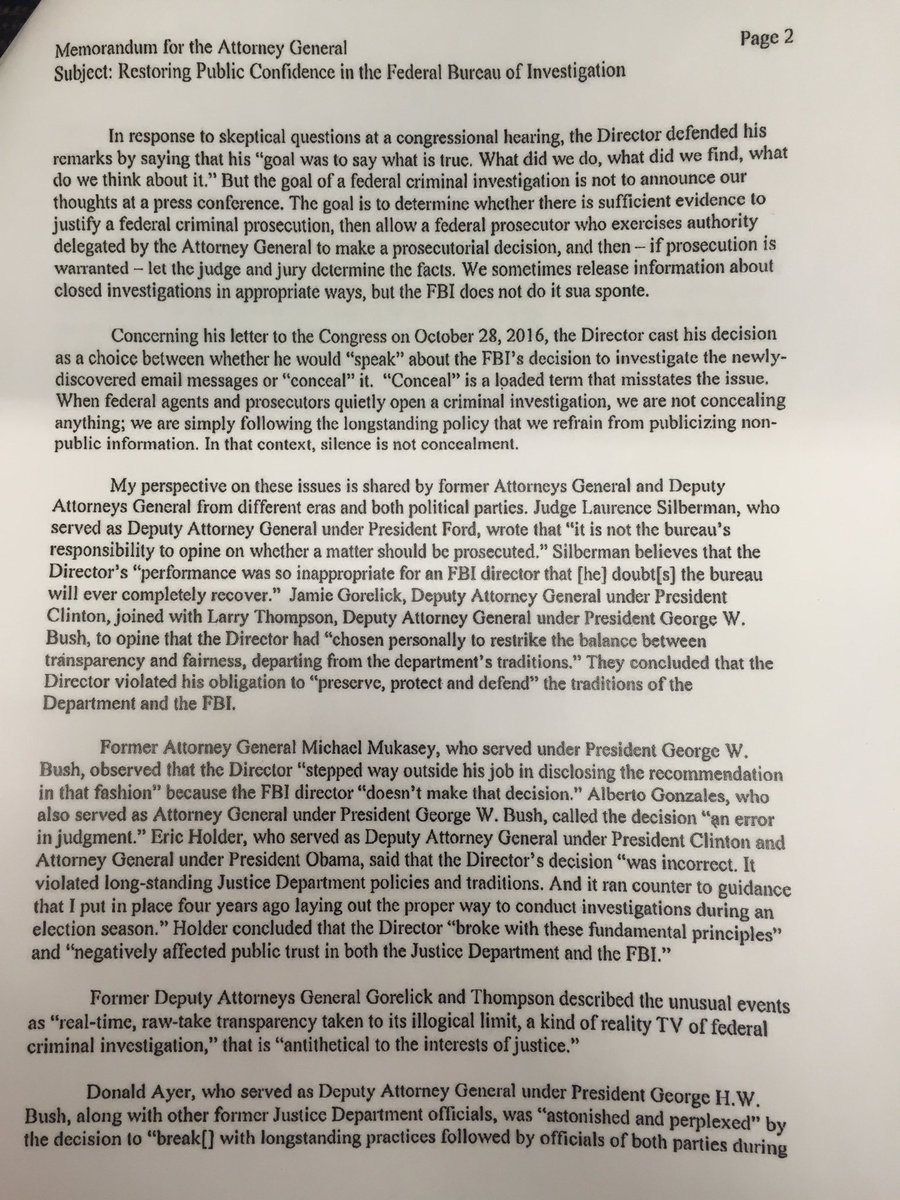

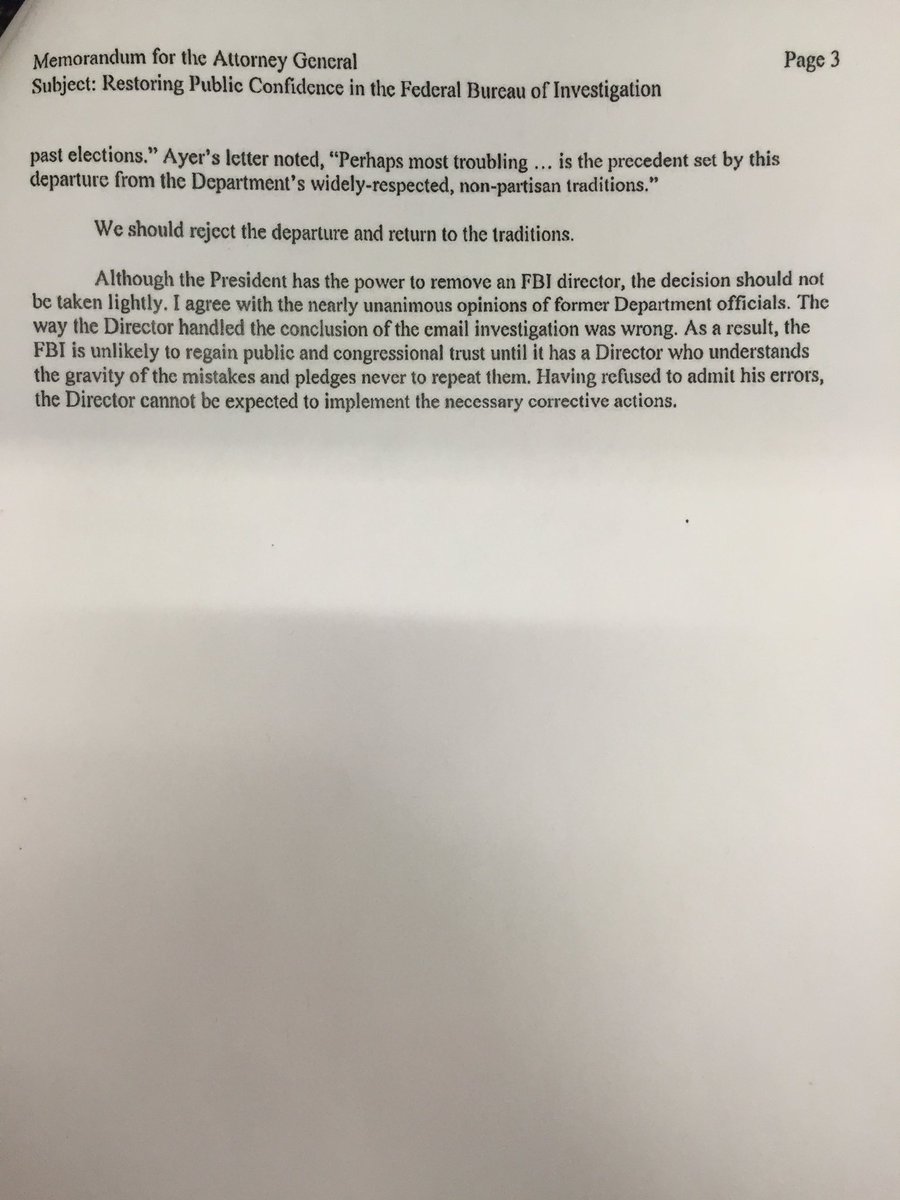

The decision to revisit the voter fraud issue comes during a tumultuous week, after Trump on Tuesday fired FBI Director James Comey. The administration cited Comey’s handling of the Clinton email probe, but Democrats also question what role his bureau investigation into Russian meddling in the 2016 race played.

In a House Intelligence Committee hearing on Russian election tampering in March, voter fraud became a topic of questioning — Committee Chairman Devin Nunes, R-Calif., asked Comey if the FBI had any evidence that votes were changed in states like Pennsylvania, North Carolina, Florida, and Ohio, to which Comey answered “No.”

After winning the election, Trump singled out several states and claimed fraud in their voting system, but officials in those states insisted that his claims were unfounded.

The case is presented in the other DoJ memo on Comey posted below. Just remember the Deputy Director of the FBI is Andrew McCabe, whose wife

The case is presented in the other DoJ memo on Comey posted below. Just remember the Deputy Director of the FBI is Andrew McCabe, whose wife

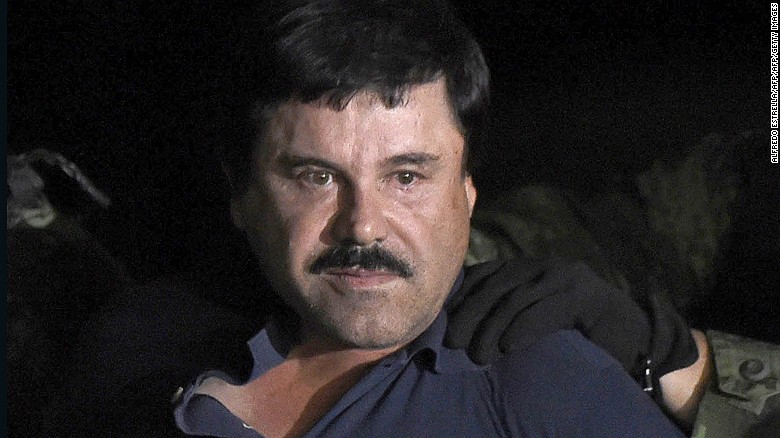

CNN

CNN